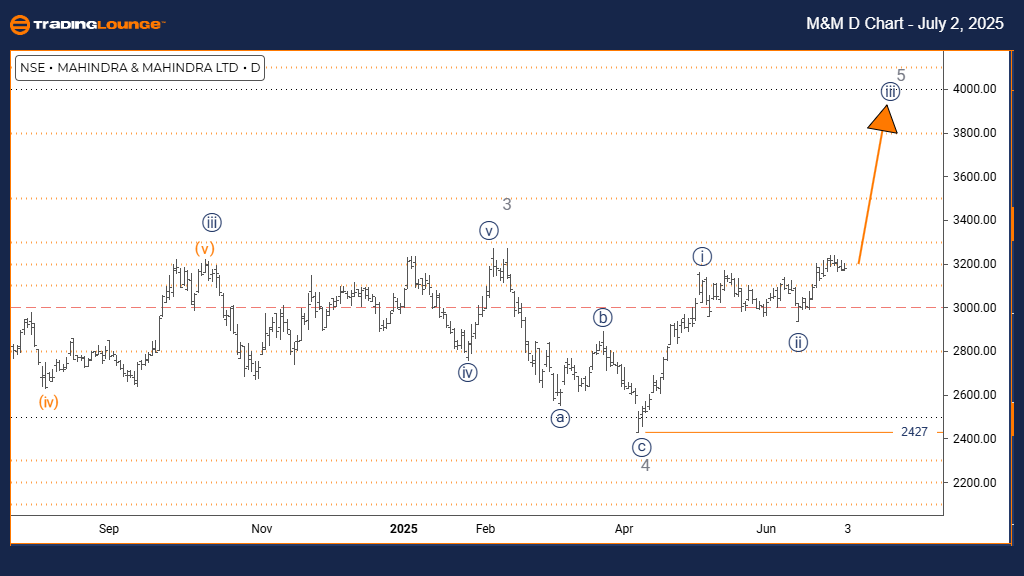

MAHINDRA & MAHINDRA – Elliott Wave Analysis (Daily Chart) – Trading Lounge

M&M Elliott Wave Technical Overview

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 3

POSITION: Gray Wave 5

NEXT HIGHER DEGREE DIRECTION: Navy Blue Wave 3 (In Progress)

DETAILS: Navy Blue Wave 2 has completed. Navy Blue Wave 3 within Gray Wave 5 is currently active.

Wave Cancel Invalidation Level: 2427

The Elliott Wave daily analysis for MAHINDRA & MAHINDRA stock presents a strong bullish outlook, with the stock currently advancing in an impulsive phase. The ongoing wave count identifies the current move as Navy Blue Wave 3, a substructure within Gray Wave 5, suggesting momentum-backed upward movement as part of the larger bullish pattern.

Following the apparent completion of Navy Blue Wave 2, the structure has transitioned into Navy Blue Wave 3 of Gray Wave 5. In Elliott Wave theory, third waves are typically the most dynamic and strong, indicating potential for further gains in share price.

The critical invalidation level is 2427. If the stock price dips below this support, the current Elliott Wave count would be invalidated, and the bullish case would need reassessment. Until then, the technical outlook remains upward-biased.

With the stock progressing through an impulsive third wave and forming the inner structure of a fifth wave, investors and traders should note the increasing potential for a trend peak, though short-term gains may still be achievable.

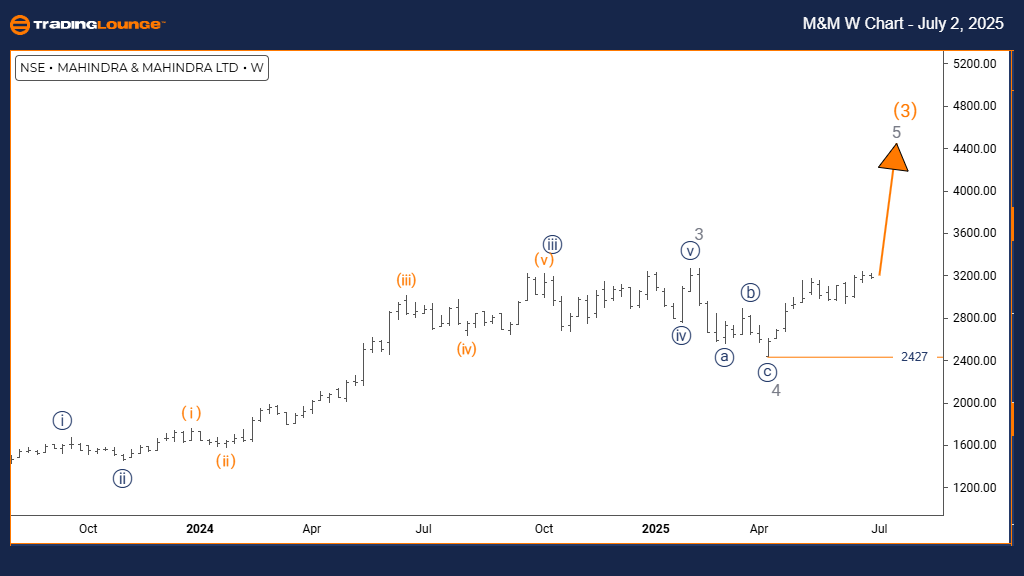

MAHINDRA & MAHINDRA – Elliott Wave Analysis (Weekly Chart) – Trading Lounge

M&M Elliott Wave Technical Overview

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Gray Wave 5

POSITION: Orange Wave 3

NEXT LOWER DEGREE DIRECTION: Orange Wave 4

DETAILS: Gray Wave 4 has likely completed. Gray Wave 5 is currently active.

Wave Cancel Invalidation Level: 2427

The weekly Elliott Wave analysis for MAHINDRA & MAHINDRA supports a bullish market trend. The price action remains impulsive, confirming ongoing upward pressure. The wave structure is now unfolding as Gray Wave 5, fitting within the broader Orange Wave 3 cycle. This phase typically represents the final thrust in a bullish pattern before corrective moves set in.

As per current wave counts, Gray Wave 4 has ended, and Gray Wave 5 is in motion. This wave is usually characterized by increased buying and a final push higher. Once it completes, Orange Wave 4, the subsequent corrective phase, is expected to start.

A drop below the 2427 invalidation level would void this wave count and call for an updated analysis. As long as price stays above that mark, the bullish Elliott Wave scenario stays intact.

With Gray Wave 5 in progress, investors might observe short-term bullish potential. However, since this move represents a fifth wave within a third wave, traders should remain alert for signs of an upcoming cycle peak.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: COAL INDIA Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support