Explore the latest Elliott Wave analysis for Chevron (CVX) as of May 20, 2024. Discover key support and resistance levels and potential price targets for CVX stock.

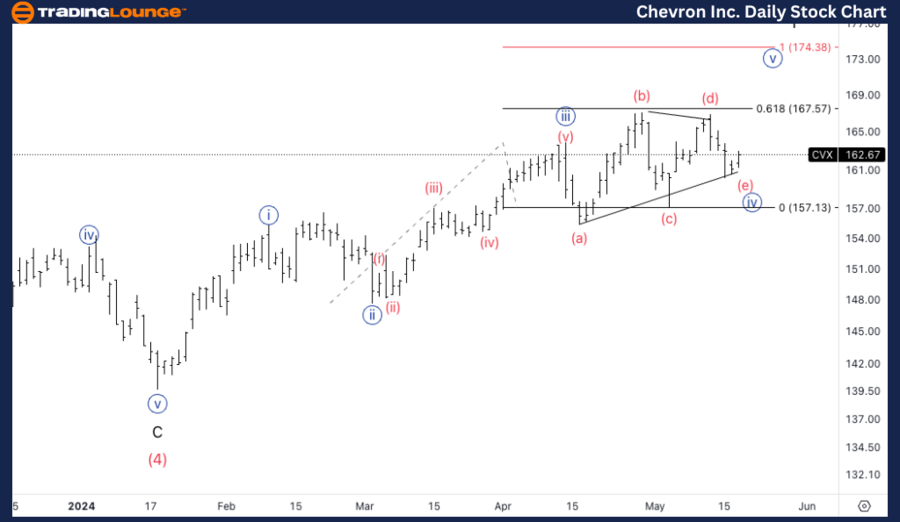

Chevron Inc. (CVX) Elliott Wave Trading Lounge Analysis - Daily Chart

Chevron Inc., (CVX) Daily Chart Analysis

CVX Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor wave 1

Direction: Upside in Minute {v}

Details: Chevron Inc. (CVX) shows an upward trend in the daily chart analysis. We are closely monitoring Minor wave 1 for a top. A breakthrough past the previous wave B top at $171 is critical. Achieving this level will confirm further bullish momentum.

Chevron (CVX) is currently in the final stages of Minor wave 1, with an expected top in Minute wave {v}. We are looking for a break above the previous wave B top at $171, which would provide additional confirmation of further upside potential.

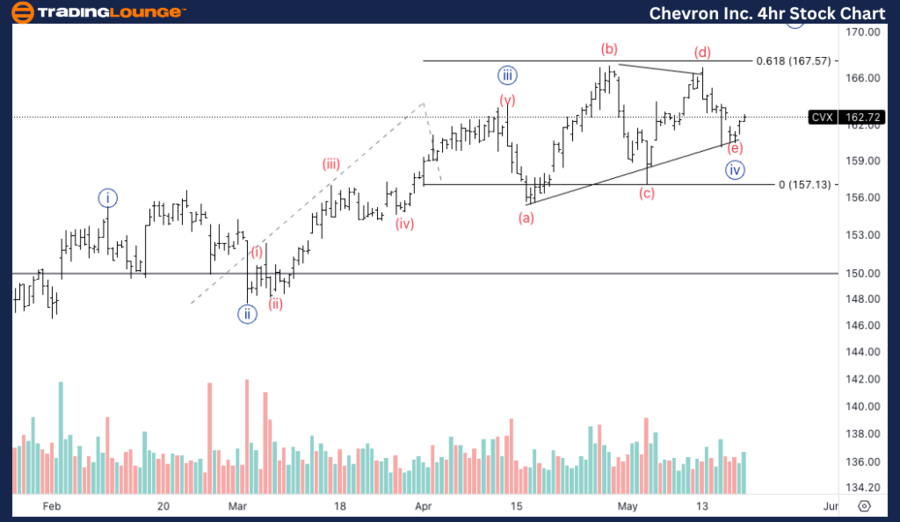

Trading Lounge Chevron Inc. (CVX) Elliott Wave Analysis - 4-Hour Chart

Chevron Inc., (CVX) 4Hr Chart Analysis

CVX In-Depth Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (e) of {iv}

Direction: Upside in wave (i) of {v}

Details: On the 4-hour chart, we are observing a potential triangle formation in wave {iv}. We expect this pattern to be completed soon. Post-completion, an upside movement in wave (i) of {v} is anticipated, indicating a resumption of the bullish trend.

On the 4-hour chart, CVX appears to be completing a potential triangle formation in wave {iv}. Once this triangle is completed, we expect an upside resumption in wave (i) of {v}.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Texas Instruments Inc.(TXN) Stocks Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support

Conclusion

The Elliott Wave analysis for Chevron Inc. (CVX) indicates a strong potential for an upward trend. Investors should watch for key levels and patterns highlighted in the daily and 4-hour charts. This analysis provides critical insights to make well-informed investment decisions.