Copper Elliott Wave Technical Analysis

Copper Elliott Wave Analysis

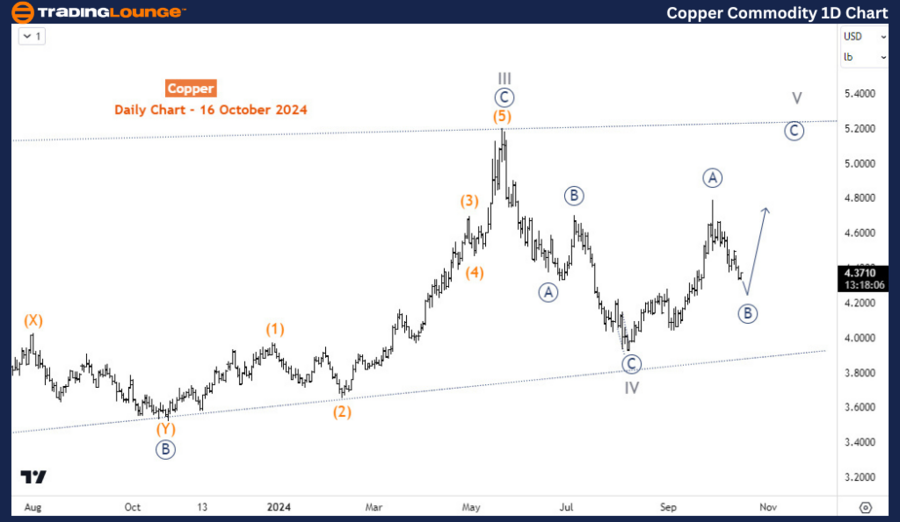

Copper prices have pulled back from their September 2024 highs, correcting the bullish movement seen in August and September 2024. This correction is expected to complete soon, after which the bullish trend is likely to resume.

Copper Commodity Daily Chart Analysis

From a long-term perspective, Copper's price has been developing in a diagonal wave structure since the March 2020 lows. On the daily chart, wave I of the cycle degree concluded in March 2022, followed by a decline for wave II that ended in July 2022. Waves III and IV were completed in May 2024 and August 2024, respectively. The current rise from the August 2024 lows is likely the beginning of wave V. Once wave V completes, a larger correction is anticipated to correct the entire five-wave diagonal structure from March 2020.

Wave V is projected to develop in a corrective three-wave structure. It now appears that wave ((A)) of V concluded in September 2024, and the current pullback is wave ((B)). The H4 chart offers insight into how far wave ((B)) has progressed and its potential continuation.

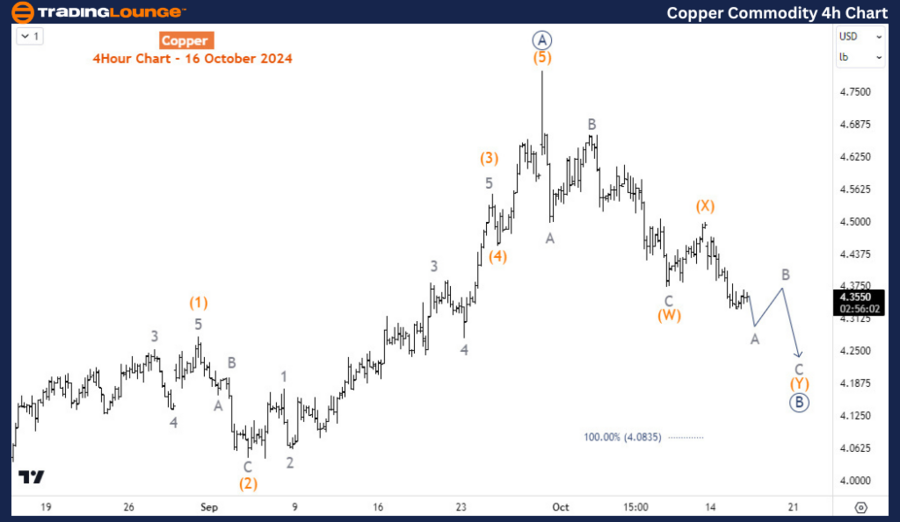

Copper Commodity H4 Chart Analysis

On the H4 chart, wave ((A)) completed as a five-wave impulse structure. The ongoing pullback, wave ((B)), is emerging as a double zigzag pattern. Projections suggest wave (Y) of ((B)) could push the price lower to 4.083. If the price fails to reach this level and instead stages a strong five-wave rally toward October highs, it would confirm that wave ((B)) is complete, signaling the start of wave ((C)). Otherwise, in the short term, downside movement toward 4.083 is favored.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Cocoa Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support