SPOT Elliott Wave Analysis - Trading Lounge Daily Chart

Spotify Technology S.A. (SPOT) - Daily Chart

SPOT Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave 5 of (1)

Direction: Bullish within wave 5

Details: Current pullbacks are manifesting in a three-wave pattern, keeping the outlook optimistic for further upward movement in Minor wave 5. This progression could aim toward the $500 mark.

Daily Chart Insight: On the daily chart, SPOT is progressing within Minor wave 5 of (1), exhibiting a structured three-wave pullback. This setup supports the continuation of the upward trend, potentially reaching around $500.

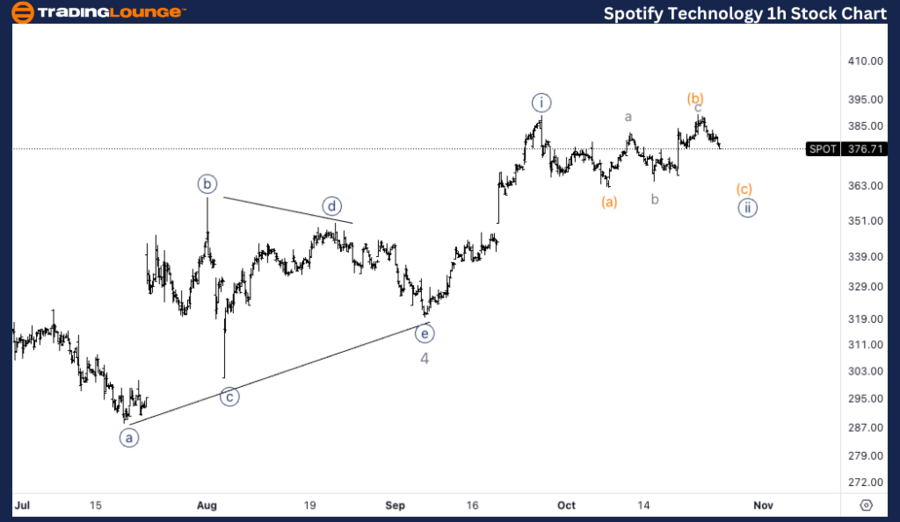

Spotify Technology S.A. (SPOT) - 1H Chart

SPOT Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {ii} of 5

Direction: Bottom formation within wave {ii}

Details: The ongoing pattern in wave {ii} indicates it may still be forming, as recent upward movement maintains a three-wave structure. This implies the possibility of one last minor decline before an upward movement resumes in wave {iii} of 5.

1H Chart Insight: The 1-hour chart suggests wave {ii} is likely continuing, with a potential small pullback ahead before resuming the upward trend in wave {iii} of 5.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Salesforce Inc Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Summary of SPOT Elliott Wave Analysis

This analysis applies Elliott Wave Theory to Spotify Technology S.A. (SPOT) across daily and 1-hour charts, examining current trends to forecast future price directions.