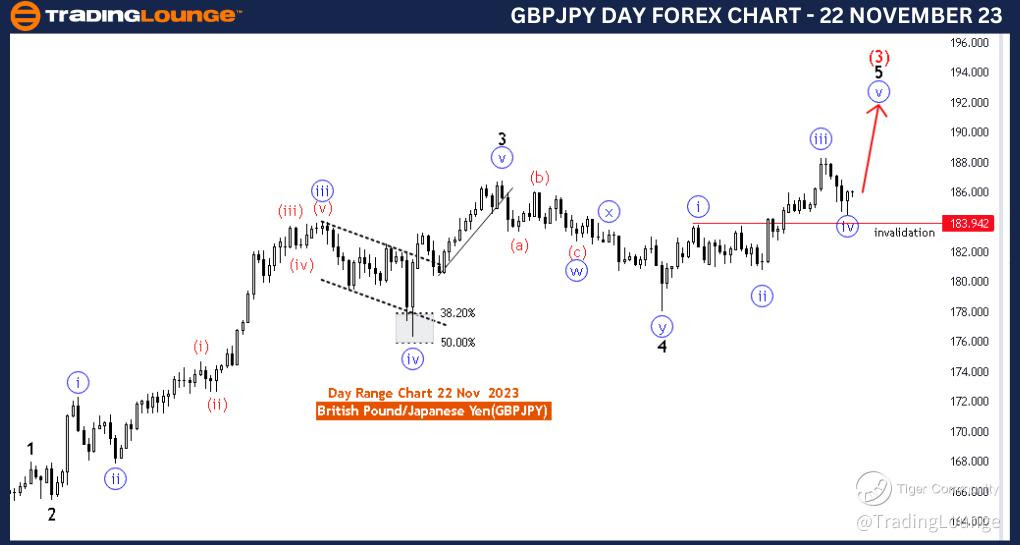

GBPJPY Elliott Wave Analysis Trading Lounge 4 Hour Chart, 22 November 23

British Pound/Japanese Yen(GBPJPY) 4 Hour Chart

GBPJPY Elliott Wave Technical Analysis

Function: Trend

Mode: impulsive

Structure: blue wave 5 of black wave 5

Position: Black wave 5

Direction Next Higher Degrees: blue wave 5 of 5(started)

Details: blue wave 4 of 5 looking completed at 184.461, now blue wave 5 of 5 is in play . Wave Cancel invalid level: 183.942

The "GBPJPY Elliott Wave Analysis Trading Lounge 4 Hour Chart" dated November 22, 2023, provides a comprehensive analysis of the British Pound/Japanese Yen (GBPJPY) currency pair using the Elliott Wave theory. This analysis is tailored for a 4-hour chart, offering insights into potential price movements over a shorter time frame.

The designated "Function" is identified as "Trend," suggesting that the analysis is focused on identifying and riding the current trend in the market. The market is presently in an "Impulsive" mode, indicating a strong directional bias in the price movements.

The specific "Structure" being analyzed is denoted as "Blue wave 5 of black wave 5." This implies a detailed examination of a specific sub-wave within the broader Elliott Wave sequence, focusing on the fifth wave within the larger fifth wave.

The "Position" is clarified as "Black wave 5," suggesting that the analysis is centered around the fifth wave of the broader Elliott Wave structure, providing insights into the potential completion of the current cycle.

Concerning the "Direction; Next Higher Degrees," the analysis points to "Blue wave 5 of 5 (started)." This suggests an expectation of upward movement at a higher degree within the broader Elliott Wave structure, indicating a continuation of the ongoing bullish phase.

In terms of "Details," the report notes that "blue wave 4 of 5 looking completed at 184.461, now blue wave 5 of 5 is in play." This implies a focus on the completion of the corrective wave (blue wave 4) and the initiation of the next impulsive wave (blue wave 5). The "Wave Cancel invalid level" is set at 183.942, providing traders with a crucial reference point. A breach of this level could challenge the current wave count, prompting traders to reassess their analysis and trading strategies.

In summary, the GBPJPY Elliott Wave Analysis on the 4-hour chart indicates an impulsive bullish movement within a larger Elliott Wave structure. The analysis emphasizes the completion of a corrective phase and the initiation of the next impulsive wave, providing traders with valuable insights for decision-making.

