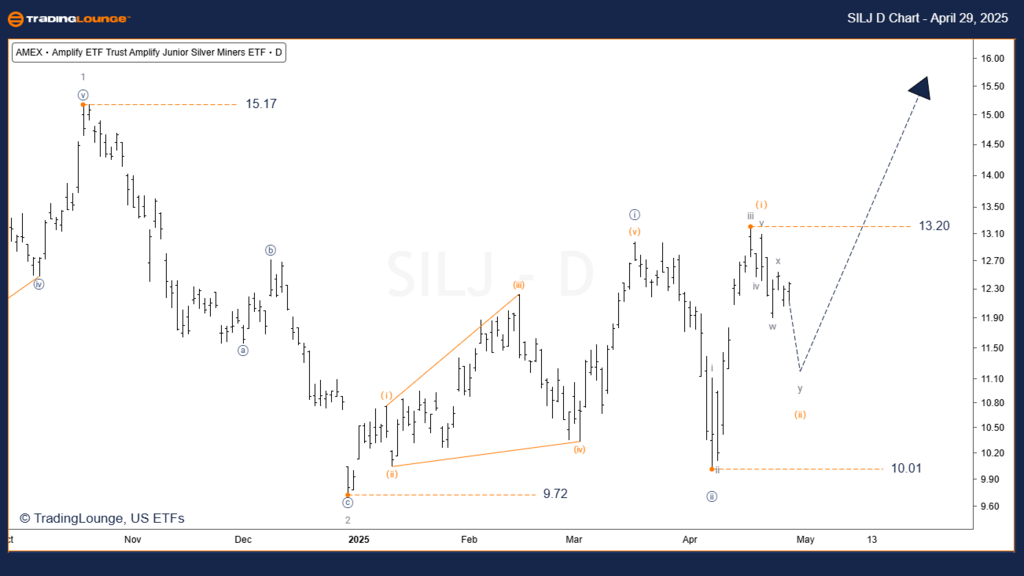

Trust Amplify Junior Silver Miners ETF Elliott Wave Analysis - TradingLounge Day Chart

SILJ US ETF Daily Chart Analysis

SILJ Elliott Wave Technical Analysis

Function: Major Trend

Mode: Motive

Structure: Impulse

Position: Wave [iii] Navy

Direction: Rally

Invalidation Level: $10.01

Details:

Silver Miners ETF (SILJ) is showing a strong bullish Elliott Wave setup on the daily chart, currently developing within wave [iii], which is approaching its most powerful segment — the third of a third of a third wave.

Wave (ii) is undergoing a short-term three-wave corrective move, which is required to complete the pullback phase.

Once wave (ii) finalizes, we anticipate a new rally to begin, likely pushing prices well above the previous $15.17 high.

This Elliott Wave count suggests high bullish momentum and an impending breakout phase. Traders should stay alert for the end of the correction, as the rally from wave (ii) is expected to be significant. The $10.01 invalidation level remains key — a break below this level would negate the current bullish impulse structure.

Trust Amplify Junior Silver Miners ETF Elliott Wave Analysis - TradingLounge 4h Chart

SILJ Hourly Chart Elliott Wave Analysis (4H)

Function: Major Trend (Minor Degree – Gray)

Mode: Motive

Structure: Impulse

Position: Wave (ii) of [iii]

Direction: Minor Decline

Invalidation Level: $10.01

Details:

On the 4-hour chart, SILJ has completed wave (i) of [iii] and is currently in wave (ii), a corrective phase within the ongoing bullish trend.

Wave (ii) is expected to retrace sharply, likely aligning with Fibonacci retracement levels, offering a potential buy zone for the next impulsive leg.

This correction is a typical setup phase before wave (iii) unfolds, which is often the most explosive and rewarding wave for trend traders.

As such, traders should closely monitor price action during this wave (ii) dip, as it presents a prime opportunity to position for the next upward move. A drop below $10.01 invalidates the bullish wave count and requires reassessment.

Technical Analyst: Simon Brooks

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: ETF (IBB) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

- SILJ is building a strong Elliott Wave bullish structure, currently within wave (ii) corrections across both daily and intraday timeframes.

- While patience is required as wave (ii) finalizes, the setup for the next major rally is aligning.

- The $10.01 invalidation level is critical — maintaining above it supports the bullish outlook.

- Elliott Wave traders should prepare to capitalize on the next wave (iii) advance while applying proper risk controls to protect against any shift in wave structure.