UNH Elliott Wave Analysis Trading Lounge Daily Chart, 29 February 24

Welcome to our UNH Elliott Wave Analysis Trading Lounge, your go-to resource for in-depth insights into UnitedHealth Group Inc. (UNH) using Elliott Wave Technical Analysis. As of the Daily Chart on 29th February 2024, we delve into significant trends driving the market.

UnitedHealth Group Inc., (UNH) Daily Chart Analysis

UNH Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Triangle

POSITION: Wave (C) of 4.

DIRECTION: Sideways continuation in the triangle.

DETAILS: We have been correcting ever since the end of 2022, and at this point we seem to be “dancing” around Trading Level 5 at 500$. In this daily chart we entertain the possibility of a triangle in wave 4, meaning we could see sideways continuation until the triangle resolves.

UNH Technical Analysis – Daily Chart

In terms of wave dynamics, we identify a counter trend function with a corrective structure, particularly a triangle pattern. The current position is in Wave (C) of 4, indicating sideways continuation within the triangle. Since the end of 2022, we've been in a correction phase, and currently, we're hovering around Trading Level 5 at $500. The daily chart presents the possibility of a triangle formation in wave 4, suggesting sideways movement until the triangle resolves.

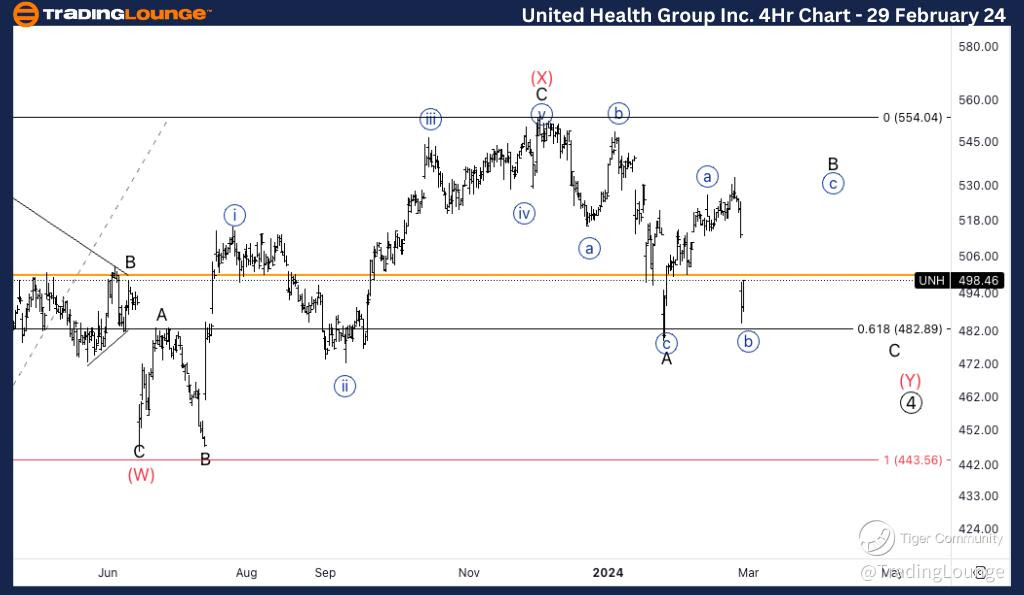

UNH Elliott Wave Analysis Trading Lounge 4Hr Chart, 29 February 24

UnitedHealth Group Inc., (UNH) 4Hr Chart

UNH Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Complex

POSITION: Wave B of (Y).

DIRECTION: Upside in wave C of (Y).

DETAILS: Here we entertain the possibility of a complex correction in Primary wave 4, where we could be near the end, as we have found support on 0.618 (Y) vs. (W). We could either continue higher in wave {c} of B to then continue lower towards equality of (Y) vs. (W) at 443, or else we could already have a bottom in place.

Here, we explore a counter trend mode with a corrective and complex structure, potentially indicating Wave B of (Y). The direction is upside in wave C of (Y). We consider the prospect of a complex correction in Primary wave 4, nearing its end, with support identified at 0.618 (Y) versus (W). We anticipate either further upside in wave {c} of B followed by a downturn towards equality of (Y) versus (W) at $443 or a potential bottom already in place.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Apple Inc.

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.