AAPL Elliott Wave Analysis Trading Lounge Daily Chart, 28 February 24

Welcome to our AAPL Elliott Wave Analysis Trading Lounge, your premier destination for comprehensive insights into Apple Inc. (AAPL) using Elliott Wave Technical Analysis. As of the Daily Chart on 28th February 2024, we explore significant trends shaping the market.

AAPL Elliott Wave Technical Analysis

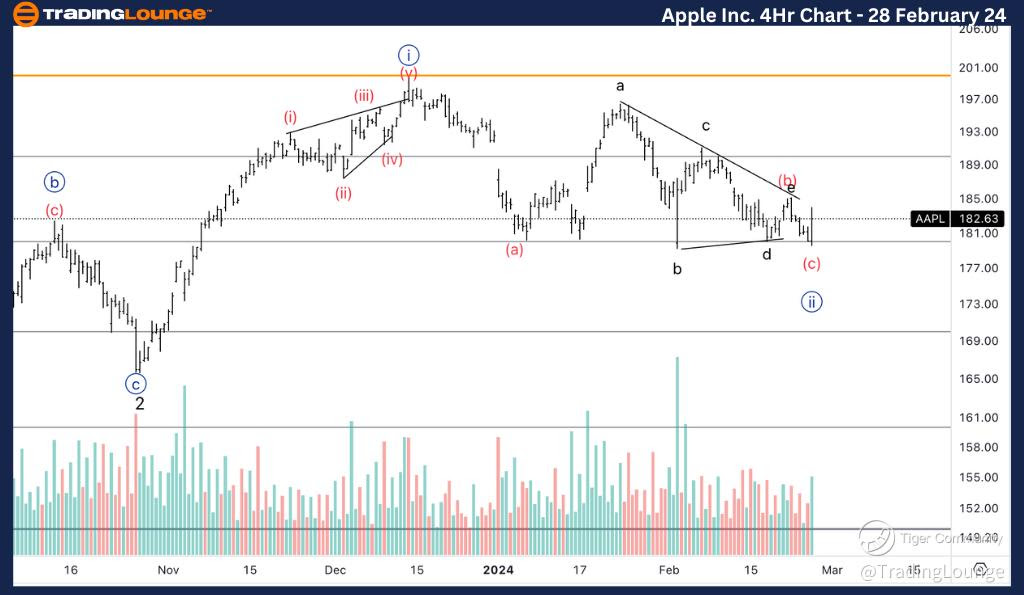

Apple Inc., (AAPL) Daily Chart Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Flat

POSITION: Wave (c) of {ii}.

DIRECTION: Bottoming in wave {ii}.

DETAILS: Despite the fact we keep finding resistance on top of TL2 at 200$, the bullish count is still valid as, on the other hand, we keep finding support on top of the end of MG2 at 180$. We are looking for a end of wave (c) to then find additional confirmation higher. The safe trades stands after finding support on 200$.

In terms of wave dynamics, we identify a counter-trend function with a corrective structure, specifically a flat pattern. The current position is in Wave (c) of {ii}, indicating potential bottoming in Wave {ii}. Despite encountering resistance at TL2 at $200, the bullish count remains valid as we consistently find support at the end of MG2 at $180. We anticipate the completion of wave (c) for additional confirmation higher, with a safe trade identified after finding support at $200.

AAPL Elliott Wave Analysis Trading Lounge, 28 February 24

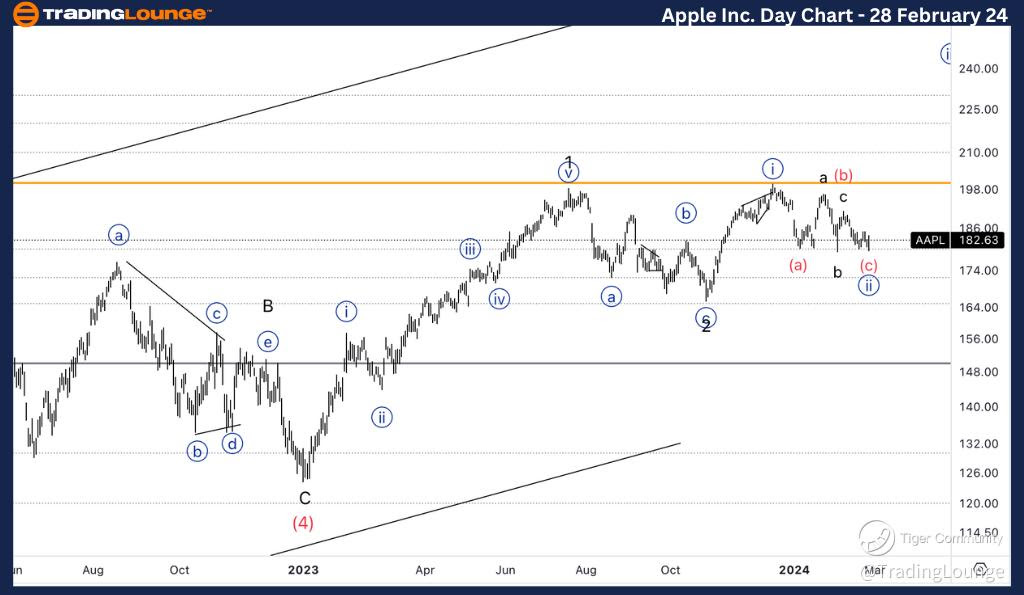

Apple Inc., (AAPL) 4Hr Chart Analysis

AAPL Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Flat

POSITION: Wave (c) of {ii}.

DIRECTION: Bottoming in wave {ii}.

DETAILS: Here we take a look at an alternative count, with a triangle in wave (b) instead of a regular flat correction. Looking for either a short wave (c) in place, or else we are in substitute wave ii of (c).

Here, we explore an alternative count with a triangle pattern in wave (b) instead of a regular flat correction. The present position is in Wave (c) of {ii}, also suggesting bottoming in wave {ii}. We anticipate either a short wave (c) in place or substitute wave ii of (c) to unfold.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Alphabet Inc.,(GOOGL)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.