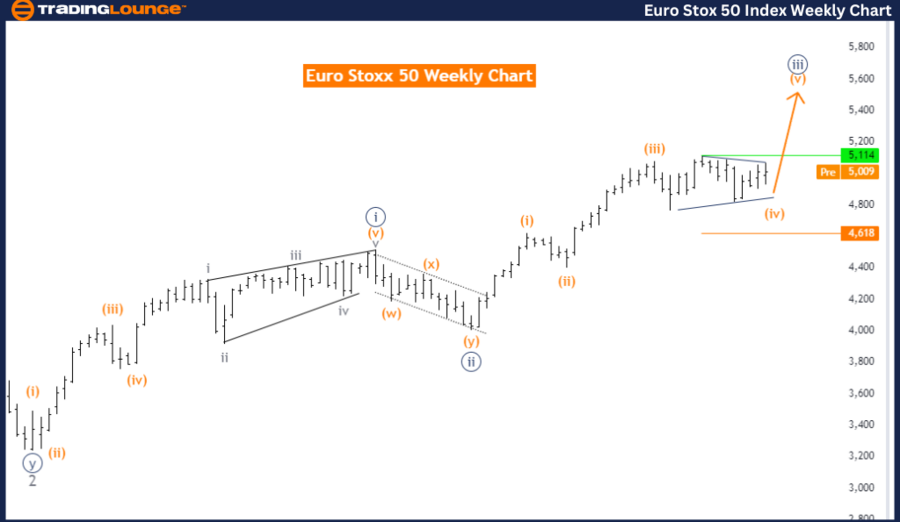

Euro Stoxx 50 Elliott Wave Analysis - Daily Chart

Overview

The Euro Stoxx 50 Elliott Wave analysis on the daily chart highlights a counter-trend within a corrective mode.

Trend Identification

- Function: Counter Trend

- Mode: Corrective

- Structure: Orange wave 4

- Position: Navy blue wave 3

Current Analysis

- Details: Orange wave 4 continues to exhibit sideways movement.

- Invalidation Level: 4618

Key Points

Detailed Analysis

- Sideways Movement: Orange wave 4 is characterized by a lack of clear directional bias and range-bound market behavior.

- Wave 4 Characteristics: The ongoing orange wave 4 reflects a period of fluctuation without a strong upward or downward trend.

- Invalidation Level: Set at 4618, this level is crucial; surpassing it would invalidate the current wave analysis, indicating a significant market shift.

Conclusion

The Euro Stoxx 50 daily chart analysis identifies a counter trend within the Elliott Wave framework. The market is in the corrective phase of orange wave 4 within navy blue wave 3, marked by sideways movement. This phase is ongoing, with the next phase being Orange Wave 5. The invalidation level at 4618 is essential for confirming the current wave structure.

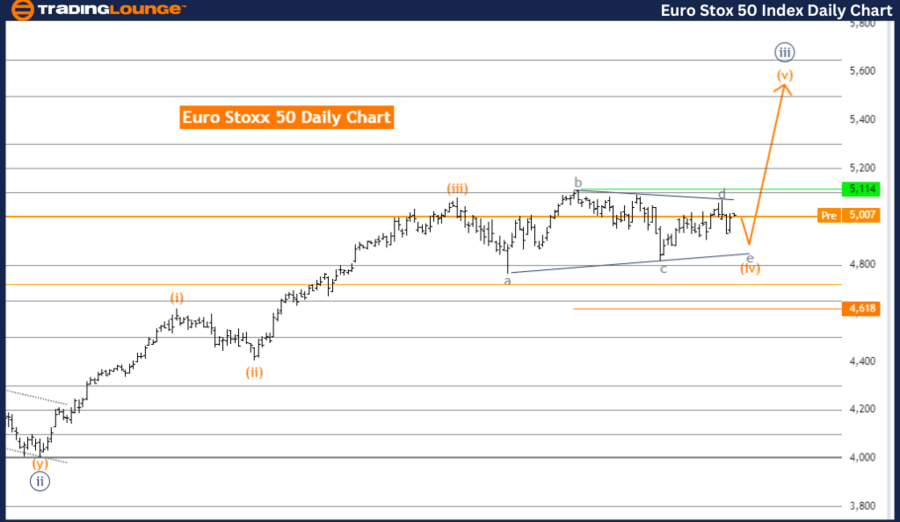

Euro Stoxx 50 Elliott Wave Analysis - Weekly Chart

Overview

The Euro Stoxx 50 Elliott Wave analysis on the weekly chart highlights a strong trend within an impulsive mode.

Trend Identification

- Function: Trend

- Mode: Impulsive

- Structure: Navy blue wave 3

- Position: Gray wave 3

Current Analysis

- Details: Navy blue wave 3 is currently in progress.

- Invalidation Level: 4618

Key Points

Detailed Analysis

Conclusion

The Euro Stoxx 50 weekly chart analysis highlights an impulsive trend within the Elliott Wave framework. The market is in the upward phase of navy blue wave 3 within gray wave 3, showing strong bullish momentum. The next phase is expected to be Navy Blue Wave 4, involving a corrective retracement. The invalidation level at 4618 is critical for confirming the current wave structure.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See previous: Swiss Market Index Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support