Welcome to our latest Elliott Wave analysis for Spotify Technology S.A. (SPOT). In this report, we provide a detailed examination of SPOT's price movements and future projections using the Elliott Wave Theory. This analysis will cover both the daily and 4-hour charts, offering insights into the current trends and potential trading opportunities. Whether you are a seasoned trader or a market enthusiast, this analysis aims to enhance your understanding of SPOT's market behavior.

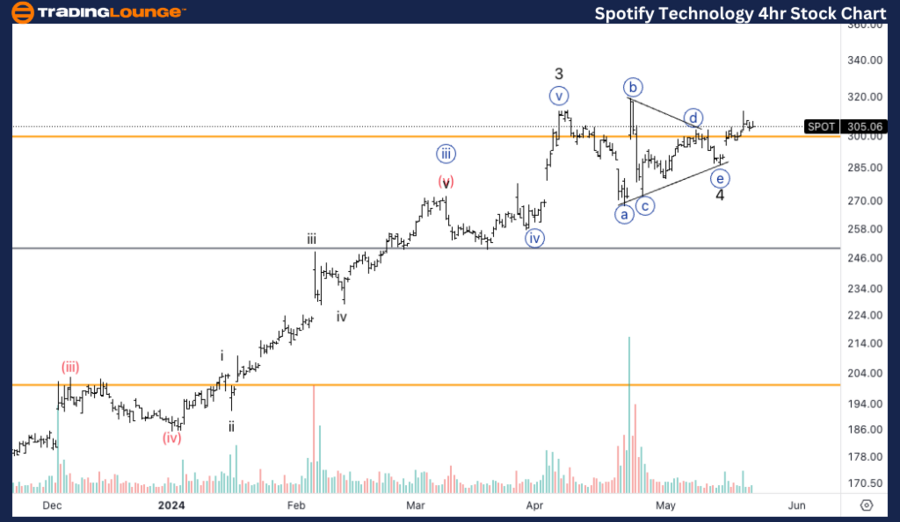

SPOT Elliott Wave Analysis Trading Lounge Daily Chart,

Spotify Technology S.A., (SPOT) Daily Chart Analysis

SPOT Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Minor 5.

DIRECTION: Upside in Minor 5

DETAILS: Looking for start moving higher after trading around TL3 at 300$. Looking for further upside towards at least the end of MG2 at 330$.

In our latest Elliott Wave analysis of Spotify Technology S.A. (SPOT), we observe a bullish trend with an impulsive structure. Currently positioned at Minor wave 5, SPOT is gearing up for an upside move in Minor 5. After trading around Trading Level 3 (TL3) at $300, we anticipate further upside towards at least the end of Major Group 2 (MG2) at $330. Traders should be prepared for a potential continuation of the upward trend as the market gains momentum.

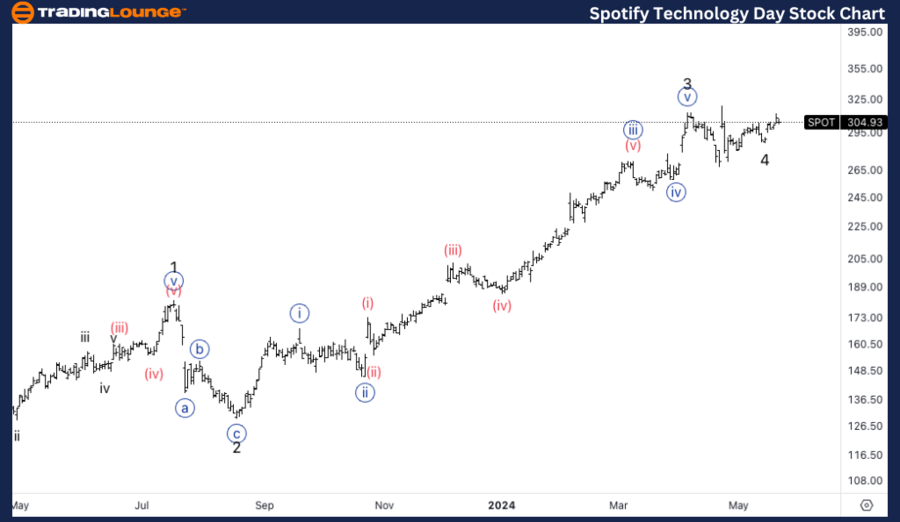

SPOT Elliott Wave Analysis Trading Lounge 4Hr Chart,

Spotify Technology S.A., (SPOT) 4Hr Chart Analysis

SPOT Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Minor 5.

DIRECTION: Upside in Minor 5

DETAILS: Looking for a triangle in 4 to be completed. There is a possibility we just completed wave {iv} and not 4, as equality of Minor 3 vs. 1 stands at 340$.

On the 4-hour chart, SPOT is also exhibiting an impulsive mode within a motive structure, specifically positioned in Minor wave 5. We are looking for the completion of a triangle in wave 4. However, there is a possibility that we have just completed wave {iv} instead of 4, with the equality of Minor wave 3 vs. 1 standing at $340. This scenario suggests further upside potential as SPOT continues to move higher in wave 5.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Deere & Co.(DE) Stocks Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support