COAL INDIA Elliott Wave Analysis – TradingLounge Daily Chart

COAL INDIA Stock Overview & Technical Insight

COAL INDIA Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Gray Wave B

Position: Orange Wave 4

Next Lower Degree Direction: Gray Wave C

Invalidation Level: 543.16

Analysis Overview:

COAL INDIA’s daily chart reveals a counter-trend corrective pattern within a larger Elliott Wave cycle. The focus is on Gray Wave B, part of the broader Orange Wave 4 structure.

According to Elliott Wave principles, Gray Wave A has likely completed its downward leg, and the stock is now moving through Gray Wave B—signaling a corrective rebound. This wave represents a temporary pause in the downtrend before transitioning into Gray Wave C, continuing the bearish move.

The key invalidation level is 543.16. A break above this price invalidates the current wave count.

Structural Insight & Strategic Outlook:

Gray Wave B, positioned within Orange Wave 4, suggests a mid-trend corrective retracement. Traders should watch for classic correction patterns—like three-wave moves or sideways price action—that typically develop during counter-trend phases.

Wave structure hierarchy remains critical. Upon the completion of Wave B, a decline into Wave C is expected, potentially offering renewed bearish trading setups.

Trading Considerations:

Short-Term Opportunity: Potential upside during corrective Gray Wave B.

Long-Term Strategy: Monitor for transition into bearish Gray Wave C.

Risk Level: Invalidation above 543.16.

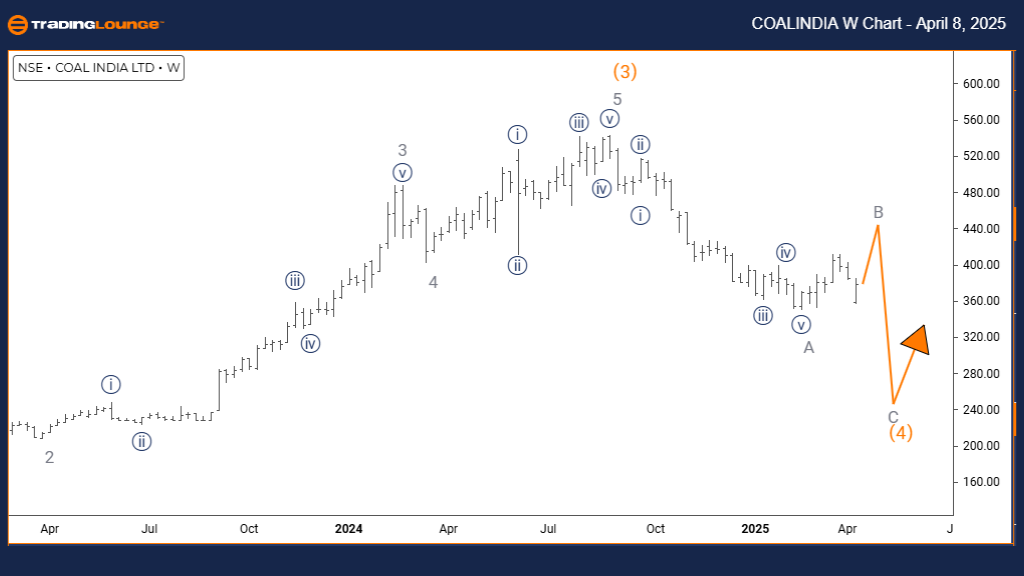

COAL INDIA Elliott Wave Analysis – TradingLounge Weekly Chart

Market Structure & Price Trend Outlook

COAL INDIA – Elliott Wave Technical Analysis

Function: Counter-Trend

Mode: Corrective

Structure: Gray Wave B

Position: Orange Wave 4

Next Lower Degree Direction: Gray Wave C

Invalidation Level: 543.16

Analysis Overview:

The weekly Elliott Wave analysis of COAL INDIA highlights a broader corrective phase within Orange Wave 4. The current active wave is Gray Wave B, part of a mid-cycle retracement.

Gray Wave A appears to have ended its downward sequence, with Gray Wave B now unfolding. This reflects a short-term counter-trend rebound within the dominant downtrend, ahead of a potential continuation via Gray Wave C.

The 543.16 level stands as a crucial invalidation point—surpassing it would negate this wave count.

Strategic Structure & Market Perspective:

This longer-term view positions Gray Wave B as a part of the Orange Wave 4 correction. Traders should look for corrective formations like ABC patterns or horizontal consolidations.

Understanding wave relationships is key. A completed Wave B would likely lead into Wave C, resuming the downward trend and presenting bearish trading prospects.

Trading Considerations:

Medium-Term Opportunity: Possible gains in corrective Wave B.

Long-Term Positioning: Prepare for downside move in Wave C.

Risk Management: Key invalidation remains at 543.16.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: BAJAJ FINSERV Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support