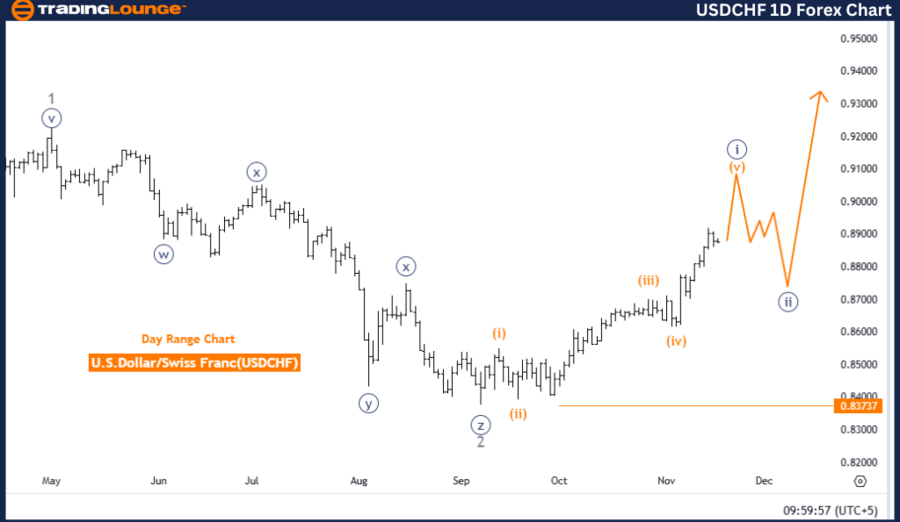

USDCHF Elliott Wave Analysis - Trading Lounge Day Chart

U.S. Dollar / Swiss Franc (USDCHF) Day Chart Analysis

USDCHF Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 5

Position: Navy Blue Wave 1

Direction Next Lower Degrees: Navy Blue Wave 2

Wave Cancel Invalidation Level: 0.83737

Detailed Analysis:

The USDCHF daily chart indicates a bullish trend with an impulsive Elliott Wave structure. The analysis pinpoints orange wave 5 as active within navy blue wave 1, projecting an ongoing upward trajectory for the USDCHF pair. The completion of orange wave 4 sets the stage for orange wave 5 to advance, suggesting further gains in the market.

In Elliott Wave theory, wave 5 represents the final phase of an impulsive sequence, often characterized by reaching new highs before a corrective phase ensues. For the USDCHF, the ongoing development of orange wave 5 reinforces bullish momentum, signaling the potential for further appreciation in the near term.

Key Validation Level:

The invalidation level is established at 0.83737. A drop to or below this price would invalidate the current wave structure, potentially signaling a weakening or reversal of the bullish trend. Monitoring this level is critical for traders, as any breach would require a reevaluation of the bullish outlook.

Summary:

The USDCHF Elliott Wave analysis on the daily chart confirms a bullish outlook, with orange wave 5 within navy blue wave 1 suggesting continued upward momentum. Traders should focus on the invalidation level at 0.83737, as a breach could signal a trend reversal or weakness in the current bullish setup.

U.S. Dollar / Swiss Franc (USDCHF) – Trading Lounge 4-Hour Chart

USDCHF Forex Pair Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Gray Wave 3

Position: Orange Wave 5

Direction Next Lower Degrees: Gray Wave 4

Wave Cancel Invalidation Level: 0.87033

Detailed Analysis:

The USDCHF 4-hour chart highlights a bullish trend, driven by an impulsive Elliott Wave structure. The current phase is gray wave 3, with orange wave 5 advancing within this broader wave, indicating sustained upward momentum for the currency pair. The completion of gray wave 2 has led to the activation of gray wave 3, often regarded as the strongest phase of an impulsive wave.

In Elliott Wave theory, wave 3 typically exhibits the most pronounced price movements, with substantial market advances. The ongoing development of orange wave 5 within this phase supports continued bullish momentum, with further gains anticipated until gray wave 4 initiates a corrective phase.

Key Validation Level:

The invalidation level is set at 0.87033. A decline to or below this level would invalidate the current wave structure, potentially signaling a shift away from the bullish trend. This level serves as a critical marker for traders to confirm the robustness of the ongoing wave pattern.

Summary:

The USDCHF Elliott Wave analysis on the 4-hour chart reinforces a bullish perspective, with gray wave 3 driving the upward trend supported by orange wave 5. Traders should closely watch the invalidation level at 0.87033, as a breach could challenge the bullish wave structure and indicate a possible trend reversal.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: AUDJPY Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support