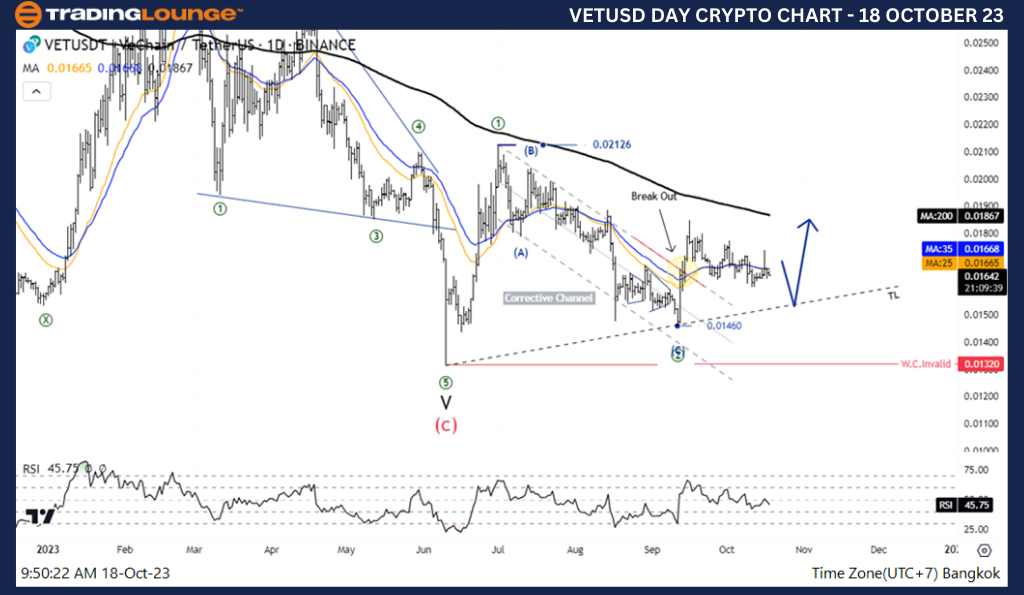

Elliott Wave Analysis TradingLounge Daily Chart, 18 October 23,

VeChain/U.S. dollar(VETUSD)

VETUSD Elliott Wave Technical Analysis

Function: Counter trend

Mode: Corrective

Structure: Zigzag

Position: Wave (C)

Direction Next higher Degrees: wave ((2)) of Impulse

Wave Cancel invalid Level: 0.01318

Details: Wave (2) may is end at 0.01628 and the price move to wave(3)

VeChain/U.S. dollar(VETUSD)Trading Strategy: VeChain's overall picture is in a period of correction to accumulate power in Wave 2. The price is likely to come down to test. trend line below before rising again in wave 3

VeChain/U.S. dollar(VETUSD)Technical Indicators: The price is below the MA200 indicating a Downtrend, RSI is a Bearish Momentum.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

Source: Tradinglounge.com get trial here!

Elliott Wave Analysis TradingLounge 4H Chart, 18 October 23,

VeChain/U.S. dollar(VETUSD)

VETUSD Elliott Wave Technical Analysis

Function: Counter trend

Mode: Corrective

Structure: Double Corrective

Position: Wave Y

Direction Next higher Degrees: wave ((3)) of Impulse

Wave Cancel invalid Level: 0.01318

Details: Wave (2) Equal to 78.6% of wave (1) at 0.015

VeChain/U.S. dollar(VETUSD)Trading Strategy: VeChain's overall picture is in a period of correction to accumulate power in Wave 2. The price is likely to come down to test. trend line below before rising again in wave 3

VeChain/U.S. dollar(VETUSD)Technical Indicators: The price is below the MA200 indicating a Downtrend, RSI is a Bearish Momentum.