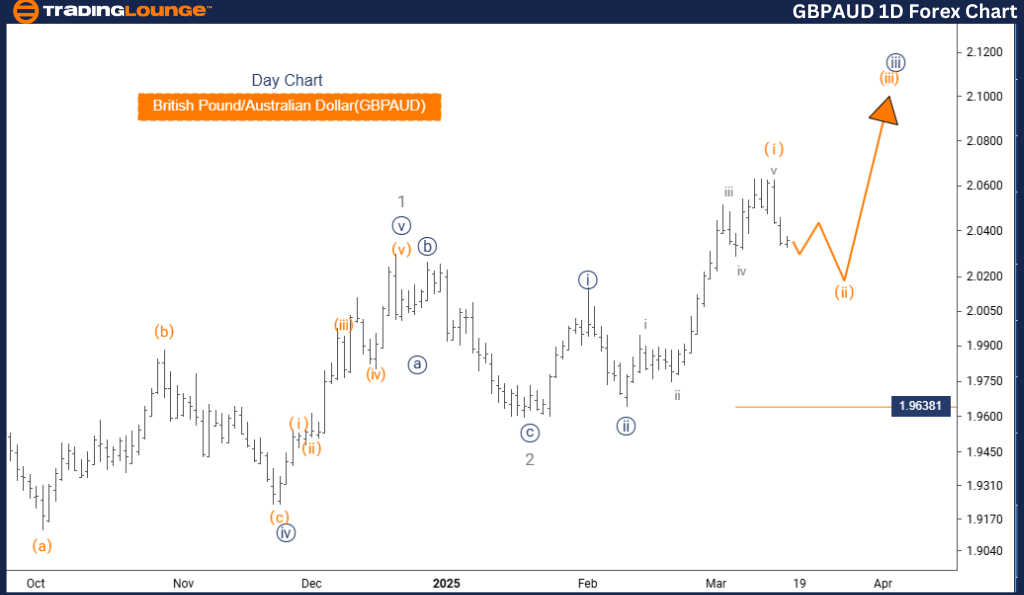

British Pound/Australian Dollar (GBPAUD) Elliott Wave Analysis – Trading Lounge Daily Chart

GBPAUD Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Orange Wave 2

Position: Navy Blue Wave 3

Next Higher Degree Direction: Orange Wave 3

Wave Cancel Invalidation Level: 1.96381

Analysis Overview

The GBPAUD Elliott Wave Analysis for the daily chart provides a comprehensive evaluation of the British Pound to Australian Dollar (GBPAUD) currency pair, identifying current trends and forecasting potential price movements.

The market is presently in a counter-trend phase, indicating a corrective movement rather than a strong directional shift. The primary wave structure under analysis is Orange Wave 2, nested within Navy Blue Wave 3, placing it within the broader Elliott Wave framework.

Key Insights

- Orange Wave 1 has likely concluded, and the market is transitioning into Orange Wave 2 of 3.

- Corrective movement is anticipated, meaning the market may experience sideways action or retracement before a stronger trend emerges.

- The next higher-degree wave to monitor is Orange Wave 3, expected to form once Orange Wave 2 completes.

- A critical invalidation level is set at 1.96381. If breached, the current Elliott Wave count becomes invalid, suggesting a possible shift in market direction.

Trading Implications & Market Outlook

Traders should closely track the development of Orange Wave 2, as it sets the stage for the anticipated Orange Wave 3 uptrend. Understanding Elliott Wave structures is essential for accurately predicting price movements.

By analyzing the daily chart, traders gain a broader perspective, allowing them to align their strategies with long-term trends and market turning points. Recognizing wave patterns and key price levels helps traders anticipate the transition between waves, enhancing decision-making and trade positioning.

This strategic approach equips traders with the necessary insights to navigate market conditions effectively and adjust their trading strategies for optimal performance.

British Pound/Australian Dollar (GBPAUD) Elliott Wave Analysis – Trading Lounge 4-Hour Chart Analysis

GBPAUD Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Orange Wave 2

Position: Navy Blue Wave 3

Next Higher Degree Direction: Orange Wave 3

Wave Cancel Invalidation Level: 1.96381

Analysis Overview

The GBPAUD Elliott Wave Analysis for the 4-hour chart provides insights into short-term trends and potential market movements for the British Pound/Australian Dollar currency pair.

The market remains in a counter-trend phase, indicating corrective price action rather than a strong directional movement. The primary wave structure under examination is Orange Wave 2, nested within Navy Blue Wave 3, defining its broader wave position in the Elliott Wave cycle.

Key Insights

- Orange Wave 1 appears completed, and the market is now progressing through Orange Wave 2 of 3.

- This corrective phase may involve sideways movement or retracement before a stronger trend establishes.

- The next key wave to monitor is Orange Wave 3, expected to develop after Orange Wave 2 concludes.

- The critical invalidation level is set at 1.96381. If this level is broken, the current Elliott Wave count becomes invalid, indicating a potential market trend shift.

Trading Implications & Market Outlook

Traders should monitor the progress of Orange Wave 2, as it may lead to the formation of Orange Wave 3, which could initiate a new trend.

The 4-hour chart analysis offers a short-term perspective, enabling traders to align their strategies with immediate market movements and potential reversals. By studying wave formations and critical price levels, traders can pinpoint entry and exit points, thereby refining their trading strategies.

This methodology ensures traders remain prepared for market fluctuations, allowing them to adjust their approach proactively and capitalize on emerging trading opportunities.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts Join TradingLounge Here

Previous: USDJPY Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support