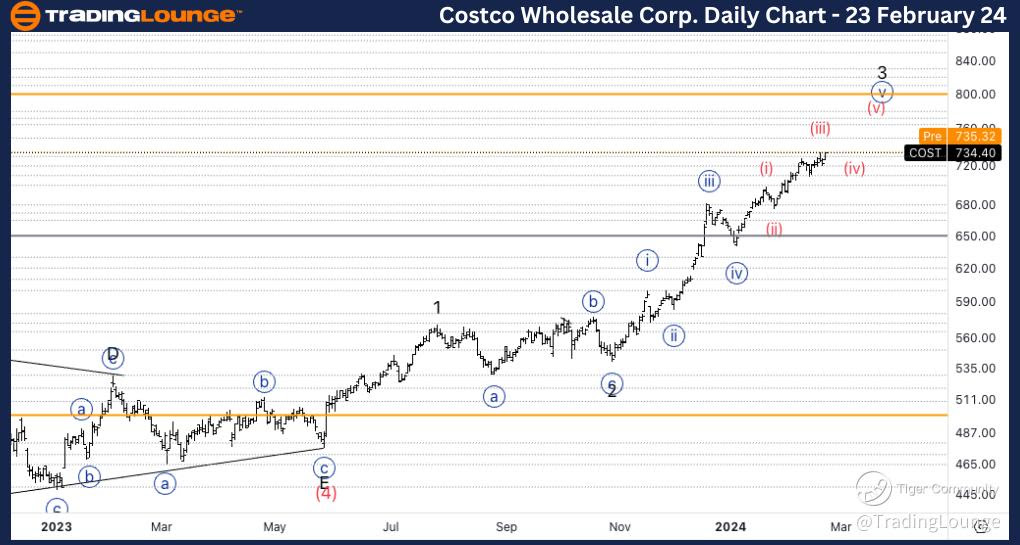

COST Elliott Wave Analysis Trading Lounge Daily Chart, 23 February 24

Welcome to our COST Elliott Wave Analysis Trading Lounge, your ultimate destination for comprehensive insights into Costco Wholesale Corp. (COST) using Elliott Wave Technical Analysis. As of the Daily Chart on 23rd February 2024, we delve into significant trends guiding the market.

COST Elliott Wave Technical Analysis

Costco Wholesale Corp., (COST) Daily Chart Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Minor wave 3 of (1).

DIRECTION: Upside in wave {v} of 3.

DETAILS: We are in between Medium Level 650$ and TL 800$ in what could be the end of a major Minor wave 3. Looking for continuation higher towards 800$, knowing the trend is starting to get weak as we are in the final stage of a wave {v}

In terms of wave dynamics, we identify a dominant impulse function with a motive structure. The current position is in Minor wave 3 of (1), indicating upside momentum in wave {v} of 3. As we hover between Medium Level $650 and TL $800, this could mark the potential end of a major Minor wave 3. We anticipate further continuation higher towards $800, although we recognize the weakening trend as we approach the final stage of wave {v}.

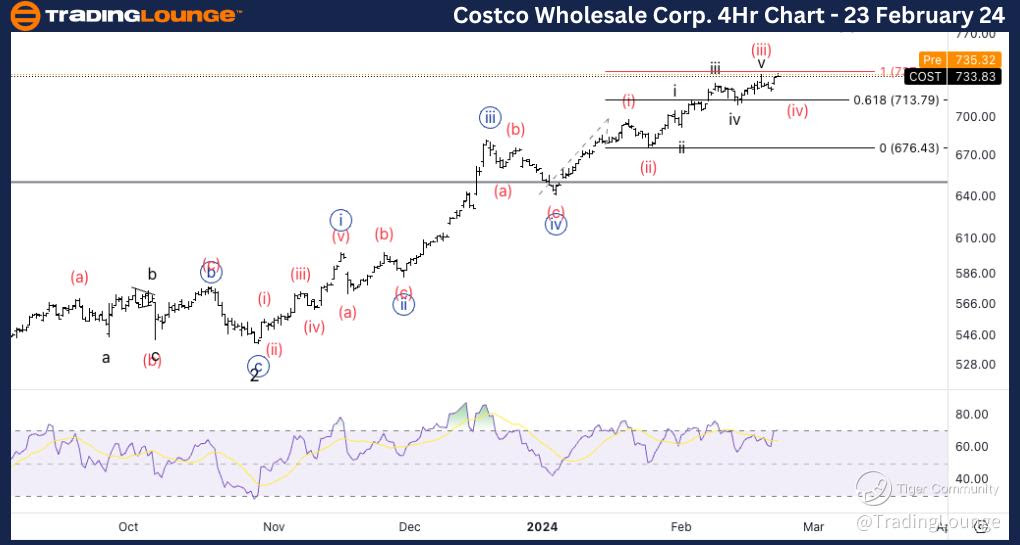

COST Elliott Wave Analysis Trading Lounge 4Hr Chart, 23 February 24

Costco Wholesale Corp., (COST) 4Hr Chart Analysis

COST Elliott Wave Technical Analysis – 4Hr Chart

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave (v) of {iii}.

DIRECTION: Upside into wave {v}.

DETAILS: We are looking for either a wave (iv) in place or else a wave (iv) in the making, to then continue higher into wave (v). We can see RSI is showing signs of weakness which confirms the bias we are in the final stages of a trend.

Here, the wave function maintains its impulsive mode with a motive structure. The present position is in Wave (v) of {iii}, signaling further upside movement into wave {v}. We anticipate either a completed wave (iv) or the formations of wave (iv), followed by continued upward momentum into wave (v). Notably, the RSI shows signs of weakness, confirming our bias toward the final stages of the trend.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: JP Morgan Chase & Co.(JPM)