Elliott Wave Analysis for JP Morgan & Chase Co. (JPM)

This comprehensive Elliott Wave analysis of JP Morgan & Chase Co. (JPM) explores both the daily and 1-hour charts to provide insight into the current market trend, leveraging Elliott Wave Theory to forecast potential movements.

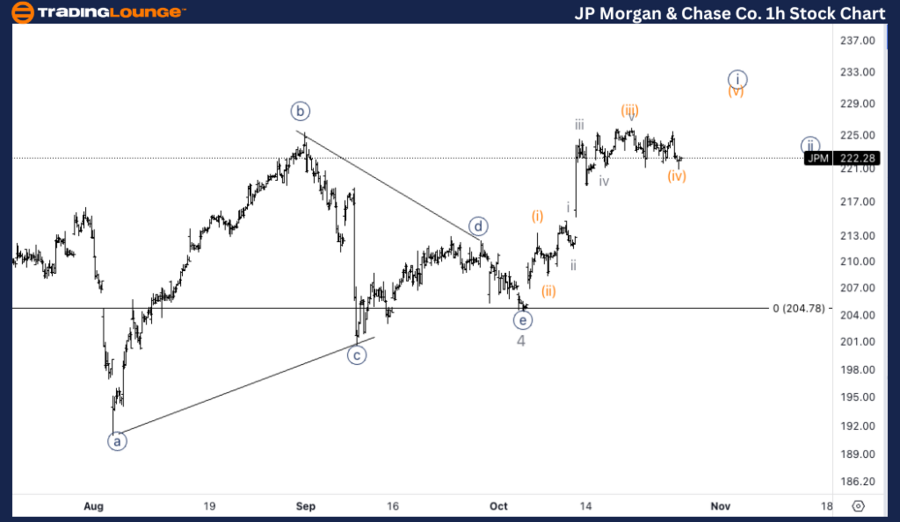

JPM Elliott Wave Analysis - Trading Lounge Daily Chart

JP Morgan & Chase Co. (JPM) Daily Chart Analysis

JPM Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor wave 5

Direction: Upside within wave 5

Details: The daily analysis indicates the potential completion of wave {i} of 5 at the $220 level. From here, a corrective pullback in wave {ii} may emerge before a resumption of the uptrend. If wave 5 reaches the 0.618 Fibonacci extension relative to prior waves, the target could extend to approximately $254.

JPM Stock Technical Analysis - Daily Chart

On the daily chart, JP Morgan (JPM) appears to be advancing within Minor wave 5, with wave {i} potentially completed upon reaching the $220 mark. The forecast includes a probable retracement in wave {ii} before a push higher in wave {iii}. Using the 0.618 extension target for wave 5, JPM may reach around $254.

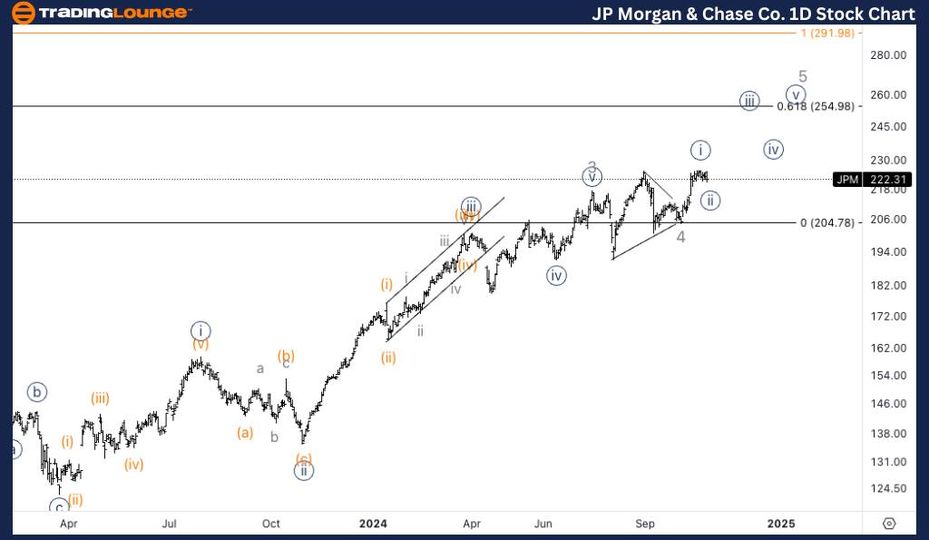

JP Morgan & Chase Co. (JPM) TradingLounge 1-Hour Chart

JP Morgan & Chase Co - JPM Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {i} of 5

Direction: Top in wave {i}

Details: The 1-hour chart hints at an alternative scenario where wave {i} remains active, specifically suggesting that JPM is in wave (iv) of {i}. Following this corrective phase, the expectation is for an upward move, marking wave (v) of {i} to complete the initial segment of Minor wave 5.

JPM Elliott Wave Technical Analysis – 1-Hour Chart

The 1-hour chart presents an alternate count for wave {i} of 5, implying that the wave may be in wave (iv) before resuming an upward trend. Once this correction concludes, JPM could experience further upside in wave (v) of {i}, finalizing the opening phase of Minor wave 5.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Spotify Technology S.A Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support