TXN Elliott Wave Analysis: Texas Instruments Inc. (TXN)

Discover the latest Elliott Wave analysis for Texas Instruments (TXN) as of May 17, 2024. Learn about key support and resistance levels, and potential price targets for TXN stock.

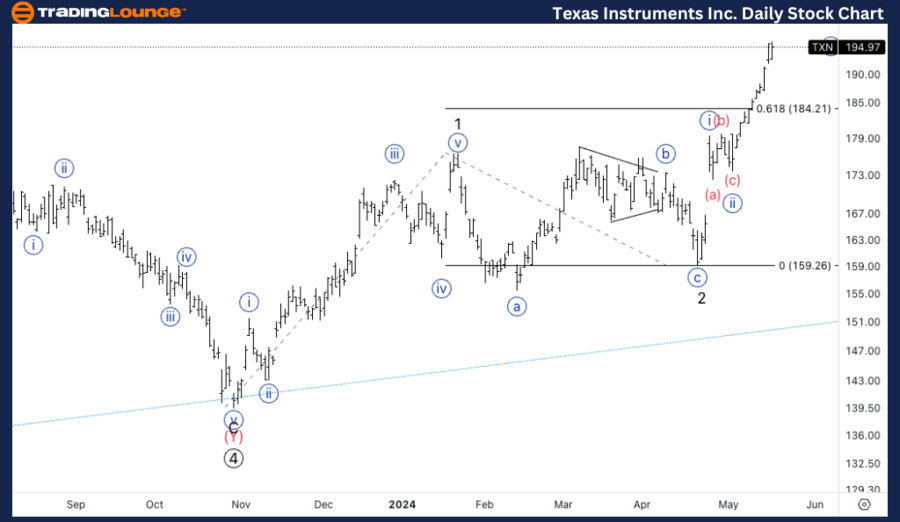

TXN Elliott Wave Technical Analysis - Daily Chart

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Minute {iii} or 3.

DIRECTION: Upside in {iii}.

DETAILS: Texas Instruments Inc. (TXN) is progressing as anticipated in its Elliott Wave pattern. The current wave structure suggests an impulsive trend, specifically in the minute wave {iii}. We are observing the movement towards at least equality of wave 3 compared to wave 1. There is a potential for this pattern to evolve into an ABC correction, with equality between wave C and wave A being a common target.

Texas Instruments (TXN) is moving as expected within the impulsive wave structure. We are looking for at least equality of wave 3 vs. wave 1. This movement could potentially turn into an ABC pattern, as equality of wave C vs. wave A is a common target in corrective waves.

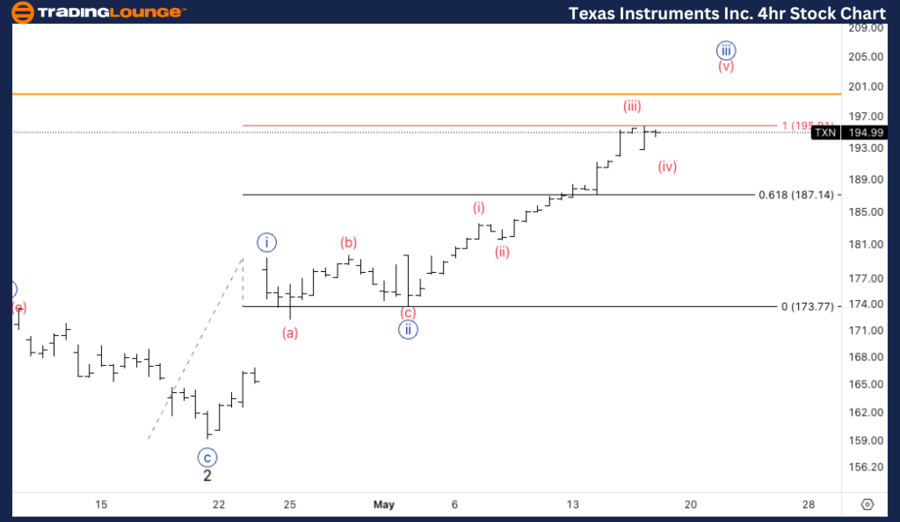

TXN Elliott Wave Analysis Trading Lounge 4Hr Chart,

TXN Elliott Wave Technical Analysis - 4-Hour Chart Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Minute (iii) of {iii}.

DIRECTION: Upside in {iii}.

DETAILS: On the 4-hour chart, TXN continues its impulsive trend, currently in minute wave (iii) of {iii}. The analysis indicates an upward movement towards wave (v) of {iii}. We have reached the point of equality between waves {iii} and {i}, and we are now looking for this equality to establish a support level.

In the 4-hour chart, TXN is progressing within wave (v) of {iii}. Currently, the stock is at the equality level of wave {iii} vs. wave {i}. We are looking for this equality to turn into a support level, which would further confirm the bullish trend.