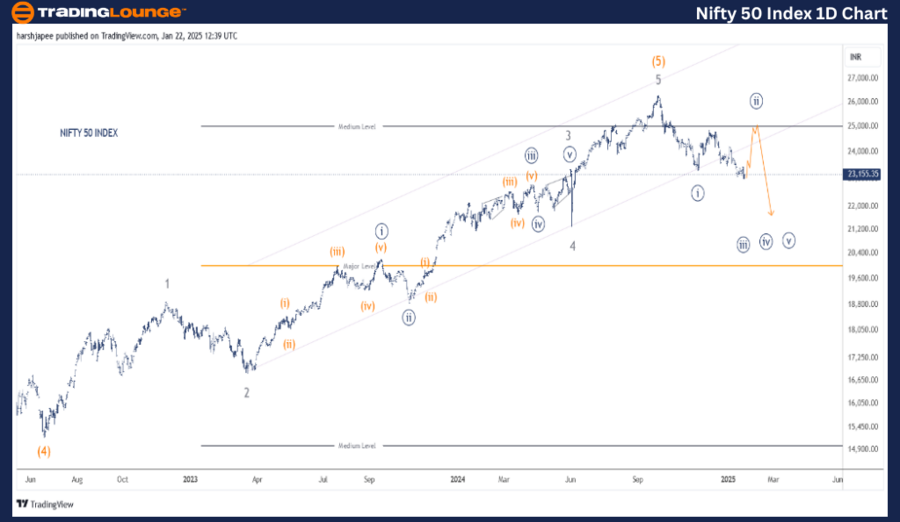

NIFTY 50 INDEX Elliott Wave Technical Analysis – Trading Lounge (1D Chart)

NIFTY 50 Elliott Wave Technical Analysis

Function: Counter Trend (Minor degree, Grey)

Mode: Corrective

Structure: Impulse within a larger degree

Position: Minute Wave ((ii))

Analysis Details:

Minute Wave ((ii)) is advancing towards the 25000 range before a potential downward continuation. The ongoing Minuette (a)-(b)-(c) corrective wave may be forming an expanded flat. If this count is valid, Wave (c) is expected to unfold soon. A short position is advisable in the 25000-100 zone.

Invalidation Point: 26400

NIFTY 50 INDEX Daily Chart Analysis & Elliott Wave Outlook

The NIFTY 50 INDEX daily chart indicates a significant top formation around the 26300 level in September 2024. Since then, the index has reversed downward, marking Minute Wave ((i)) around the 23267 zone and progressing in an expanded flat corrective pattern targeting the 25000-100 area.

The market previously completed Intermediate Wave (4) around the 15200 level in June 2022, after which a bullish trend subdivided into five waves (Minor degree) from Wave 1 to Wave 5, culminating at the 26300 mark.

If the current Elliott Wave structure holds, the index is expected to follow a corrective move against the 26300 resistance level, reinforcing a larger-degree correction phase.

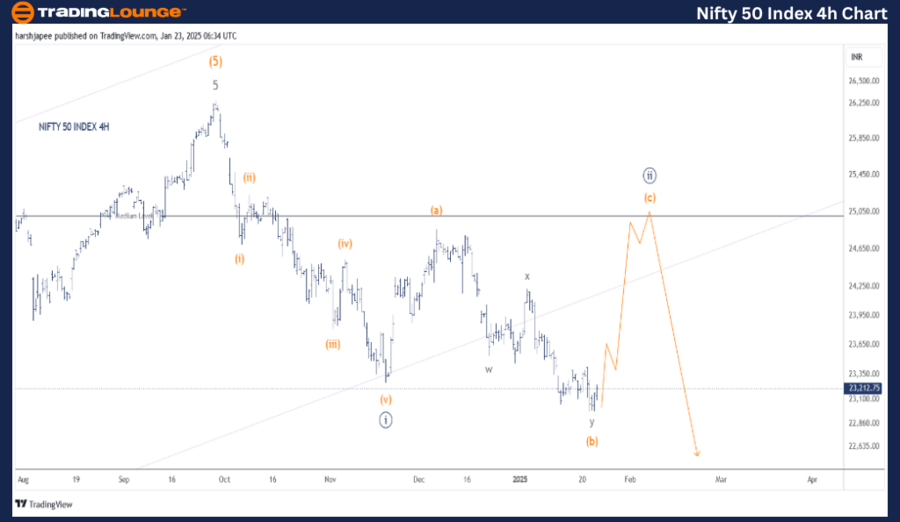

NIFTY 50 INDEX Elliott Wave Technical Analysis – Trading Lounge (4h Chart)

Function: Counter Trend (Minor degree, Grey)

Mode: Corrective

Structure: Impulse within a larger degree

Position: Minute Wave ((ii))

Analysis Details:

Minute Wave ((ii)) is progressing towards the 25000 level, signaling a continuation of the corrective phase before a resumption of the downward trend. The unfolding Minuette (a)-(b)-(c) pattern suggests an expanded flat structure. If the count is accurate, Wave (c) should push higher soon. Short positions are recommended around the 25000-100 range.

Invalidation Point: 26400

NIFTY 50 INDEX 4H Chart Analysis & Elliott Wave Outlook

The NIFTY 50 INDEX 4H chart illustrates potential wave counts after the index peaked at the 26280-300 range on September 27, 2024. The initial decline to the 23267 low represents an impulse wave at Minuette Degree, labeled (i) to (v) in Orange, concluding Minute Wave ((i)).

Following this impulse, the structure appears to be unfolding as an expanded flat corrective wave (a)-(b)-(c), with an expected push towards the 25000-100 zone. Notably, Wave (b) may have developed as a complex combination w-x-y at the Sub-Minuette level.

If this outlook remains valid, a move toward the 25000-100 target is expected, and confirmation of the bullish scenario would occur with a break above the 23430 resistance level.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: IBEX 35 (Spain) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

The NIFTY 50 INDEX is poised to advance towards the 25000-100 zone, completing Minuette Wave (c) in Orange and concluding Minute Wave ((ii)) against the 23000 support zone.