Technical Analyst : Malik Awais

Source : Tradinglounge.com get trial here!

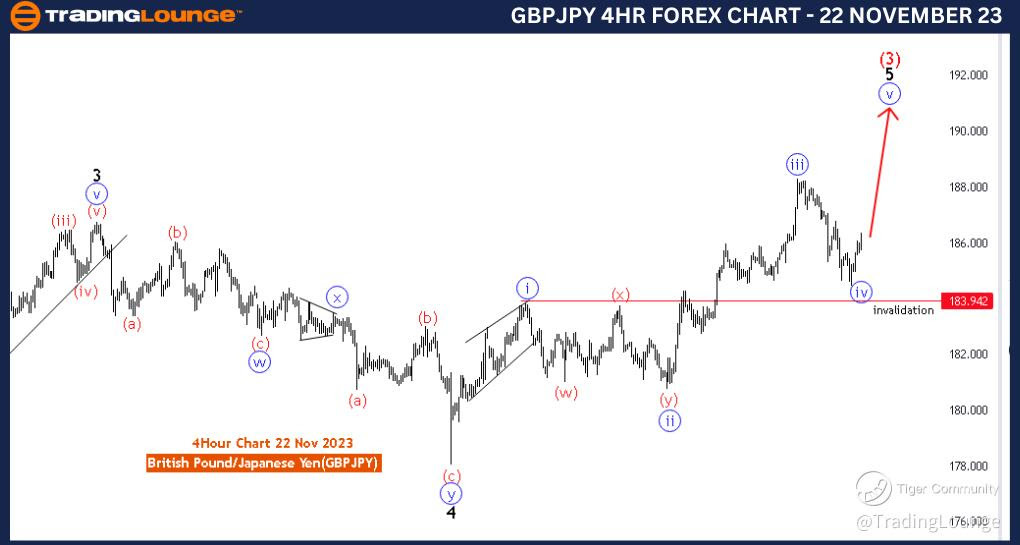

GBPJPY Elliott Wave Analysis Trading Lounge Day Chart, 22 November 23

British Pound/Japanese Yen(GBPJPY) Day Chart

GBPJPY Elliott Wave Technical Analysis

Function: Trend

Mode: impulsive

Structure: blue wave 5 of black wave 5

Position: Black wave 5

Direction Next Higher Degrees: blue wave 5 of 5(started)

Details: blue wave 4 of 5 looking completed at 184.461, now blue wave 5 of 5 is in play . Wave Cancel invalid level: 183.942

The "GBPJPY Elliott Wave Analysis Trading Lounge Day Chart" dated 23 November 23, offers an in-depth examination of the British Pound/Japanese Yen (GBPJPY) currency pair using Elliott Wave theory. This analysis is conducted on a daily chart, providing insights into potential longer-term price movements.

The identified "Function" is labeled as "Trend," indicating that the focus of the analysis is on identifying and capitalizing on the prevailing trend in the market. The market is currently assessed to be in an "Impulsive" mode, suggesting a strong and sustained directional movement.

The specific "Structure" being analyzed is denoted as "Blue wave 5 of black wave 5." This signifies a detailed study of a sub-wave within the larger Elliott Wave structure, specifically the fifth wave within the broader fifth wave.

The designated "Position" is clarified as "Black wave 5," indicating that the analysis is centered around the fifth wave of the broader Elliott Wave structure, offering insights into the potential completion of the current cycle.

Concerning the "Direction; Next Higher Degrees," the analysis points to "Blue wave 5 of 5 (started)." This implies an expectation of upward movement at a higher degree within the overarching Elliott Wave structure, indicating a continuation of the current bullish phase.

In terms of "Details," the report notes that "blue wave 4 of 5 looking completed at 184.461, now blue wave 5 of 5 is in play." This suggests a focus on the conclusion of a corrective wave (blue wave 4) and the initiation of the next impulsive wave (blue wave 5). The "Wave Cancel invalid level" is set at 183.942, providing a critical reference point. A breach of this level could challenge the current wave count, prompting traders to reassess their analysis and trading strategies.

In summary, the GBPJPY Elliott Wave Analysis on the daily chart indicates an impulsive bullish movement within a larger Elliott Wave structure. The analysis highlights the completion of a corrective phase and the initiation of the next impulsive wave, providing traders with valuable insights for longer-term decision-making.