WTI Crudeoil Commodity Elliott Wave Analysis

WTI Elliott Wave Technical Analysis

WTI Price Recovery and Potential Upside in 2024

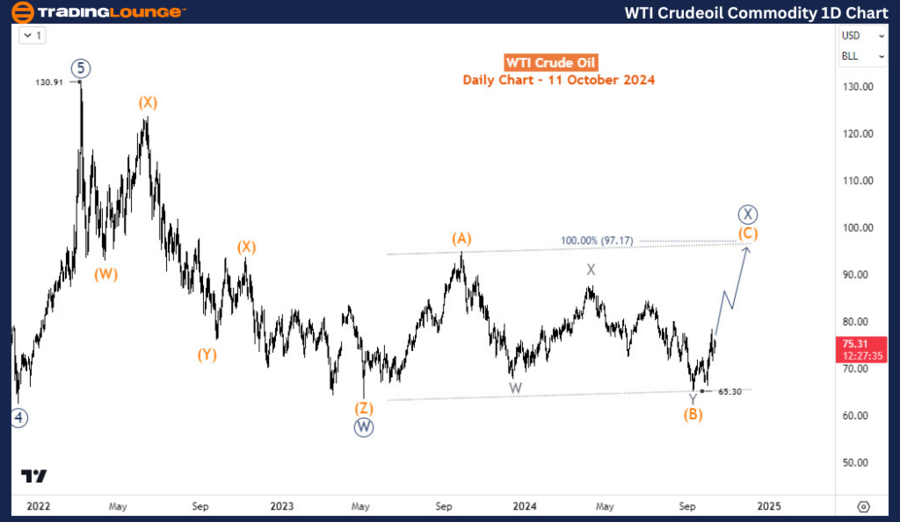

WTI crude oil is showing signs of recovery from the low reached in September 2024 and may advance further towards the $80-$90 range in the coming weeks. This bullish corrective sequence has been unfolding since May 2023. As long as the dips do not break below the September 2024 low of $65.3, the short-term outlook remains bullish.

WTI Crudeoil Commodity Day Chart Analysis

Long-Term Elliott Wave Perspective for WTI

From a broader perspective, WTI is still in a corrective phase following the significant rally to $130.9 in March 2022. This rally was driven by an impulse wave sequence that began in April 2022. The current correction appears to be taking the form of a double zigzag pattern, with wave ((W)) completing in May 2023 and wave ((X)) starting thereafter.

According to the daily chart analysis, waves (A) and (B) of wave ((X)) completed in October 2023 and September 2024, respectively. The ongoing rally from the $65.3 low marks wave (C), which could potentially push WTI prices to $97.17 if the Elliott wave analysis holds. A drop below $65.3 would indicate that wave ((X)) had already finished at the September 2023 high, leading to a bearish outlook as wave ((Y)) continues, potentially driving prices towards $50 or lower.

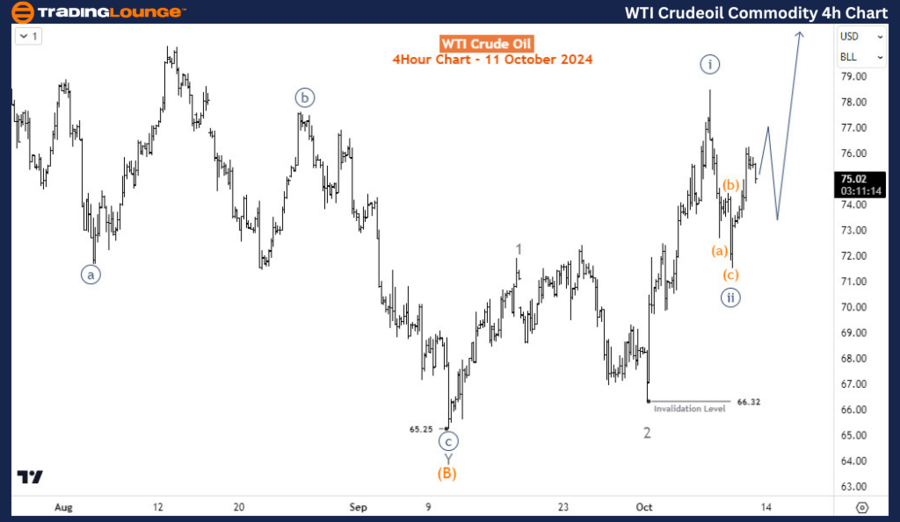

WTI Crudeoil Commodity 4-Hour Chart Analysis

H4 Chart and Short-Term WTI Price Projections

On the 4-hour chart, WTI is currently in wave 3 of the Elliott wave pattern, specifically in sub-wave ((iii)) of 3 after completing sub-wave ((ii)) at $71.56. Confirmation of this move would come with a break above the sub-wave ((i)) high. In the short term, wave ((iii)) is expected to extend, with the potential to push WTI prices above $80.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Silver Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support