Welcome to our latest Elliott Wave analysis for Deere & Co. (DE), In this report, we provide a detailed examination of DE's price movements and future projections using the Elliott Wave Theory. This analysis will cover both the daily and 4-hour charts, offering insights into the current trends and potential trading opportunities. Whether you are a seasoned trader or a market enthusiast, this analysis aims to enhance your understanding of DE's market behavior.

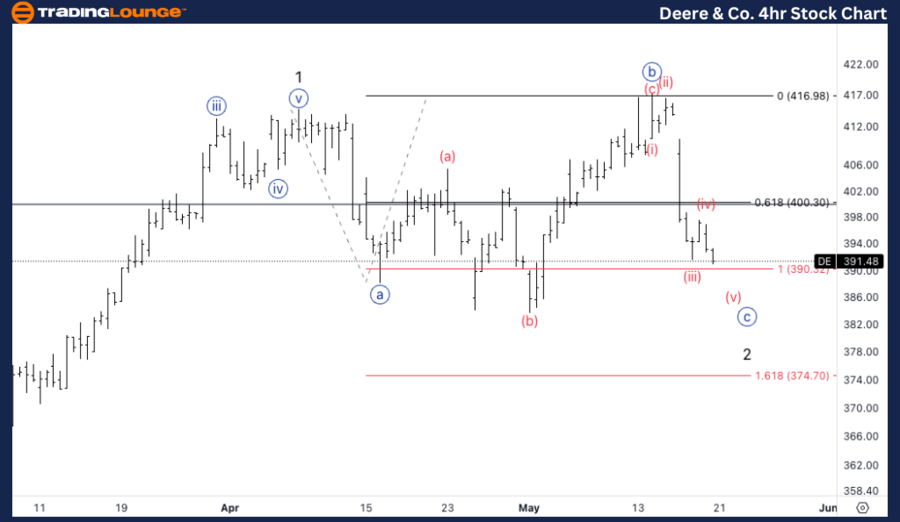

DE Elliott Wave Analysis Trading Lounge Daily Chart

Deere & Co. (DE) Daily Chart Analysis

DE Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor 2 of (1)

Direction: Bottoming in wave 2

Details: Expecting a three-wave move in wave 2 to be completed soon, anticipating a continuation higher.

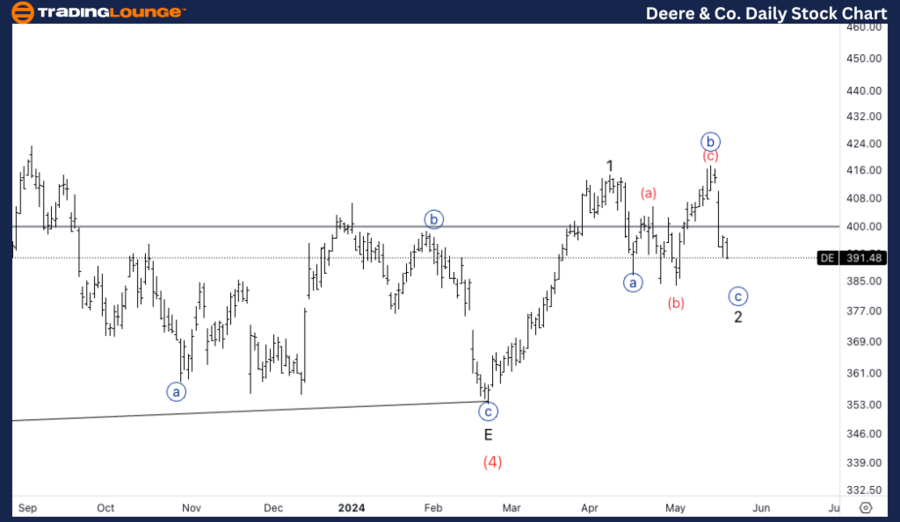

DE Elliott Wave Analysis Trading Lounge 4Hr Chart

Deere & Co. (DE) 4Hr Chart Analysis

DE Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave {c} of C

Direction: Wave (v) of {c}

Details: Looking for equality of {c} vs. {a} at $390. Expecting a Classic Trading Level Pattern around $400 to enter long positions.

On the 4-hour chart, DE is exhibiting a corrective mode within a flat structure, specifically positioned in wave {c} of C. We are looking for wave (v) of {c} to reach equality with wave {a} at the $390 level. Additionally, we expect a Classic Trading Level Pattern to emerge around the $400

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Chevron Inc., (CVX) Elliott Wave Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support