In the realm of Elliott Wave Theory, Alphabet Inc. (GOOGL) charts are revealing intriguing patterns, offering a roadmap for traders amidst corrective movements. Here's a comprehensive breakdown of the latest developments, blending technical analysis with Elliott Wave insights.

GOOGL Elliott Wave Analysis on Daily Chart: Unveiling Wave A of (2)

GOOGL Elliott Wave Technical Analysis

In the domain of Elliott Wave analysis, the current function observed in GOOGL's daily chart is indicative of a counter-trend movement. Positioned within a corrective structure known as a zigzag, GOOGL appears to be navigating Wave A of (2), signaling a downside trajectory.

The journey begins with a noteworthy rally, catapulting from a bottom resting at $80 and finding support at the crucial TL1 level around $100. However, as the price action encounters resistance at the Medium Level of $150, it suggests the completion of a five-wave rally within Wave (1).

The implications are clear: GOOGL's Wave A of (2) anticipates a downside movement, setting the stage for strategic trading decisions amidst the corrective tide.

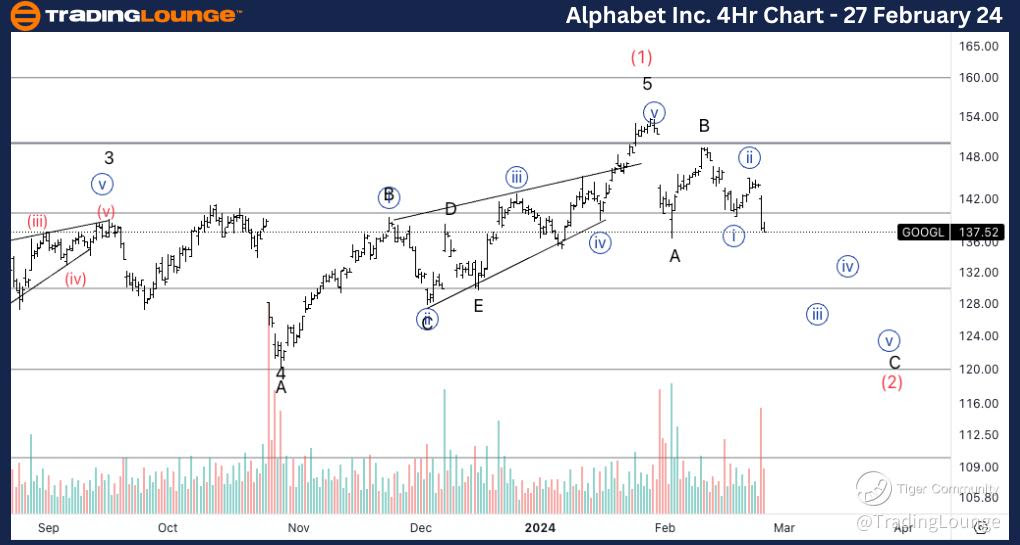

Insights from the 4-Hour Chart: Delving into Wave {iii} of C

Zooming into the 4-hour chart of Alphabet Inc. (GOOGL), the Elliott Wave analysis continues to unravel intriguing dynamics within the corrective landscape.

Once again, the prevailing function echoes a counter-trend sentiment, with the structure mirroring a zigzag pattern. Positioned within Wave {iii} of C, the directional bias leans towards the downside, encapsulating the essence of corrective movements.

As the price action unfolds, a discernible pattern emerges, hinting at an acceleration lower within Wave {iii}. The initial five-wave move witnessed in Wave {i} serves as a precursor to potential further downside within Wave {iii}.

Nevertheless, amidst the unfolding scenario, a degree of uncertainty looms. The possibility of being within Wave {c} instead of Wave C adds a layer of complexity to the analysis, underscoring the need for astute observation and strategic positioning in the face of market fluctuations.

TradingLounge Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: The Walt Disney Company (DIS)

Strategic Considerations for GOOGL Elliott Wave Traders

For traders navigating the intricate landscape of GOOGL's Elliott Wave patterns, strategic considerations are paramount. Here are some key takeaways to enhance trading efficacy:

-

Pattern Recognition: Develop a keen eye for identifying Elliott Wave patterns, discerning between corrective and impulsive movements to inform trading decisions accurately.

-

Confirmation Signals: Utilize additional technical indicators and confirmation signals to validate Elliott Wave counts, enhancing the reliability of trading setups.

-

Risk Management: Implement robust risk management strategies to mitigate potential losses, incorporating stop-loss orders and position sizing techniques to safeguard capital.

-

Flexibility: Remain adaptable to evolving market conditions, adjusting trading strategies in response to changing Elliott Wave structures and price dynamics.

-

Continuous Learning: Stay abreast of developments in Elliott Wave Theory and market analysis, fostering a mindset of continuous learning to refine trading skills and adapt to emerging trends.

By integrating these principles into their trading approach, Elliott Wave analysts can navigate the complexities of GOOGL's price action with confidence, leveraging insights from corrective movements to uncover lucrative trading opportunities.

In Conclusion

In the realm of Elliott Wave analysis, Alphabet Inc. (GOOGL) charts offer a rich tapestry of insights for astute traders. As Wave A of (2) unfolds on the daily chart and Wave {iii} of C takes shape on the 4-hour chart, opportunities abound for those adept at deciphering corrective structures and capitalizing on market dynamics.

With a strategic blend of technical analysis, Elliott Wave principles, and prudent risk management, traders can chart a course towards trading success amidst the ebb and flow of GOOGL's price action.