ASX: NEWMONT CORPORATION – NEM Elliott Wave Technical Analysis | TradingLounge (1D Chart)

Greetings,

This Elliott Wave update examines Newmont Corporation (ASX:NEM) listed on the Australian Stock Exchange. A bullish trend is identified, with ASX:NEM currently advancing through Wave 3. This technical analysis outlines key targets and invalidation levels to determine where the bullish trend remains valid and where it could potentially reverse.

ASX: NEWMONT CORPORATION – NEM 1D Chart Analysis (Semilog Scale)

Function: Primary trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave iii) orange within Wave iii) navy of Wave 3 grey

Details: Wave ii) orange most likely ended at the 74.25 low, completing a zigzag correction (a-b-c in grey). Following this, Wave iii) orange has shown upward momentum with a projected resistance target near the 100.00 level.

Invalidation Point: 74.25

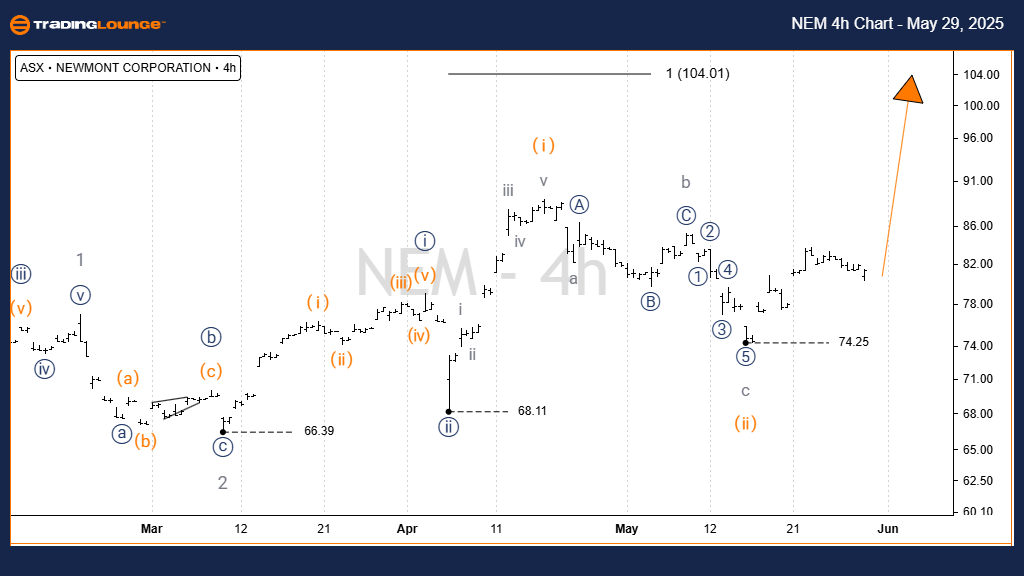

ASX: NEM Elliott Wave Analysis | TradingLounge (4-Hour Chart)

Function: Primary trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave iii) orange within Wave ((iii)) navy of Wave 3 grey

Details:

The 4-hour chart supports the bullish case, confirming that Wave iii) orange is still progressing. The medium-term Elliott Wave price target remains 100.00, while the short-term resistance level is estimated around 90.00 for Wave iii grey.

Invalidation Point: 74.25

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: COH Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave forecast for ASX:NEM offers valuable insight into the continuation of the bullish trend. The defined targets and invalidation levels deliver actionable trading signals for technical traders. Our analysis ensures a structured approach for interpreting Newmont Corporation's market momentum on the ASX, supporting precise and confident trading decisions.