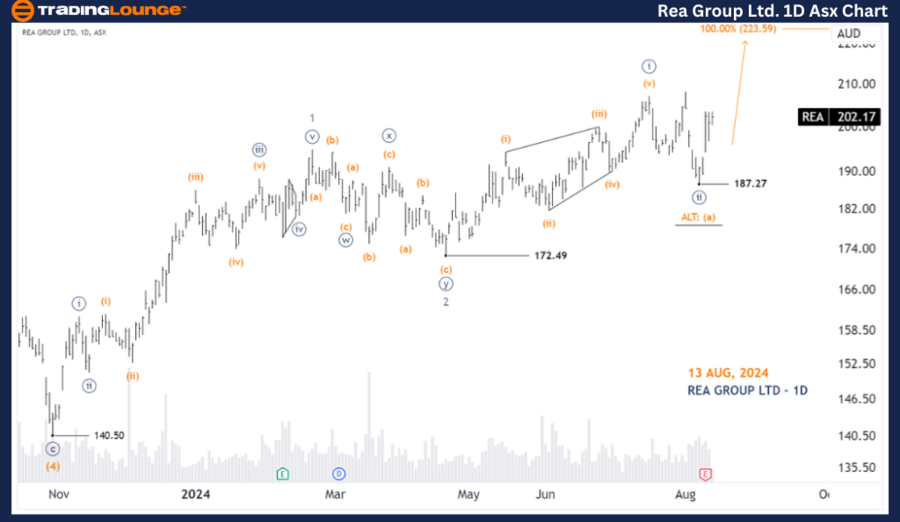

ASX: REA GROUP LTD – REA Elliott Wave Analysis (1D Chart)

Greetings, today’s Elliott Wave analysis for the Australian Stock Exchange (ASX) focuses on REA GROUP LTD – REA. Our analysis indicates that REA.ASX may be entering a rising phase within wave ((iii))-navy.

ASX: REA GROUP LTD – REA Elliott Wave Technical Analysis

ASX: REA GROUP LTD – 1D Chart (Semilog Scale) Analysis

Function: Major trend (Minor degree, gray)

Mode: Motive

Structure: Impulse

Position: Wave ((iii))-navy

Details: Wave ((ii))-navy has concluded at the recent low of 187.27, suggesting that wave ((iii))-navy is beginning to unfold and push higher. The price must remain above 187.27 to maintain this bullish outlook.

Invalidation Point: 187.27

ASX: REA GROUP LTD – REA Elliott Wave Technical Analysis (4-Hour Chart)

ASX: REA GROUP LTD – 4-Hour Chart Analysis

REA Stock Technical Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (i)-orange of Wave ((iii))-navy

Details: Following the low at 187.27, wave ((iii))-navy is progressing upwards. It is currently subdividing into wave (i)-orange, which is expected to complete soon. Once wave (ii)-orange unfolds, it should push lower, presenting a potential Long Trade Setup to target wave (iii)-orange.

Invalidation Point: 187.27

Conclusion

Our Elliott Wave analysis of ASX: REA GROUP LTD – REA provides valuable insights into the market's current trends and potential trading opportunities. By identifying specific price levels that validate or invalidate our wave counts, we aim to enhance the accuracy and reliability of our analysis. This approach allows traders to make more informed decisions and capitalize on market movements with greater confidence.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: WISETECH GLOBAL LIMITED Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support