SPDR Select Sector Fund ETF – XLF Elliott Wave Analysis Daily Chart

SPDR Select Sector Fund ETF – XLF Daily Chart Analysis

XLF Elliott Wave Technical Analysis

Function: Major Trend

Mode: Motive

Structure: Impulse Wave

Position: Wave 3

Direction: Uptrend

Details:

- Wave 3 is currently in motion, suggesting continued bullish momentum and the potential to break above previous highs.

- This phase is typically the most powerful segment within the five-wave impulse pattern.

- The rally is expected to surpass the prior key resistance at $52.64.

However, caution is warranted as this movement may still be part of a corrective sequence—potentially wave [b] of 2 yet to fully complete.

Key support holds at $45.14, which acts as a pivot for the bullish scenario.

Invalidation for the wave count is set at $42.21.

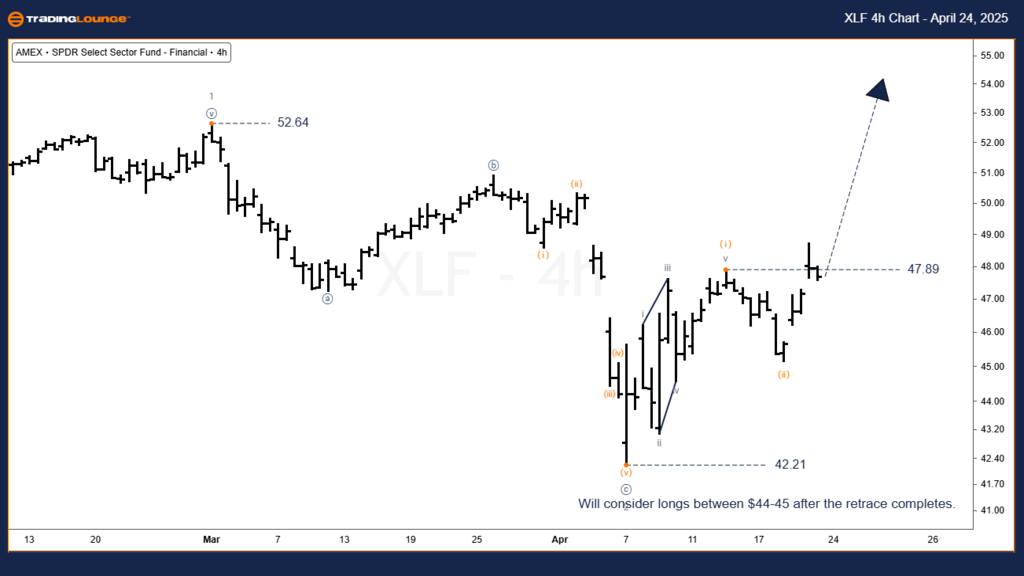

SPDR Select Sector Fund ETF – XLF Elliott Wave Analysis – 4-Hour Chart

Function: Major Trend

Mode: Motive

Structure: Impulse

Position: Wave (iii) orange

Direction: Uptrend

Details:

Wave (ii) seems to have completed, although a flat correction is still possible.

Support is clearly defined by the low of wave (ii) and the wave [c] of 2 low.

A breakout above $47.89 offers the first bullish confirmation, though more is needed to validate wave (iii).

Wave (iii) is projected to reach and likely exceed $51.00, in line with standard third-wave behavior.

Key support remains firm at $45.14.

Invalidation level is set at $42.21.

Technical Analyst: Simon Brooks

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: Grayscale Ethereum Trust ETF – ETHE Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

XLF’s upward trajectory is likely part of wave (iii) within a developing wave [i] of wave 3, indicating a strong bullish setup for ETF traders. The next leg higher should exceed the $52.64 mark, with $51.00 as a primary target for wave (iii). Traders should adhere closely to Elliott Wave guidelines and watch invalidation levels to maintain disciplined entries and exits in this bullish scenario.