COST Elliott Wave Analysis: Forecasting Trends in Costco Wholesale Corp. (COST)

In this Elliott Wave analysis, we examine the trend structure of Costco Wholesale Corp. (COST) using daily and 1-hour charts to analyze the current wave position and potential price movements.

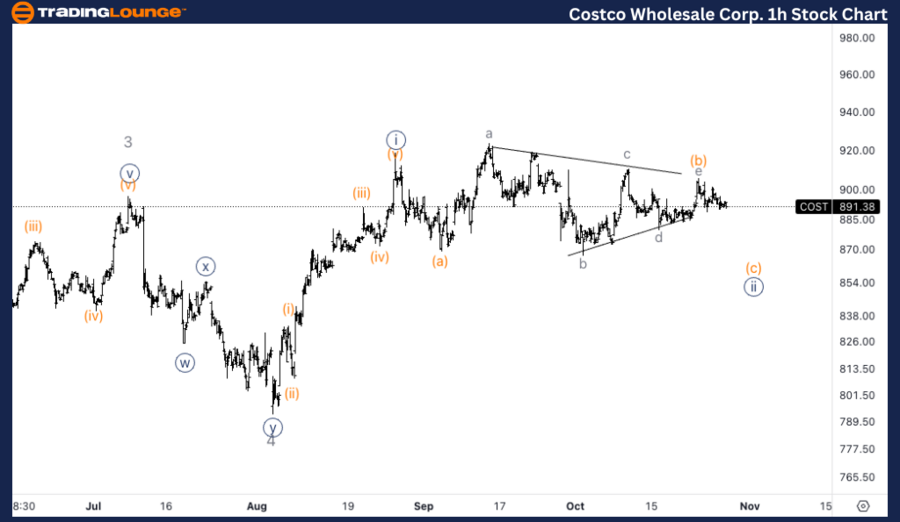

COST Elliott Wave Analysis – Trading Lounge Daily Chart

Costco Wholesale Corp. (COST) Daily Chart Analysis

COST Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 5 of (5)

Direction: Upside in wave 5

Details: We anticipate a continuation higher within wave 5 of (5), with the next key resistance level near the Trading Level at $1000, a potential psychological threshold.

COST Elliott Wave Technical Analysis – Daily Chart

On the daily chart, COST is advancing within wave 5 of (5), which marks the final leg in this bullish trend. The next major resistance level is expected around the Trading Level at $1000. This price level could act as a significant barrier, given its psychological influence. The broader trend remains bullish as the price approaches this critical resistance zone.

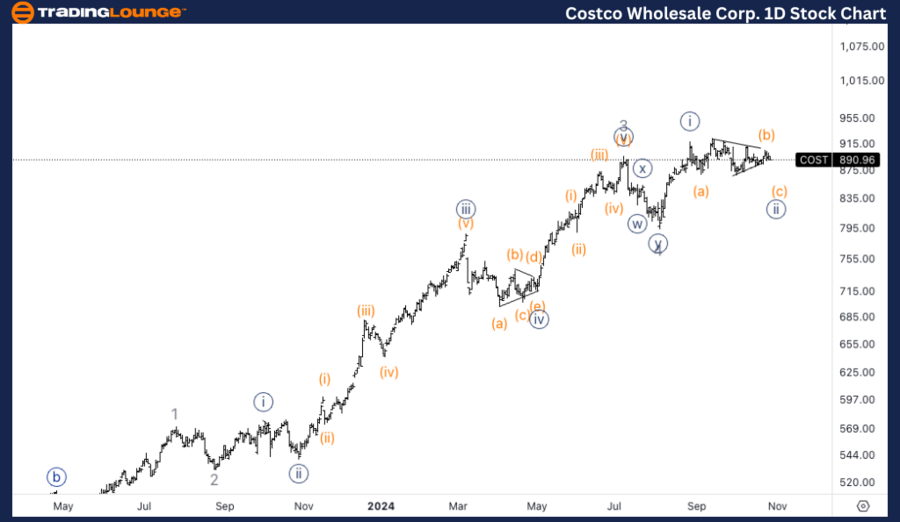

Costco Wholesale Corp. (COST) 1-Hour Chart

COST Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (c) of {ii}

Direction: Downside in wave (c)

Details: The formation of a triangle within wave (b) of {ii} suggests a potential move lower in wave (c) to complete the correction phase. A support zone around $850 could serve as a possible base.

COST Elliott Wave Technical Analysis – 1H Chart

On the 1-hour chart, COST appears to be in the corrective phase of wave {ii}, particularly in wave (c). The development of a triangle in wave (b) suggests one more leg down in wave (c), which could complete the overall correction. Support near the $850 mark is an important level to watch, as it could serve as a launch point for the next upward trend leg.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: JP Morgan & Chase Co Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support