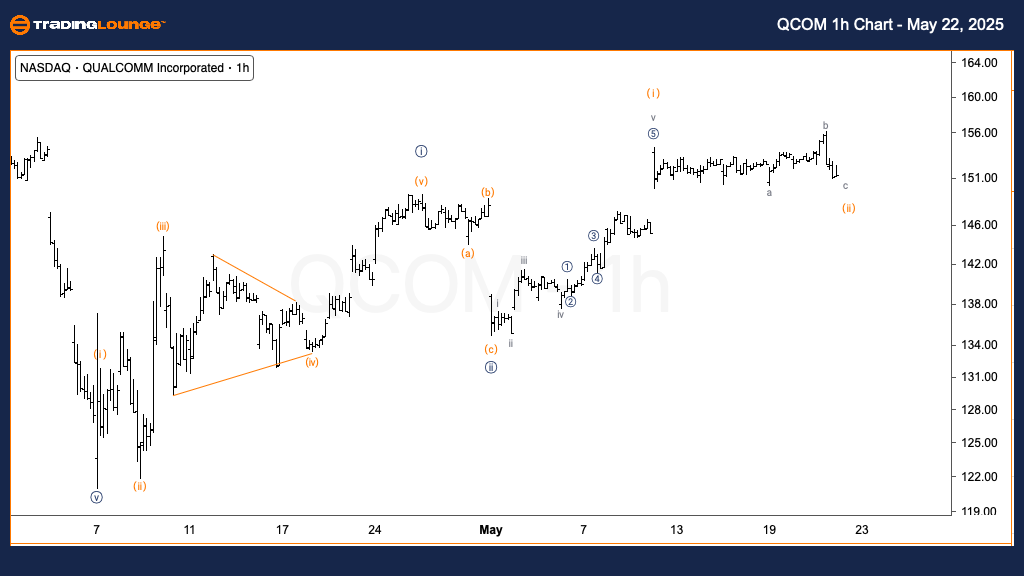

QCOM Elliott Wave Analysis | QUALCOMM Inc. (QCOM) – Daily Chart

QUALCOMM Inc. (QCOM) – Daily Chart Analysis

QCOM Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (ii) of {iii}

Direction: Upside in Wave (iii)

Details: QCOM stock is approaching the key medium resistance level at $150, with upward momentum expected in wave (iii).

QUALCOMM Inc. (NASDAQ: QCOM) is consolidating near the critical $150 resistance level, indicating a potential bullish breakout. Elliott Wave analysis suggests the market is finalizing wave (ii) within a broader wave {iii}. If QCOM maintains strength above this level, it could confirm an impulsive wave (iii) rally, reinforcing the bullish trend. This scenario supports continued upward price action in the short term, provided structural confirmation aligns with the analysis.

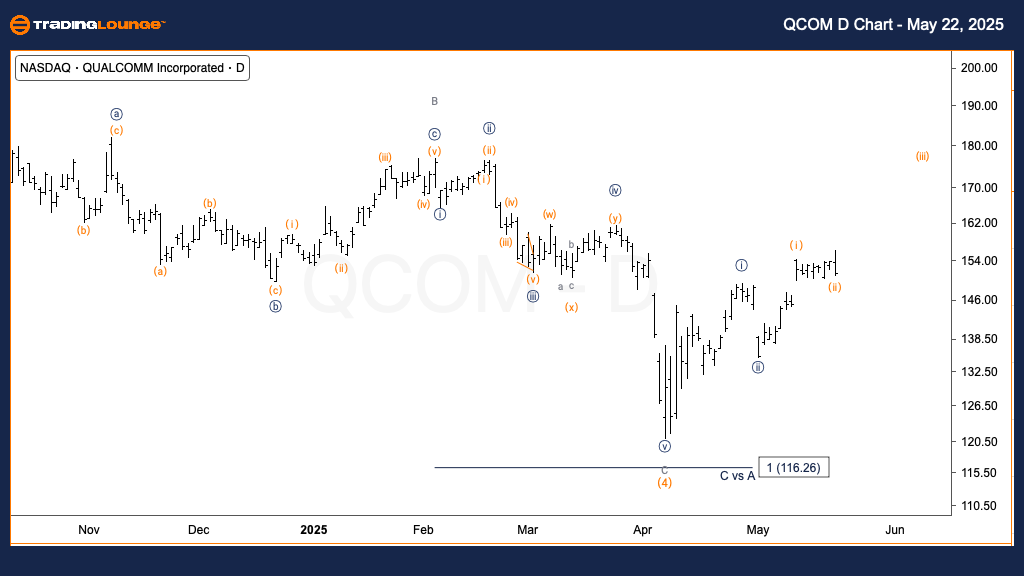

QCOM Elliott Wave Analysis | QUALCOMM Inc. (QCOM) – 1H Chart

QCOM Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave c of (ii)

Direction: Upside in Wave (iii)

Details: Wave (ii) is developing as a flat correction, with one more leg in wave c expected before a strong rally into wave (iii) of {iii}.

The 1-hour chart of QCOM highlights the final stages of wave (ii), forming as a flat correction. Wave c is anticipated to complete this pattern, after which a significant upside movement into wave (iii) of {iii} could follow. This setup presents a strategic entry opportunity for traders looking to capitalize on the next impulsive wave, particularly if price breaks above the $150 threshold.

Technical Analyst: Alessio Barretta

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Dell Technologies Inc (DELL) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support