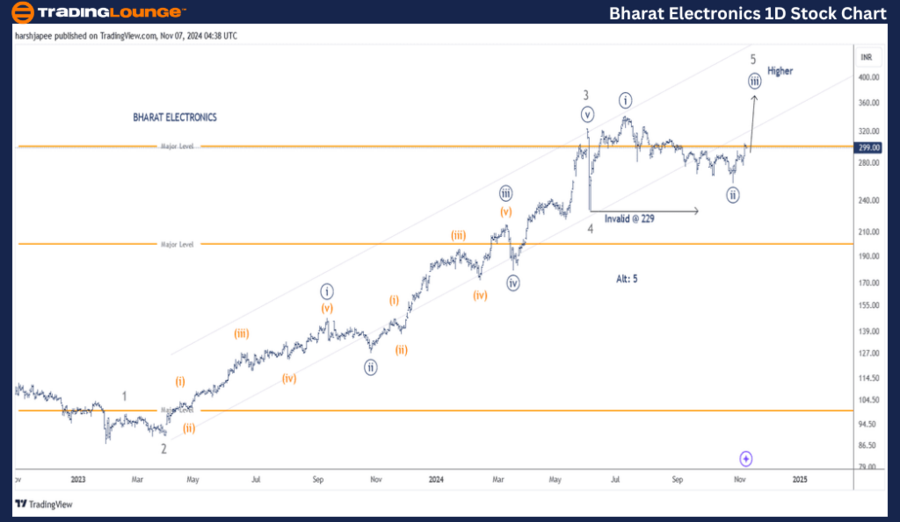

BHARAT ELECTRONICS – BEL Elliott Wave Analysis (1D Chart)

BEL Elliott Wave Technical Analysis

Trend Analysis: Intermediate Degree Trend Moving Higher (Orange)

Market Mode: Motive Structure

Wave Structure: Impulse Formation

Current Wave Position: Minute Wave ((ii)) in Navy

Technical Insights: Minute Wave ((iii)) in Navy within Minor Wave 5 in Grey is advancing higher, holding above the 229 level, with Wave ((ii)) potentially positioned near the 250-60 range. Alternatively, Minor Wave 5 in Grey may have concluded above the 342 mark.

Key Invalidation Level: 229

BHARAT ELECTRONICS Daily Chart Analysis and Potential Elliott Wave Counts

The daily chart analysis of Bharat Electronics indicates a bullish trend as long as prices remain above the 229 support. The stock is advancing towards a potential Minor Wave 5 Grey peak, targeting the 350-70 price range as Minute Wave ((iii)) takes shape.

Following a significant drop to a low of 87 in January 2023, suggesting a potential Intermediate Wave (4), the stock has shown a strong recovery. This upward move divides into Minor Waves 1 to 4, which appears to have completed around the 229 support. If correct, the price is now advancing with Minor Wave 5 unfolding higher.

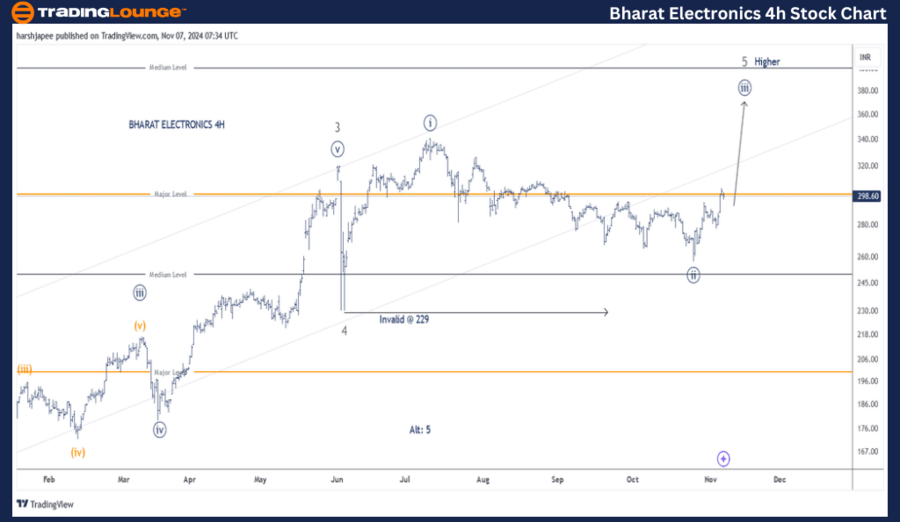

BHARAT ELECTRONICS – BEL (4H Chart) Elliott Wave Technical Analysis

Trend Analysis: Intermediate Degree Trend Moving Higher (Orange)

Market Mode: Motive Structure

Wave Structure: Impulse Formation

Current Wave Position: Minute Wave ((ii)) in Navy

Technical Insights: Minute Wave ((iii)) in Navy within Minor Wave 5 in Grey is advancing higher above the 229 mark, suggesting Wave ((ii)) may have been set around the 250-60 levels. Alternatively, Minor Wave 5 in Grey might have completed above 342. A drop below the 229 mark would invalidate the bullish outlook.

Key Invalidation Level: 229

BHARAT ELECTRONICS 4H Chart Analysis and Potential Elliott Wave Counts

The 4H chart for Bharat Electronics illustrates the minor sub-waves following the completion of Minor Wave 3 near the 325 level. After a sharp correction with Wave 4 ending around 229 on June 03, 2024, Minor Wave 5 is now progressing. Minute Waves ((i)) and ((ii)) appear completed near 342 and 260, respectively. If correct, Minute Wave ((iii)) is likely underway. For the bullish momentum to persist, prices must hold above the 229 level.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ITC Ltd Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Bharat Electronics appears to be advancing within Minute Wave ((iii)) of Minor Wave 5 in Grey, holding support above 229.