ASX: BLOCK, INC – XYZ (SQ2) Elliott Wave Technical Analysis – TradingLounge

Greetings,

Today’s updated Elliott Wave analysis of BLOCK, INC – XYZ (SQ2) on the Australian Stock Exchange (ASX) highlights a potentially pivotal setup for traders watching this stock.

We are currently identifying a possible market bottom around 61.42, which may conclude a complete five-wave impulse decline. Presently, wave 1) – orange seems close to finishing, suggesting that a wave 2) – orange correction may develop lower. Once wave 2) is complete, it could lead to the onset of wave 3) – orange, aligning with a potential bullish trend.

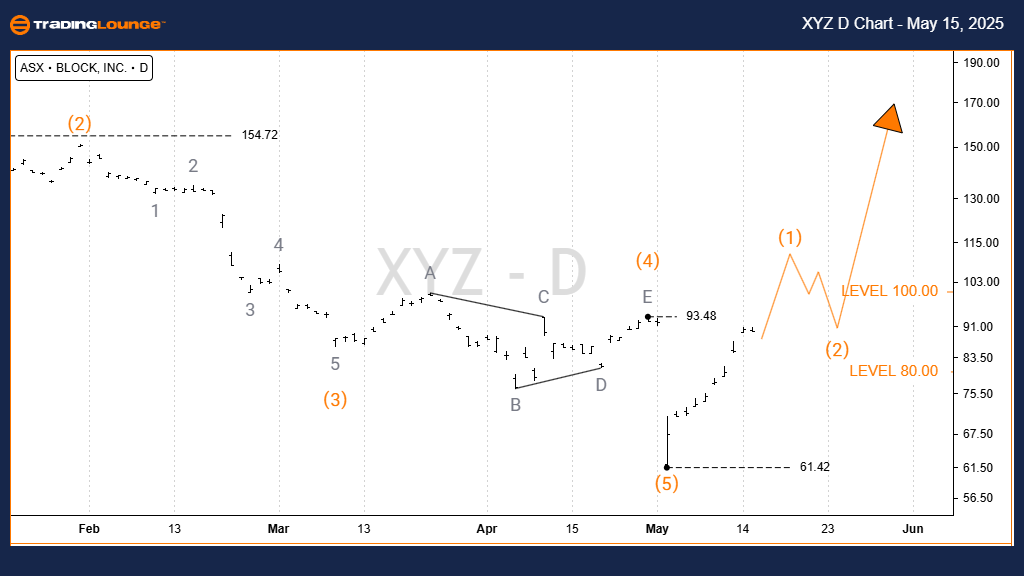

ASX: BLOCK, INC – XYZ (SQ2) 1d Chart (Semilog Scale) Technical Outlook

Function: Intermediate Trend

Mode: Motive

Structure: Impulse

Position: Wave 1) – orange

Invalidation Point: 61.42

We currently view the 61.42 level as a potential terminal point for the prior decline from 154.72, indicating the end of the five-wave structure. Should this level hold, we expect a limited pullback in wave 2) – orange, followed by the development of a bullish wave 3) – orange. To confirm this scenario, the market must maintain above the critical invalidation level of 61.42.

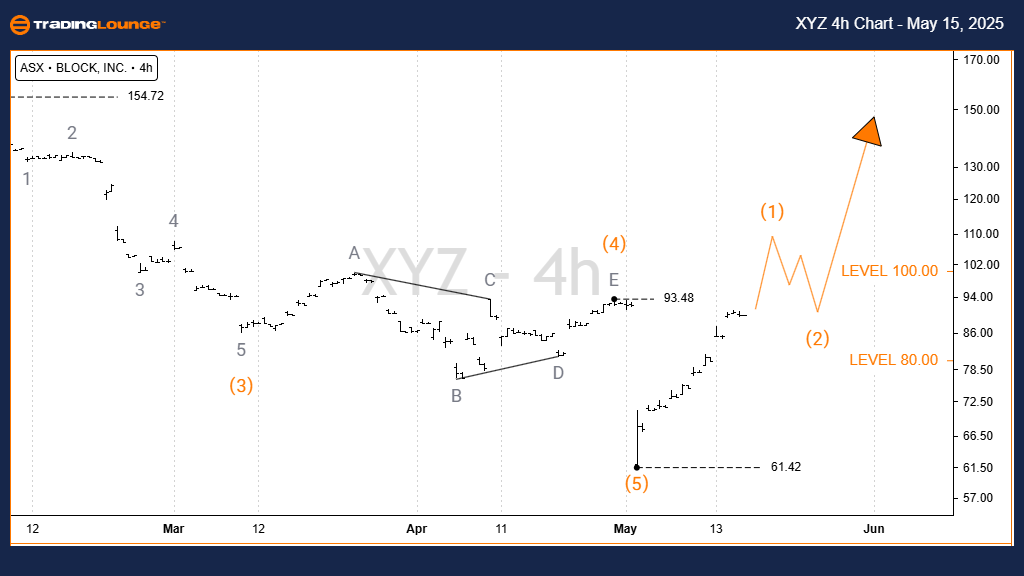

ASX: BLOCK, INC – XYZ (SQ2) 4h Chart (Semilog Scale) Technical Outlook

ASX: BLOCK, INC 4-Hour Chart Technical Analysis:

Function: Intermediate Trend

Mode: Motive

Structure: Impulse

Position: Wave 1) – orange

Invalidation Point: 61.42

The 4-hour chart also supports the hypothesis that the price bottomed at 61.42. From this level, price action could continue higher, but this is conditional upon the completion of wave 2) – orange. A clear end to this wave will increase the probability of an advance into wave 3) – orange, pointing toward a renewed bullish momentum.

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: NEWMONT CORPORATION – NEM Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

The Elliott Wave forecast for BLOCK, INC – XYZ (SQ2) outlines a key technical inflection at the 61.42 support level. Maintaining this level is essential for validating the transition from wave 2) to wave 3). Traders should watch this level closely as it offers insights into the strength and direction of the upcoming trend.