AAPL Elliott Wave Analysis Trading Lounge Daily Chart, 11 March 24

In the dynamic landscape of financial markets, understanding Elliott Wave Analysis can provide valuable insights into market trends and potential price movements. Let's explore the recent Elliott Wave Analysis of Apple Inc. (AAPL) to decipher corrective patterns and anticipate market directions for strategic trading decisions.

AAPL Stock Daily Chart Analysis

AAPL Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Minor wave 2

Direction: Completion of wave {c} of 2

On the daily chart, AAPL exhibits a counter-trend movement, indicating corrective patterns within a flat structure. Currently positioned within minor wave 2, the completion of wave {c} of 2 suggests a potential downside. While further downside is anticipated, there's a possibility of a larger degree correction, potentially reaching a top at $200.

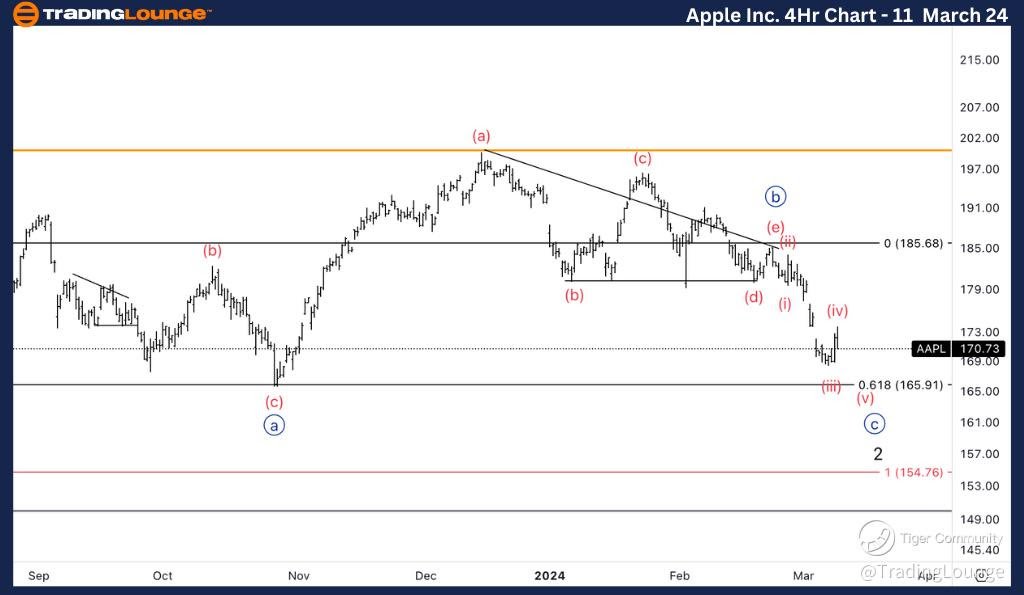

AAPL Elliott Wave Analysis Trading Lounge 4Hr Chart, 11 March 24

Apple Inc., (AAPL) 4Hr Chart Analysis

AAPL Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave (iv) of {c}

Direction: Completion of wave {c} of 2

Analyzing the 4-hour chart, AAPL continues to display counter-trend movements within a corrective mode. The structure appears flat, with the current position in wave (iv) of {c}. Observing Friday's close, increased selling pressure emerged after encountering resistance around the 173s level. The market is expected to move lower towards the bottom of MG2, potentially reaching $165.

Stay informed with our comprehensive Elliott Wave Analysis to navigate market fluctuations and make informed trading decisions. By understanding corrective patterns and potential market directions, traders can position themselves strategically to capitalize on emerging opportunities.

In conclusion, AAPL's Elliott Wave Analysis indicates ongoing corrections within a counter-trend framework. While minor wave 2 and wave (iv) of {c} are currently in focus, traders should remain vigilant for potential shifts in market dynamics. Utilize our insights to stay ahead of market movements and optimize your trading strategies effectively.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Costco Wholesale Corp., (COST)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.