Shanghai Composite Elliott Wave Analysis | Trading Lounge Daily Chart

Shanghai Composite Elliott Wave Technical Forecast

FUNCTION: Counter-Trend

MODE: Corrective

STRUCTURE: Gray Wave 2

POSITION: Orange Wave 3

DIRECTION NEXT HIGHER DEGREES: Gray Wave 3

DETAILS: Gray wave 1 is complete; gray wave 2 is actively forming.

The Shanghai Composite daily Elliott Wave analysis highlights a counter-trend correction within a bullish cycle. The market is in a corrective phase, part of gray wave 2, unfolding inside orange wave 3. This suggests a temporary retracement within the larger uptrend.

Following the completion of gray wave 1, gray wave 2 is forming a pullback that typically retraces part of the previous upward move. Once this correction ends, gray wave 3 is expected to resume the prevailing trend.

Currently, the index trades within gray wave 2, often marked by consolidation or sideways movement. Its positioning within orange wave 3 indicates the primary bullish pattern is intact.

Traders should watch for signs of gray wave 2 concluding, which may trigger a breakout towards the next upward leg, gray wave 3. The counter-trend structure implies limited downside and potential for near-term recovery.

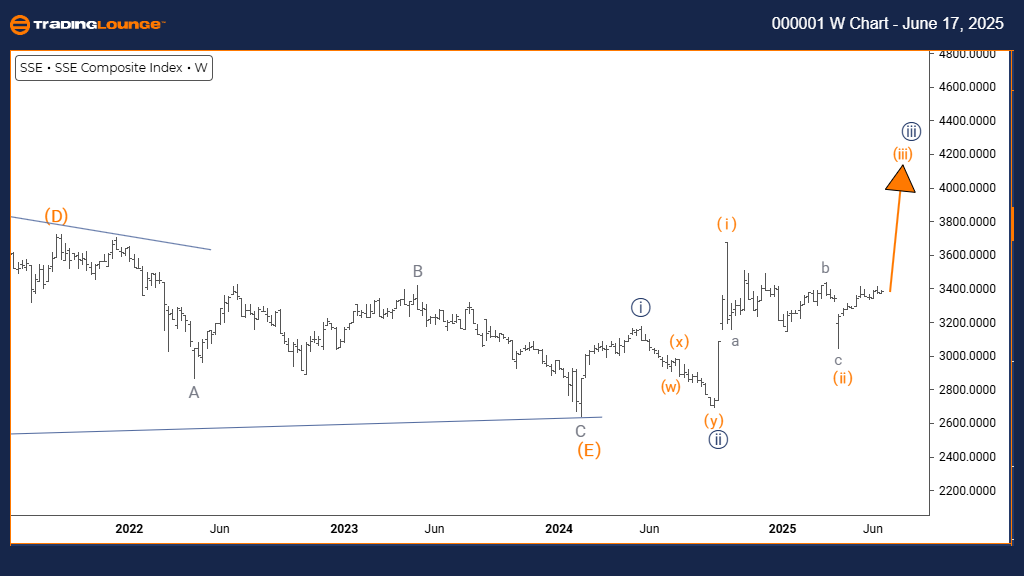

Shanghai Composite Elliott Wave Analysis | Trading Lounge Weekly Chart

Shanghai Composite Elliott Wave Technical Forecast

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 3

DIRECTION NEXT HIGHER DEGREES: Orange Wave 3 (in progress)

DETAILS: Orange wave 2 is complete; orange wave 3 of 3 is currently active.

The weekly Elliott Wave forecast for the Shanghai Composite reflects a sustained bullish trend. The price structure is impulsive, led by the unfolding of orange wave 3 inside navy blue wave 3, a setup often linked with strong upward market momentum.

The conclusion of orange wave 2 marks the start of a powerful rally within orange wave 3, commonly associated with the largest gains in an Elliott cycle. As this wave continues, further upside pressure is likely.

This technical configuration supports a bullish outlook for the Shanghai Composite. With orange wave 3 underway, buying activity appears dominant, setting the stage for sustained upward price movement in the medium term.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: DOW JONES - DJI Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support