Meta Platforms Inc., Elliott Wave Technical Analysis

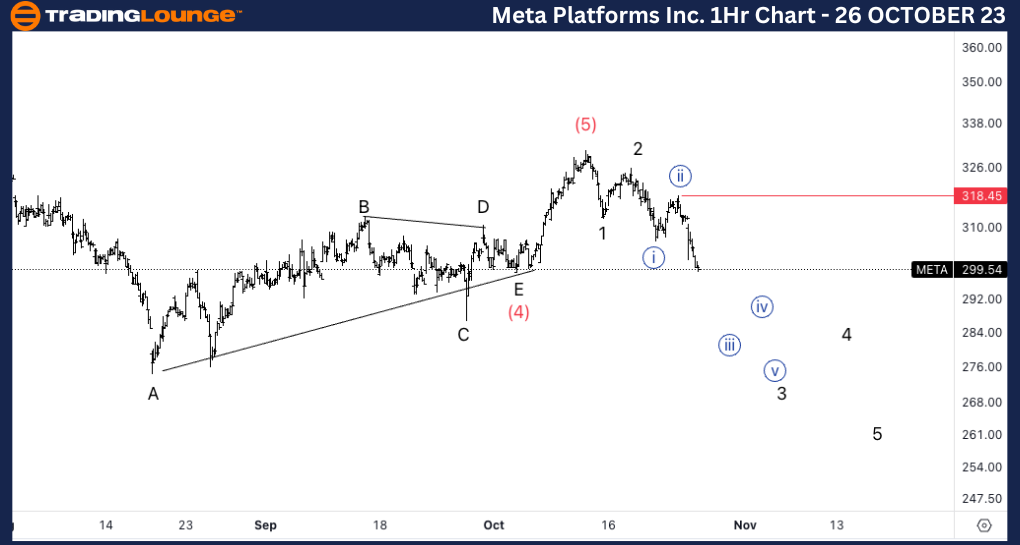

Meta Platforms Inc., (META:NASDAQ): 4H Chart 26 October 23

META Stock Market Analysis: We were looking for continuation higher into wave (5) after the triangle in wave (4), however, we nearly reached wave count invalidation, and as momentum indicators suggest we could have topped in wave (5).

META Elliott Wave Count: Wave (5) of 1.

META Technical Indicators: 200 EMA as support.

META Trading Strategy: Looking for shorts on the way down into wave (A).

TradingLounge Analyst: Alessio Barretta

Get Started With TradingLounge Today - tradinglounge.com/Pricing

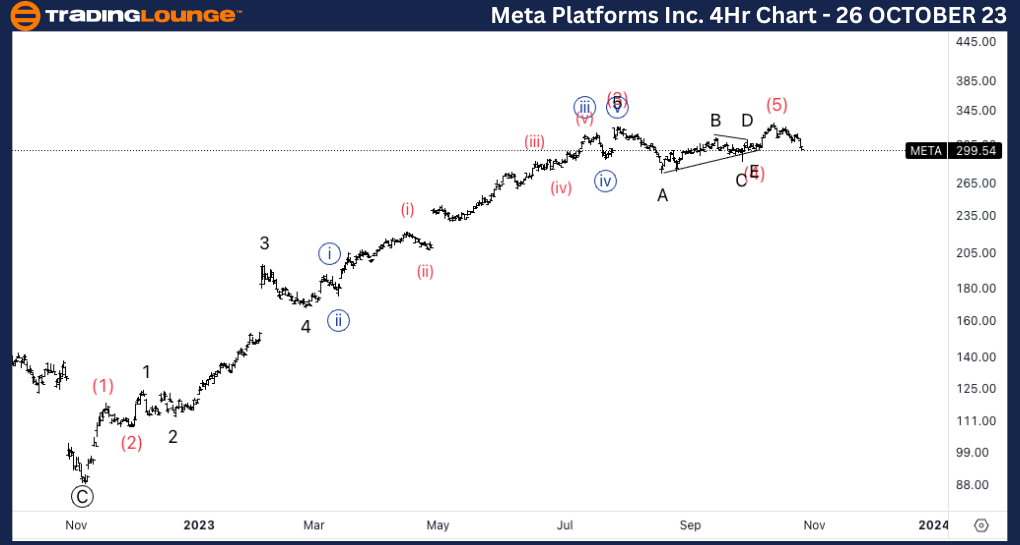

Meta Platforms Inc., META: 1-hour Chart, 26 October 23

Meta Platforms Inc., Elliott Wave Technical Analysis

META Stock Market Analysis: Looking for extension lower into wave 3. Invalidation stands at 318$. If we are indeed in a wave {iii} of 3 we should expect acceleration lower.

META Elliott Wave count: Wave {iii} of 3.

META Technical Indicators: Below all averages.

META Trading Strategy: Looking for shorts into wave 3.