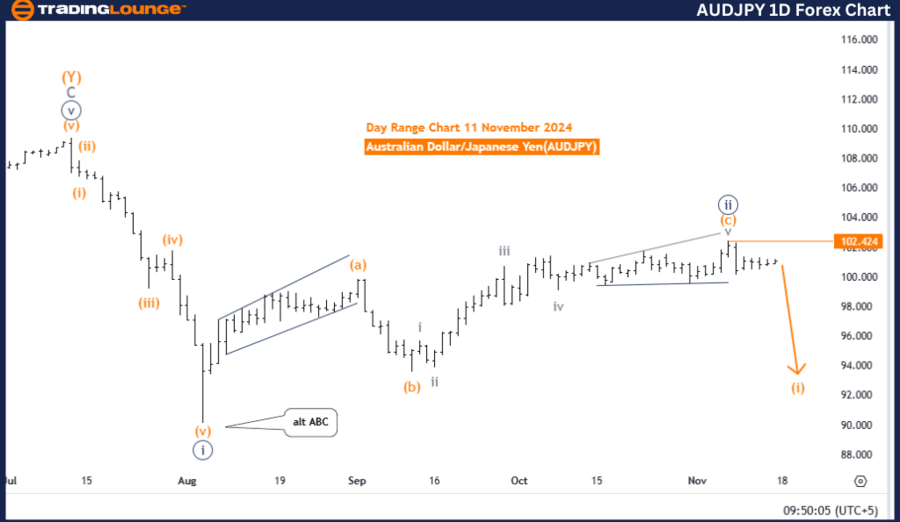

Australian Dollar / Japanese Yen (AUDJPY) – Day Chart Analysis

AUDJPY Elliott Wave Technical Analysis

Function: Bearish Trend

Mode: Impulsive

Structure: Orange Wave 1

Position: Navy Blue Wave 3

Next Higher Degree Direction: Orange Wave 2

Analysis Summary

The daily chart of AUDJPY indicates a strong bearish trend under Elliott Wave analysis. The ongoing downward momentum fits within an impulsive wave structure, where orange wave 1 is actively forming inside navy blue wave 3. This alignment underscores persistent bearish sentiment in the market.

- Navy Blue Wave 2: Completed, allowing orange wave 1 of 3 to unfold further.

- Wave Invalidation Level: Set at 102.424, marking a crucial threshold for trend validation.

Wave Analysis Details

The development of navy blue wave 3 supports a bearish trajectory, signaling that the pair holds substantial potential for continued downside momentum.

Invalidation Level and Trading Implications

The invalidation level for the bearish Elliott Wave count is established at 102.424. A price movement above this level would:

- Invalidate the current wave count.

- Suggest a potential trend reversal or weakening of bearish sentiment.

For traders, this invalidation level acts as a critical benchmark to:

- Confirm the continuation of the bearish trend.

- Prompt reassessment of trading strategies if breached.

Conclusion

The Elliott Wave analysis for AUDJPY on the daily chart projects a bearish outlook. The active progress of orange wave 1 within navy blue wave 3 suggests continued downside movement. Nevertheless, the invalidation level at 102.424 remains a key focus for traders, as breaching this point would challenge the bearish framework and signal a potential trend reversal.

Australian Dollar / Japanese Yen (AUDJPY) – 4-Hour Chart Analysis

AUDJPY Elliott Wave Technical Analysis

Function: Bearish Trend

Mode: Impulsive

Structure: Orange Wave 1

Position: Navy Blue Wave 3

Next Higher Degree Direction: Orange Wave 2

Analysis Summary

The 4-hour chart of AUDJPY continues to highlight a bearish trend, supported by an impulsive wave structure. Orange wave 1 is actively progressing within the broader navy blue wave 3, emphasizing sustained downward pressure.

- Navy Blue Wave 2: Completed, paving the way for Orange Wave 1 of Navy Blue Wave 3 to develop.

- Wave Invalidation Level: Defined at 102.424, representing a crucial threshold for the bearish outlook.

Wave Analysis Details

Invalidation Level and Trading Implications

The invalidation level for this wave structure is set at 102.424. A price movement above this level would:

- Suggest a potential trend reversal or reduced bearish momentum.

- Require traders to reassess the wave structure and adapt their trading strategies.

This level serves as a pivotal point for validating the ongoing bearish trend and gauging its strength.

Conclusion

The 4-hour chart analysis of AUDJPY reinforces a bearish outlook. The continuation of orange wave 1 within navy blue wave 3 underscores the likelihood of further downward movement. However, the invalidation level at 102.424 is a critical juncture. If breached, it would challenge the bearish structure and potentially signal a reversal in market direction.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: EURUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support