Nasdaq iShares Biotechnology ETF (IBB) - Tradinglounge Weekly Chart

Nasdaq iShares Biotechnology IBB Weekly Chart Analysis

IBB ETF Elliott Wave Technical Analysis

Function: Major Trend

Mode: Motive

Structure: Triangle

Position: Wave [4]

Direction: Uptrend

Details: The Elliott Wave analysis for the IBB Weekly Chart shows that wave [4] has completed its triangle pattern, signaling a major bullish opportunity for investors.

Following the triangle, a strong post-triangle thrust is unfolding, typically characterized by impulsive price action.

Currently, wave (1) of [5] is in progress, with an initial Elliott Wave target near $150 before a corrective wave (2) pullback occurs.

The confirmation level for this bullish forecast is set at $142.80.

Invalidation Level: $107.43

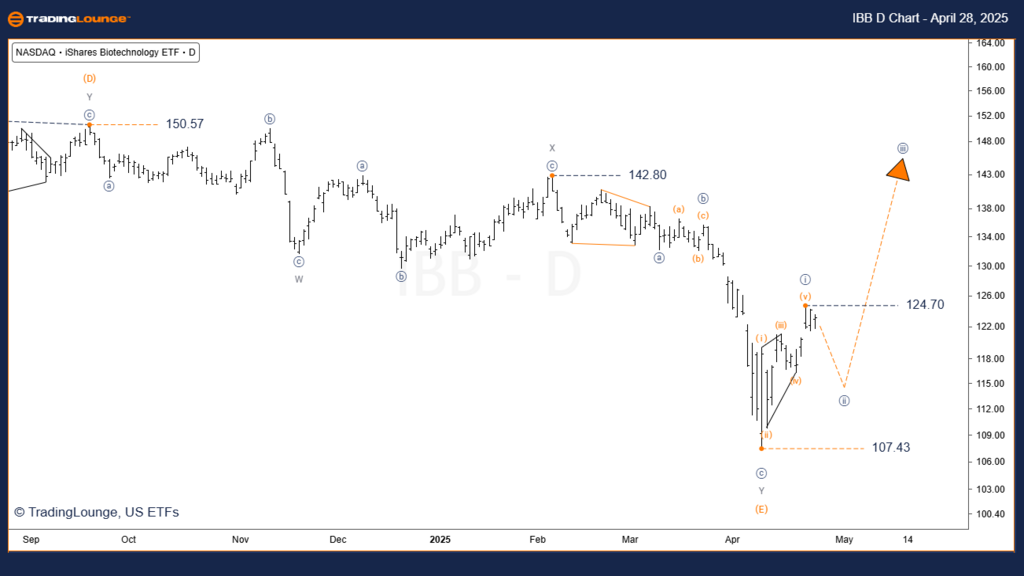

Nasdaq iShares Biotechnology ETF (IBB) - Tradinglounge Daily Chart

Nasdaq iShares Biotechnology IBB Weekly Chart Analysis

IBB Elliott Wave Technical Analysis

Function: Major Trend

Mode: Motive

Structure: Impulse

Position: Wave [ii]

Direction: Minor Decline

Details: The IBB Daily Chart Elliott Wave view suggests the current decline is part of a corrective wave [ii] within a broader bullish trend.

Wave [ii] may retrace a notable portion of the previous leading diagonal structure but should maintain the overall bullish Elliott Wave setup.

Upon completion, a strong impulsive move toward $142.80 is expected.

Invalidation Level: $107.43

Technical Analyst: Simon Brooks

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: REMX Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

- The ongoing Elliott Wave rally in IBB appears to be in its early phase, with significant upside potential due to the post-triangle thrust pattern.

- IBB is likely to retrace and exceed the full height of the previous triangle formation, offering a prime buying opportunity for ETF traders and investors.

- Monitoring the Elliott Wave structure and adhering to the $107.43 invalidation level will be critical for effective risk management.