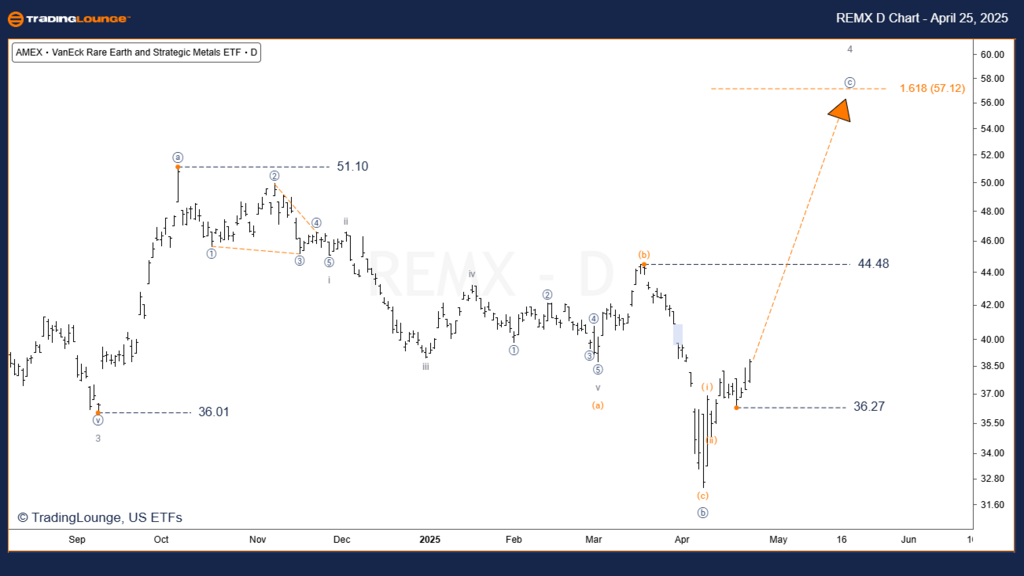

VanEck Rare Earth & Strategic Metals ETF – REMX (1D) Elliott Wave Technical Analysis Daily Chart

REMX Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Expanded Flat

Position: Wave [c] of 4

Direction: Bear Market Rally

Details:

Wave 4 of the VanEck Rare Earth & Strategic Metals ETF (REMX) is progressing through its final subwave phase before completing the overall correction.

The current bear market rally is expected to retrace between 38.2% and 50% of the preceding wave 3 decline, aligning with classic Elliott Wave corrective behavior.

Confirmation of the expanded flat corrective structure will be achieved if price action surpasses the key resistance level at $51.10.

The projected termination zone for wave 4 stands near the $57.12 price level.

Upon completion of wave 4, a bearish wave 5 decline is forecasted, likely targeting levels below the origin of wave 4.

Invalidation Level: $32.36

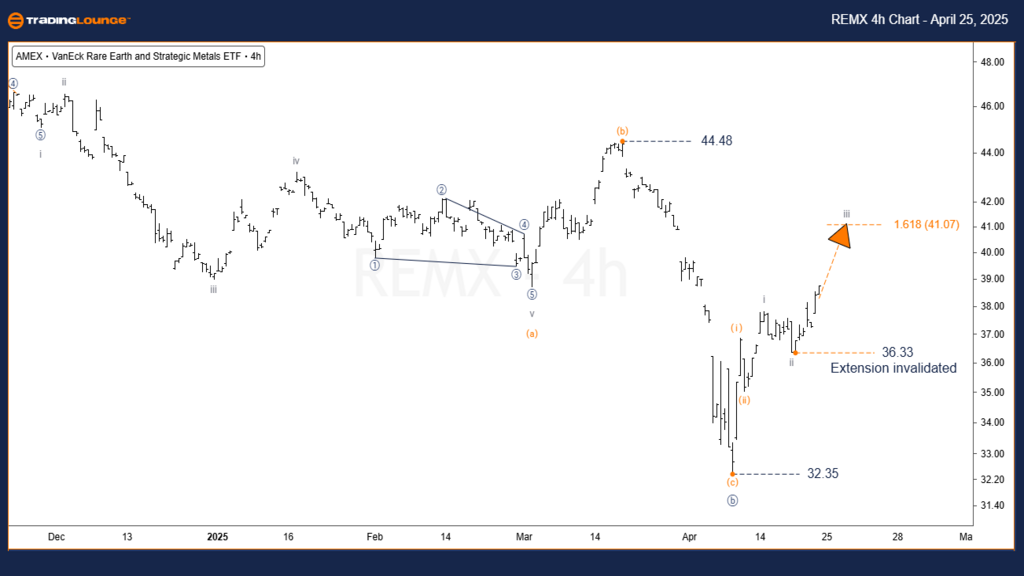

VanEck Rare Earth & Strategic Metals ETF – REMX (4H) Elliott Wave Technical Analysis Hourly Chart

REMX Elliott Wave Technical Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave [c] Navy of 4 Grey

Direction: Rally

Details:

The ongoing rally in the VanEck Rare Earth & Strategic Metals ETF (REMX) should continue with impulsive momentum, aiming to break above the crucial $51.10 resistance.

Wave [c] is anticipated to push strongly toward the previous wave [a] high, confirming the bullish impulse structure within wave 4.

This rally represents the final leg of the corrective wave 4 phase.

There is a possibility of an extended wave pattern, with further advancement into wave iii of (iii).

Critical support that must hold for the bullish scenario remains at $36.33.

Invalidation Level: $36.33

Technical Analyst: Simon Brooks

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: SPDR Select Sector Fund ETF – XLF Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support