PANW Elliott Wave Analysis: Evaluating Current Wave Structure for Potential Price Movements

This Elliott Wave analysis for Palo Alto Networks Inc. (PANW) provides an in-depth look at the wave structure and potential price action on both the daily and 1-hour charts. The focus is on identifying wave positions and key price levels that could inform trading strategies.

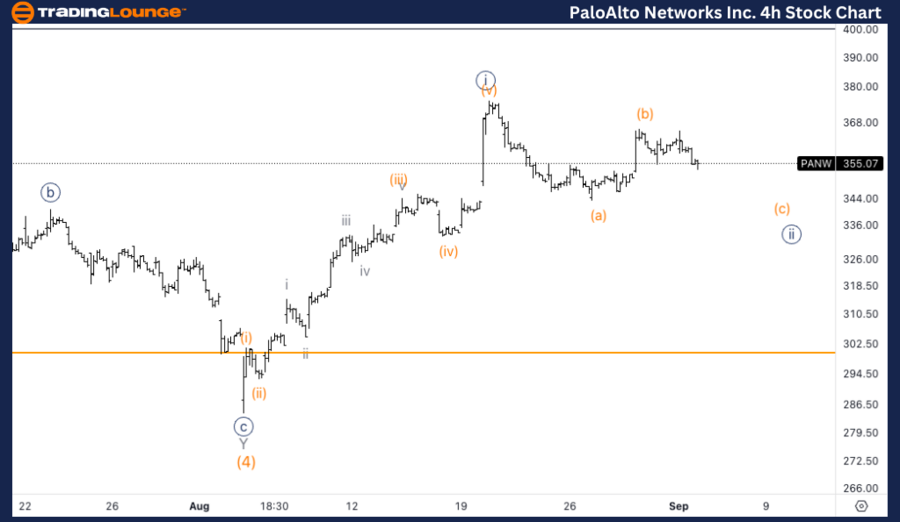

PANW Elliott Wave Analysis - TradingLounge Daily Chart

Palo Alto Networks Inc. (PANW) Daily Chart Analysis

PANW Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor 1 of (5)

Direction: Upside into wave 1

Details: The daily chart suggests that PANW is resuming its uptrend following a three-wave move into wave (4). The stock is currently trading between TradingLevel3 (TL3) and the $400 price level, indicating a potential breakout to the upside in Minor wave 1 of Intermediate wave (5).

PANW Stock Technical Analysis – Daily Chart

PANW has completed a corrective three-wave structure into wave (4), positioning it for an impulsive move higher. The stock is currently trading between TL3 and $400, suggesting that the next key level to watch is a breakout above $400, which would confirm the continuation of the uptrend in Minor wave 1 of Intermediate wave (5). Traders should monitor for this breakout as it signals further upside potential.

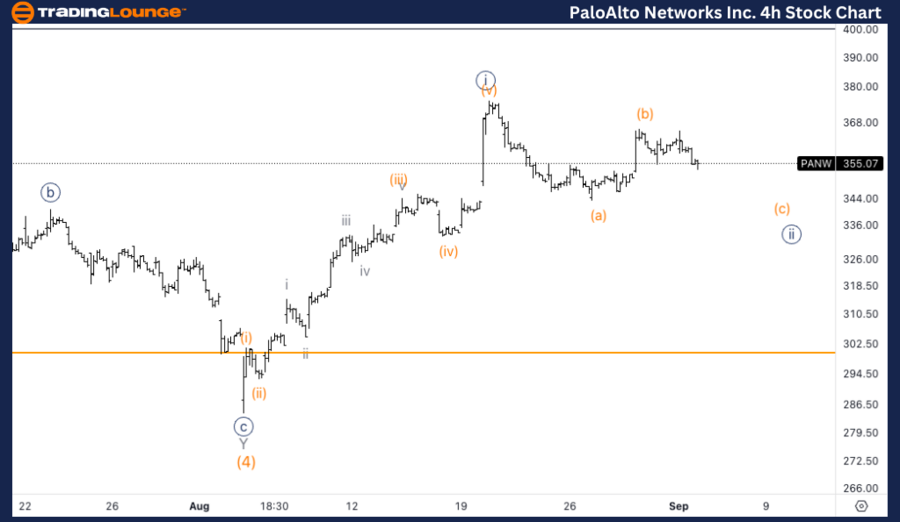

PANW Elliott Wave Analysis - TradingLounge 1H Chart

Palo Alto Networks Inc. (PANW) 1H Chart Analysis

PANW Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {ii} of 1

Direction: Bottom in wave {ii}

Details: The 1-hour chart indicates that PANW is in a corrective phase, specifically in wave {ii} of 1. The stock may either continue sideways in wave (b) of {ii} before completing the correction lower in wave (c), or wave (c) may already be in progress.

PANW Elliott Wave Technical Analysis – 1H Chart

The current corrective phase in wave {ii} of 1 could unfold in one of two scenarios: a sideways move in wave (b) of {ii}, followed by a lower move in wave (c), or wave (c) is already underway. Once wave {ii} completes, traders should anticipate a continuation of the uptrend in wave {iii} of 1, signaling a potential buying opportunity.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Costco Wholesale Corp. (COST) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support