S&P 500 Elliott Wave Analysis – Trading Lounge Daily Chart

S&P 500 Index Elliott Wave Technical Analysis

Technical Overview

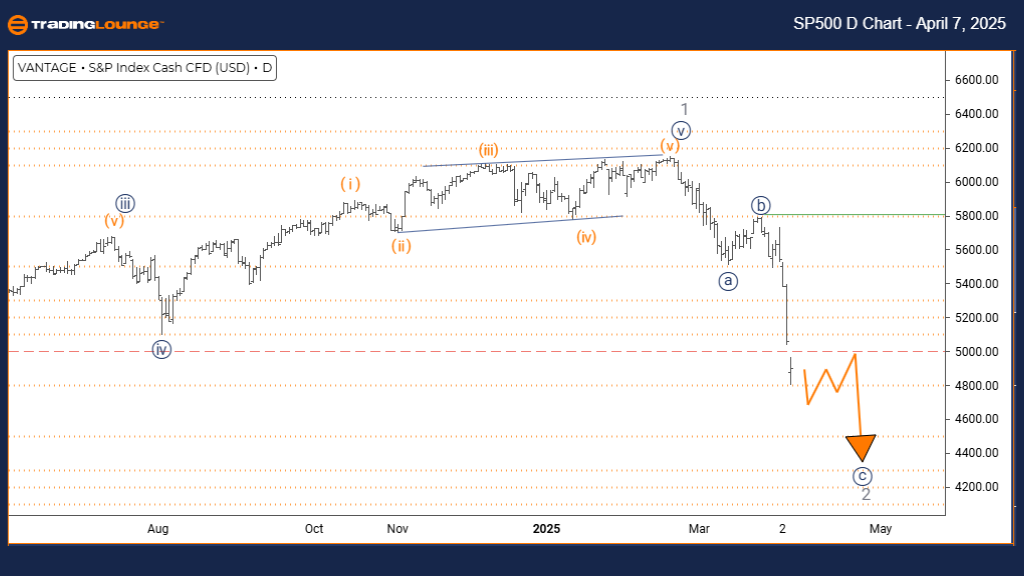

Function: Counter-Trend Mode: Impulsive (Wave C) Wave Structure: Navy Blue Wave C Current Position: Gray Wave 2 Next Higher Degree: Gray Wave 3

S&P 500 Elliott Wave Summary – Daily Perspective

The S&P 500 is currently navigating a counter-trend move, progressing through navy blue wave C, which forms part of the broader gray wave 2 structure. The preceding navy blue wave B has likely concluded, initiating this impulsive leg within a corrective cycle. As this phase unfolds, wave C is expected to maintain an impulsive pattern, aligning with typical characteristics seen in the final segments of corrections. This development may help define the broader structural bottom ahead of gray wave 3.

Analytical Insights

Wave C patterns usually develop as five-wave impulsive structures, often wrapping up larger corrections. Investors should watch for signs of wave completion to plan timely entries or exits. Recognizing the wave's placement within the full structure is vital for tactical and strategic decisions.

Trading Implications

This daily chart outlook delivers valuable insights for those managing short-term market fluctuations. With the S&P 500 in a corrective wave, traders and investors should factor in the larger Elliott Wave structure when planning their strategies. Awareness of key wave levels can guide better risk management and trade setups.

S&P 500 Elliott Wave Analysis -Trading Lounge Weekly Chart

Technical Overview

Function: Counter-Trend Mode: Corrective Wave Structure: Navy Blue Wave C Current Position: Gray Wave 2 Next Higher Degree: Gray Wave 3 Invalidation Level: 3497.72

S&P 500 Elliott Wave Summary – Weekly Perspective

On the weekly timeframe, the S&P 500 remains in a corrective counter-trend movement, progressing through navy blue wave C, within the gray wave 2 structure. The previous wave B correction has ended, confirming the current wave C advance. This wave C is anticipated to evolve as a corrective formation, typically involving three-wave movements or sideways action. The key invalidation level is marked at 3497.72—a breach would challenge the current wave count.

Analytical Insights

Navy blue wave C shapes the intermediate trend within the gray wave 2 phase. Watching for the end of this wave is critical before anticipating the potential turn into gray wave 3. The weekly view enhances long-term strategy alignment and short-term evaluation.

Trading Implications

This chart supports a measured outlook for long-term investors and swing traders. As the corrective phase continues, understanding wave dynamics will be crucial to confirm market transitions and prepare for the upcoming gray wave 3 rally.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Bovespa Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support