Copper Market Analysis - Elliott Wave Perspective

Copper, a highly traded commodity, is currently demonstrating intriguing patterns within a pivotal resistance zone, indicating potential market dynamics. An ending diagonal pattern formation implies a culmination of bullish momentum within this zone, potentially signalling an impending pullback followed by a resumption of the upward trend.

Copper Elliott Wave Technical Analysis

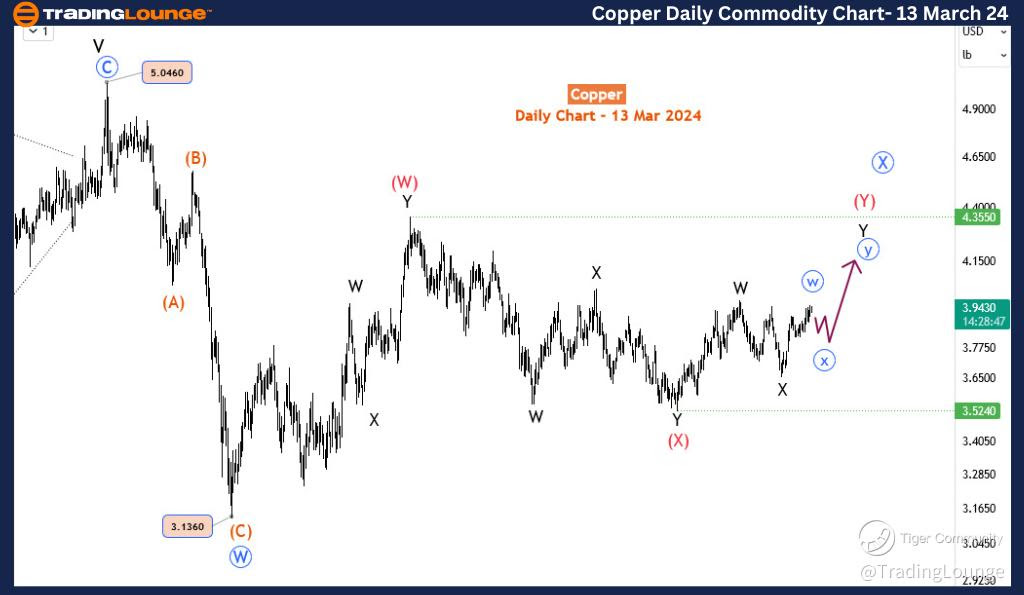

Copper Day Chart Analysis

Exploring the broader framework on the daily timeframe, the trajectory of Copper's price reveals a complex corrective structure termed a double zigzag correction. This corrective phase initiated from 3.136 in July 2022 and has since evolved through two distinct legs: wave (W) concluding at 4.355 in January 2023, followed by wave (X) reaching its terminus at 3.524 in October 2023. The current focus is on wave (Y), which is unfolding into another double zigzag pattern. Forecasts indicate potential extensions towards levels approximately at 4.45 and 4.90. It's noteworthy that both waves W and X of Y have completed, with wave Y displaying indications of sustained upward momentum.

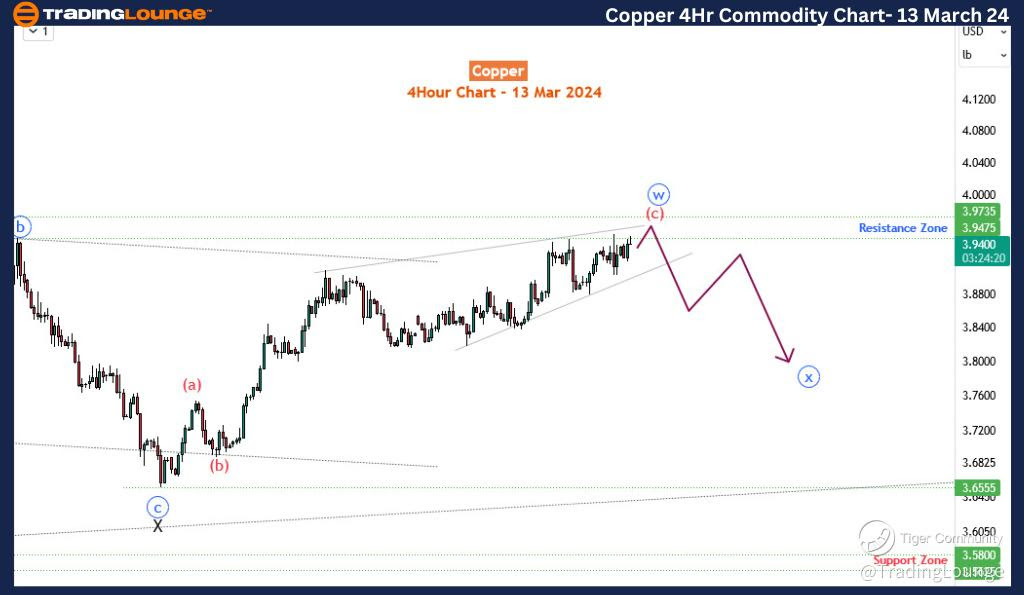

Copper Elliott Wave Analysis Trading Lounge 4 Hour Chart, 12 March 24

Copper 4-hour Chart Analysis

Zooming in on the H4 timeframe provides deeper insights into the sub-waves of wave Y. Originating from 3.655, wave Y is presently unfolding as a zigzag pattern, with specific emphasis on wave (c). This sub-wave of blue wave Y is constructing an ending diagonal pattern within the previously mentioned resistance zone, suggesting a possible exhaustion of buying pressure. The anticipation of blue wave x arises if Copper remains below the resistance zone of 3.9475-3.9735, potentially leading to a temporary retracement. After wave x, expectations lean towards wave y of Y recommencing the bullish trajectory, targeting around 4.45.

To summarize, Copper's price action hints at a complex corrective phase within a significant resistance area, likely paving the way for a brief pullback before a continuation of the overarching bullish trend. A comprehensive understanding of these patterns across various timeframes furnishes valuable insights for traders navigating the ever-evolving commodity markets.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Cocoa

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.