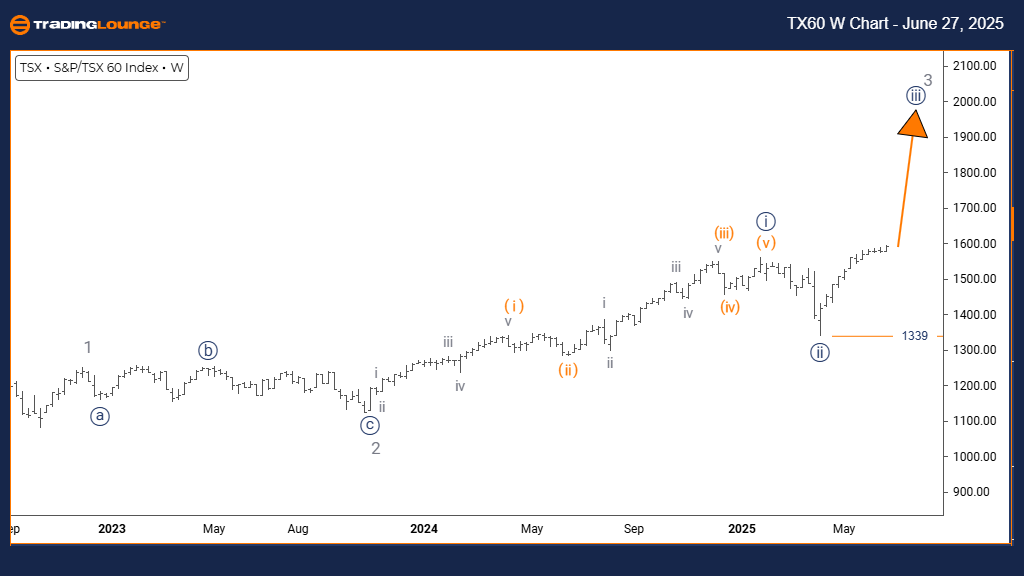

S&P/TSX 60 Elliott Wave Analysis – Trading Lounge Day Chart

S&P/TSX 60 Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 1

POSITION: Navy Blue Wave 3

DIRECTION NEXT LOWER DEGREES: Orange Wave 2

DETAILS: Navy Blue Wave 2 likely complete; Orange Wave 1 of 3 currently progressing.

Wave Cancel Invalidation Level: 1339

The S&P/TSX 60 daily Elliott Wave chart indicates a strong bullish trend. The current impulsive move, classified as Orange Wave 1, is part of the ongoing Navy Blue Wave 3, which signals upward strength and market optimism.

Navy Blue Wave 2 seems to have finalized, giving way to the formation of Orange Wave 1 within Navy Blue Wave 3. This transition highlights a shift into an impulsive breakout phase. The upcoming move to monitor is Orange Wave 2, which should act as a corrective retracement after Orange Wave 1 concludes.

The key technical level is 1339. Any price drop below this point would invalidate the current Elliott Wave setup. Maintaining levels above this threshold supports the bullish outlook.

Overall, the chart structure suggests that S&P/TSX 60 is well-positioned for further gains, with bullish momentum building within Navy Blue Wave 3. The impulse pattern points to growing market demand and potential for continued price appreciation.

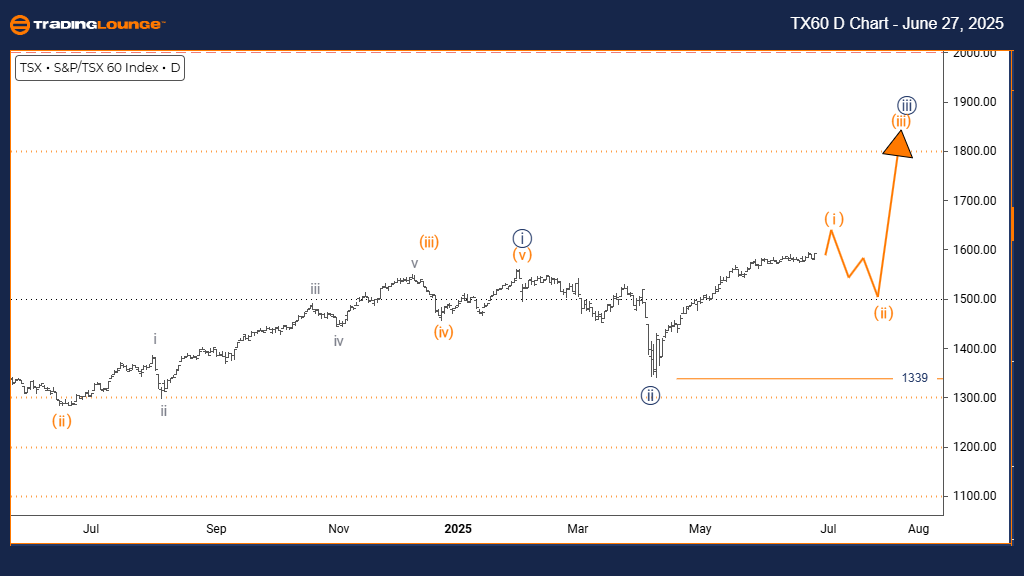

S&P/TSX 60 Elliott Wave Analysis – Trading Lounge Weekly Chart

S&P/TSX 60 Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 3

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 3 (initiated)

DETAILS: Navy Blue Wave 2 completed; now Navy Blue Wave 3 within Gray Wave 3 is advancing.

Wave Cancel Invalidation Level: 1339

The weekly Elliott Wave outlook for the S&P/TSX 60 Index maintains a bullish stance. The market remains in a robust impulsive phase, currently within Navy Blue Wave 3, which forms a segment of the broader Gray Wave 3.

Following the conclusion of Navy Blue Wave 2, the index has entered the dynamic phase of Navy Blue Wave 3 inside Gray Wave 3. This suggests the start of an elongated upward trend, often marked by limited corrections and increasing investor confidence.

Keep a close eye on the 1339 level. A sustained move below it would call for a reassessment of the current bullish wave count. Staying above this line confirms strength in the ongoing wave cycle.

The technical configuration implies strong institutional buying and momentum within Navy Blue Wave 3, supporting the expectation of further upside movement in the S&P/TSX 60 in the medium term.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: CAC 40 (France) Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support