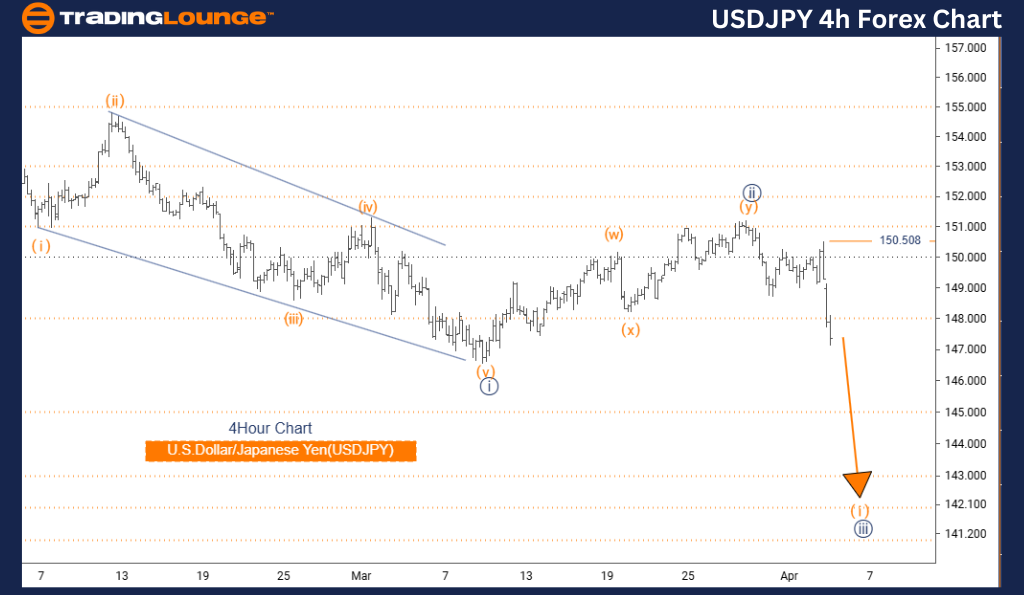

U.S. Dollar / Japanese Yen (USDJPY) Elliott Wave Analysis – TradingLounge Daily Chart

USDJPY Elliott Wave Technical Review

Function: Counter Trend

Mode: Impulsive

Structure: Navy Blue Wave 3

Position: Gray Wave C

Next Higher Degree Direction: Navy Blue Wave 4

Invalidation Level: 158.898

Analysis Summary

The daily Elliott Wave forecast for USDJPY signals a counter-trend structure that carries major implications for medium-term price action. The current focus is on the development of navy blue wave 3 within gray wave C.

Following the completion of navy blue wave 2, the USDJPY currency pair has begun the impulsive stage of navy blue wave 3. This segment plays a central role in the ongoing corrective pattern and offers trading opportunities for trend-based strategies.

Technical Assessment

Should the price fall below the invalidation level of 158.898, the existing wave structure would be invalidated. So long as the price holds above this level, the forecast remains consistent with a developing impulsive move within a corrective framework.

Once navy blue wave 3 concludes, traders should prepare for navy blue wave 4, which is expected to introduce a correction phase. Monitoring the momentum and structure of wave 3 is essential, as these are often indicative of market sentiment shifts.

Trading Outlook

This Elliott Wave analysis provides a useful framework for short-term trade setups and long-term market positioning. It's essential to keep an eye on the interaction between wave degrees and the broader market context to make informed trading decisions.

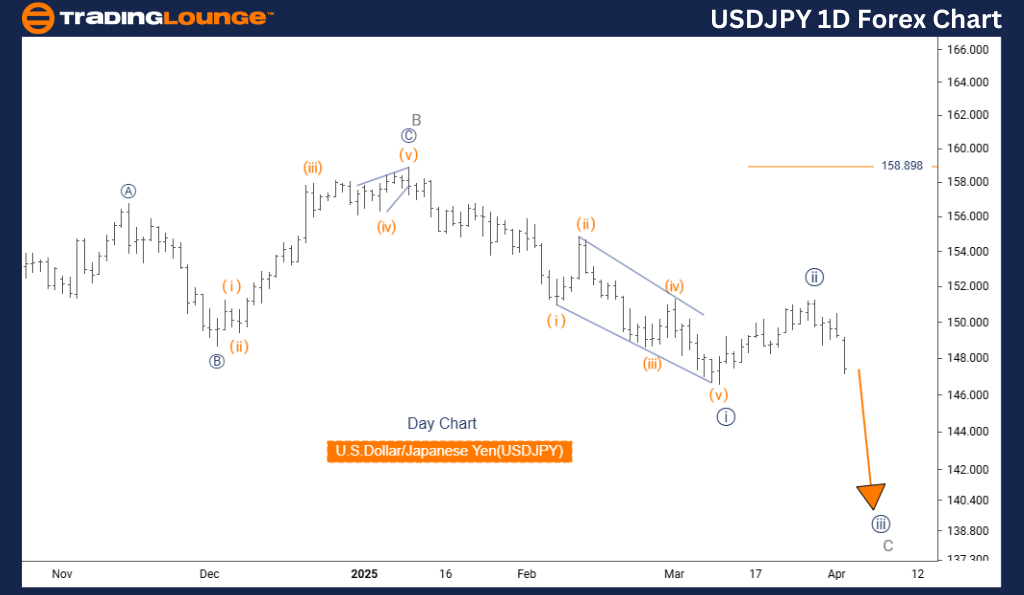

U.S. Dollar / Japanese Yen (USDJPY) Elliott Wave Analysis – TradingLounge 4-Hour Chart

USDJPY Elliott Wave Technical Review

Function: Bearish Trend

Mode: Impulsive

Structure: Orange Wave 1

Position: Navy Blue Wave 3

Next Higher Degree Direction: Orange Wave 2

Invalidation Level: 150.508

Analysis Summary

The 4-hour USDJPY Elliott Wave chart reveals a developing bearish trend with potential for momentum expansion. The structure of orange wave 1 currently dominates the setup and is part of the broader navy blue wave 3 sequence.

Navy blue wave 2 has likely ended, and the pair now appears to be entering orange wave 1 of 3, suggesting a possible continuation of downward movement.

Technical Assessment

The key invalidation level to watch is 150.508. A breach of this point would challenge the current wave count. Maintaining price action below this level supports the forecast of further downside potential.

Once orange wave 1 concludes, a short-term correction in the form of orange wave 2 is anticipated, likely preceding the resumption of bearish action in orange wave 3.

Trading Outlook

This Elliott Wave setup offers both intraday and swing trading opportunities. The progression of orange wave 1 presents a window for early short positions aligned with the growing bearish momentum. Traders should look for confirming signals such as sharp price moves and rising volume.

Effective risk management, particularly near the invalidation level, is vital to navigate potential volatility.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts Join TradingLounge Here

Previous: EURUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support