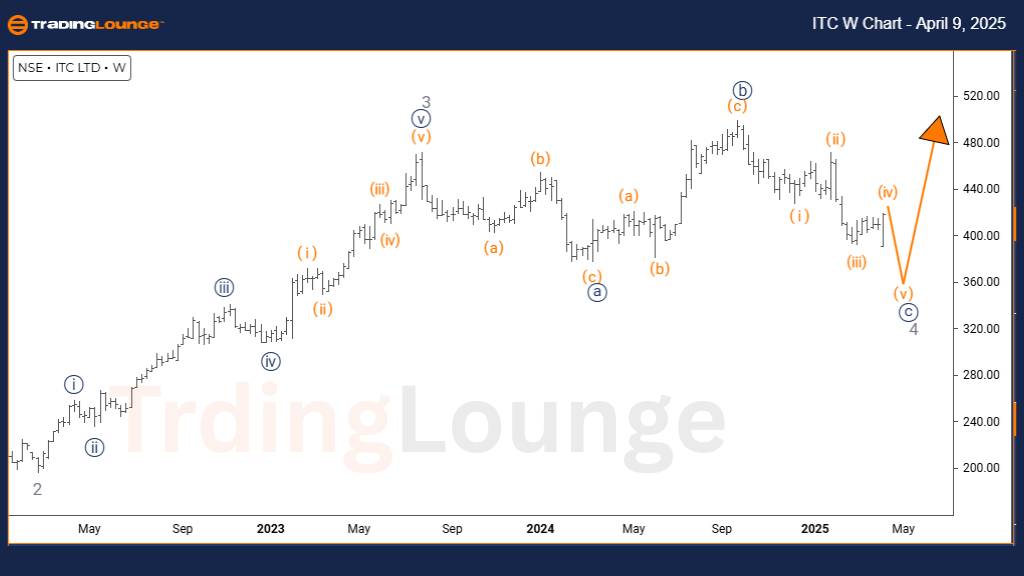

ITC INDIA Elliott Wave Analysis Trading Lounge Day Chart

ITC INDIA Stock Day Chart Analysis

ITC INDIA Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Navy blue wave C

POSITION: Gray wave 4

DIRECTION NEXT HIGHER DEGREES: Gray wave 5

DETAILS: Navy blue wave B appears complete, with navy blue wave C now unfolding.

Wave Cancel Invalid Level: 470.79

The ITC INDIA Elliott Wave Analysis on the daily chart highlights a corrective phase within the broader Elliott Wave structure, identifying a counter-trend move for this leading FMCG stock. The current setup places focus on navy blue wave C, developing within gray wave 4, signaling a potential short-term decline ahead of a bullish continuation.

With navy blue wave B concluded, the transition into navy blue wave C suggests the stock is experiencing a temporary pause before the start of gray wave 5. This scenario implies that ITC may offer short-term trading opportunities during the correction, while maintaining a longer-term bullish outlook.

Key support lies at 470.79, which is the wave count invalidation level. A break below this level would negate the current wave structure and require a reassessment of the pattern. Traders should monitor for classic corrective patterns, such as ABC zigzags or sideways ranges, to align with wave expectations. Once wave C finalizes, gray wave 5 could resume the primary upward trend, presenting strong potential for trend-following trades.

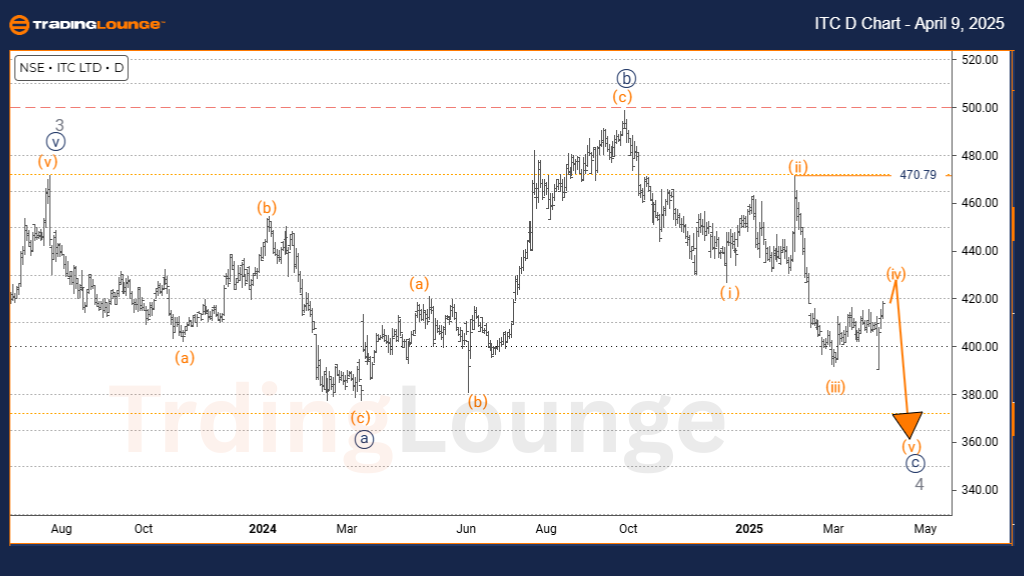

ITC INDIA Elliott Wave Analysis Trading Lounge Weekly Chart

ITC INDIA Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Navy blue wave C

POSITION: Gray wave 4

DIRECTION NEXT HIGHER DEGREES: Gray wave 5

DETAILS: Navy blue wave B appears complete, and navy blue wave C is currently in progress.

Wave Cancel Invalid Level: 470.79

The ITC INDIA Elliott Wave Analysis on the weekly chart presents a broader corrective structure in motion, with the stock navigating through navy blue wave C of gray wave 4. This wave count suggests a medium-term pullback within the prevailing uptrend, offering insight into possible entry setups ahead of gray wave 5's impulsive phase.

With the completion of navy blue wave B, the progression into wave C underscores the importance of understanding wave relationships across timeframes. The 470.79 level acts as a crucial invalidation point for this wave scenario. Breaching this threshold would challenge the integrity of the current analysis, signaling an alternate pattern could be at play.

This weekly Elliott Wave outlook provides a strategic roadmap for position traders, enabling a broader perspective on market corrections and trend resumption potential. As wave C evolves, traders should stay alert to corrective patterns and prepare for the transition into gray wave 5, which could restore bullish momentum. The chart signals short-term weakness but also hints at longer-term growth opportunities, reinforcing ITC's place within a maturing Elliott Wave cycle.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: COAL INDIA Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support