ASX: Fortescue Ltd (FMG) – Elliott Wave Analysis and Technical Insights

Greetings! Today's Elliott Wave analysis delves into the Australian Stock Exchange (ASX) with a focus on Fortescue Ltd (ASX: FMG). Our analysis suggests that ASX: FMG is positioned to enter a strong upward movement with Wave 3, offering lucrative opportunities for traders. This report outlines key data points, including probable price levels for trend confirmation, invalidation signals, and potential bullish targets.

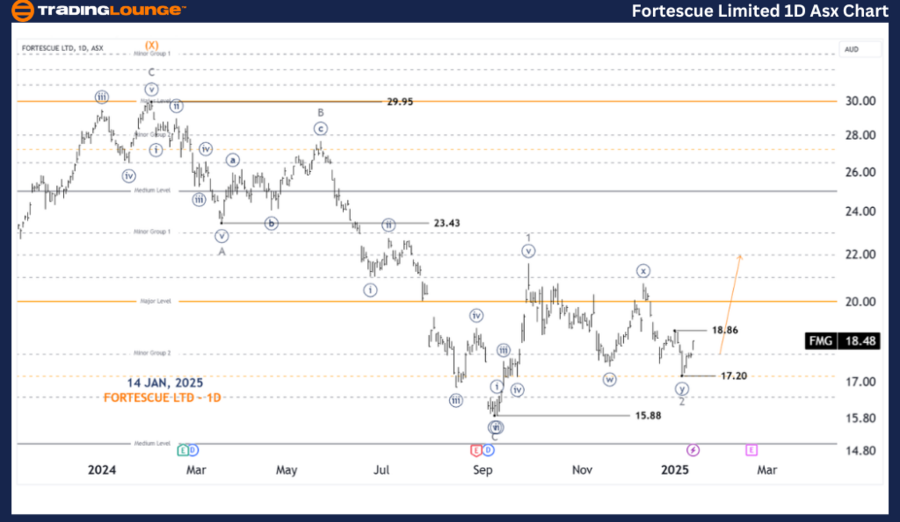

ASX: Fortescue Ltd (FMG) – 1D Chart Analysis (Semilog Scale)

Function: Major Trend (Minute Degree, Navy)

Mode: Motive

Structure: Impulse

Position: Wave 3-grey

Key Observations:

- Wave 2-grey has completed a Double Zigzag pattern at the 17.20 low.

- Wave 3-grey is likely forming, indicating a potential strong bullish momentum.

- A push above 18.86 will validate the bullish outlook, marking the start of a probable uptrend.

Important Levels:

- Invalidation Point: 15.88 (signals a breakdown in this wave count).

- Confirmation Point: 18.86 (adds weight to the bullish market view).

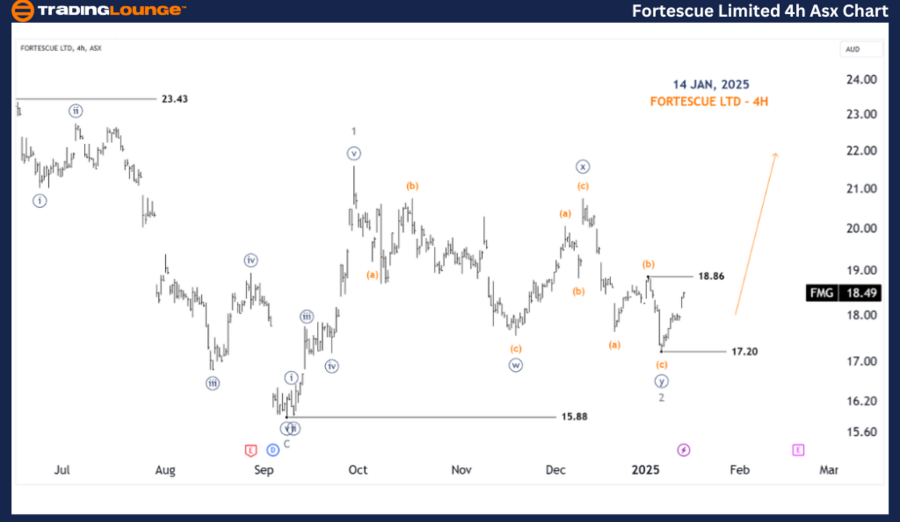

ASX: Fortescue Ltd (FMG) – 4-Hour Chart Analysis

Function: Major Trend (Minor Degree, Grey)

Mode: Motive

Structure: Impulse

Position: Wave 3-grey

Key Observations:

- The Double Zigzag pattern labeled ((w))((x))((y))-navy for Wave 2-grey is complete, signaling an imminent bullish continuation.

- A move above 20.00 with this level acting as support will present a robust opportunity to enter a Go Long position.

Important Levels:

- Invalidation Point: 17.20 (signals potential bearish reversal).

- Confirmation Point: 18.86 (solidifies the bullish trend setup).

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Fisher & Paykel Healthcare Corporation Limited Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for ASX: Fortescue Ltd (FMG) offers valuable insights into current market trends. This includes:

- Clear validation and invalidation points for effective trade decision-making.

- Strategic price levels that enhance trading confidence and market understanding.

By combining precise wave counts with a structured approach, this analysis equips traders to capitalize on ASX: FMG's potential bullish trajectory effectively.