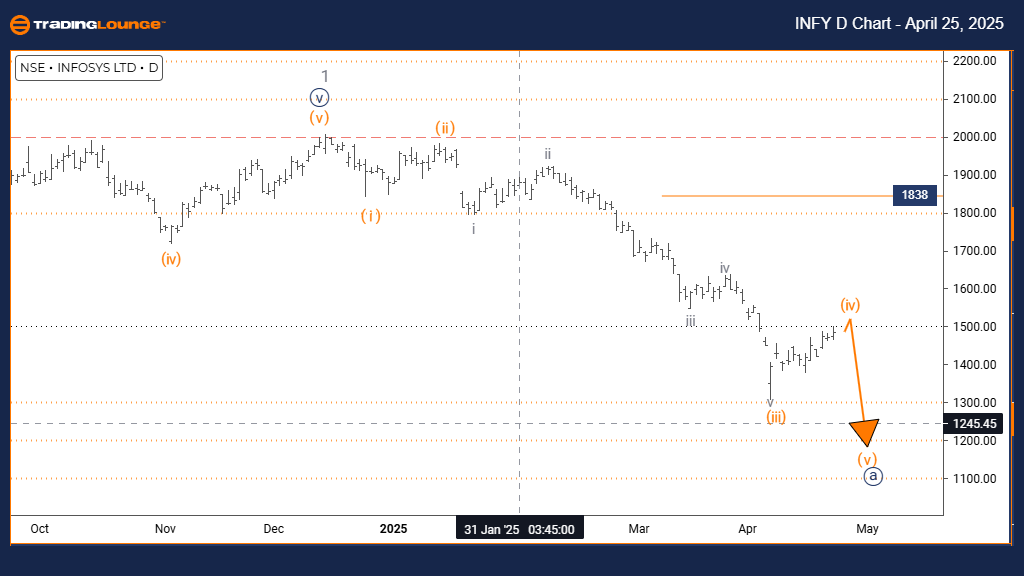

INFOSYS Elliott Wave Analysis – TradingLounge Daily Chart

INFOSYS Stock Daily Chart Analysis

INFOSYS Daily Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: Orange Wave 4

POSITION: Navy Blue Wave A

DIRECTION NEXT LOWER DEGREES: Orange Wave 5

DETAILS: Orange Wave 3 appears completed; Orange Wave 4 is currently unfolding.

Wave Cancel Invalidation Level: 1838

The INFOSYS (NSE: INFY) daily chart highlights a classic Elliott Wave correction in progress, suggesting a temporary bullish retracement within a larger downtrend. With Orange Wave 3 completed, the price is now moving through Orange Wave 4, forming part of Navy Blue Wave A in this counter-trend structure.

Orange Wave 4, a corrective rally, typically retraces 23% to 38% of the previous third wave's decline. This current phase exhibits overlapping price action and reduced momentum, in line with a standard wave 4 development. The correction signals a pause in bearish momentum, often attracting short-term trading opportunities.

Once this correction concludes, a decline into Orange Wave 5 is expected, likely marking the final leg of the broader bearish cycle. The key invalidation level is at 1838—a break above this level would invalidate the current wave structure and require a revised count.

Traders should monitor bearish reversal signals within Wave 4, such as bearish candlestick patterns, overbought oscillators, or Fibonacci resistance levels, to prepare for the anticipated Wave 5 decline. This structure offers a strategic window for trade setups aligned with the broader downtrend.

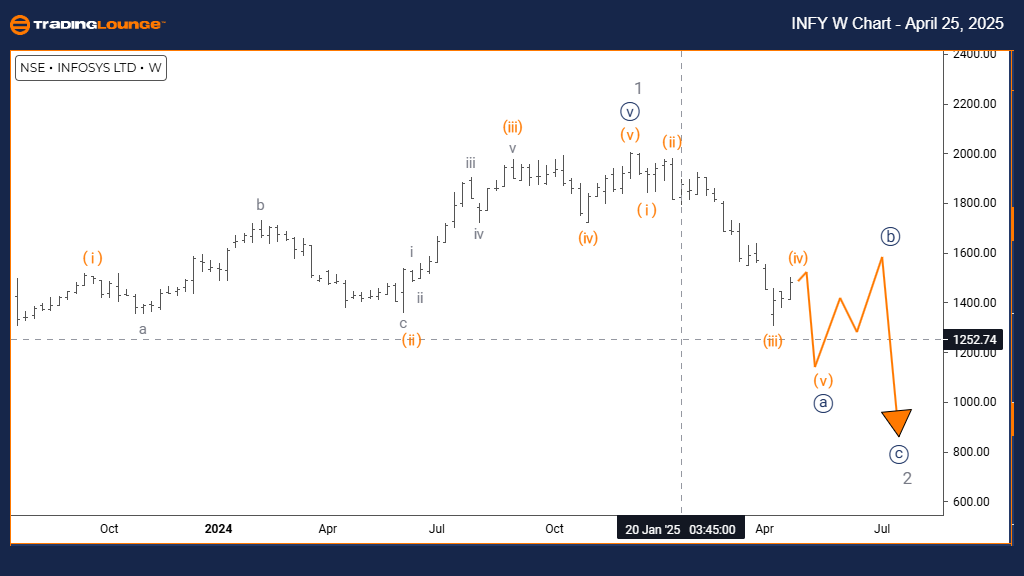

INFOSYS Elliott Wave Analysis – TradingLounge Weekly Chart

INFOSYS Weekly Technical Analysis

FUNCTION: Counter Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave A

POSITION: Gray Wave 2

DIRECTION NEXT HIGHER DEGREES: Navy Blue Wave B

DETAILS: Gray Wave 1 appears completed; Navy Blue Wave A of Gray Wave 2 is developing.

The INFOSYS (INFY) weekly chart outlines a corrective bounce taking shape after the decline of Gray Wave 1, initiating Navy Blue Wave A—the first leg of Gray Wave 2. This movement fits within a bearish Elliott Wave framework, suggesting a medium-term retracement before the larger downtrend potentially resumes.

Navy Blue Wave A typically begins an ABC correction and represents a relief rally with moderate upward momentum. As Wave 1 ends, Wave A emerges to retrace 38%–61% of the preceding decline. This phase often provides swing trading opportunities within an otherwise bearish context.

The next phase—Navy Blue Wave B—is expected to initiate a counter-move downward, continuing the ABC correction. Traders should anticipate bearish setups as Wave A nears completion and prepare for the potential decline of Wave B.

Monitoring Fibonacci retracement levels, momentum shifts, and volume divergences will be crucial in identifying the transition from Wave A to B. This weekly correction phase is significant, offering technical insights for positioning ahead of the next bearish cycle.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: TCS Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support