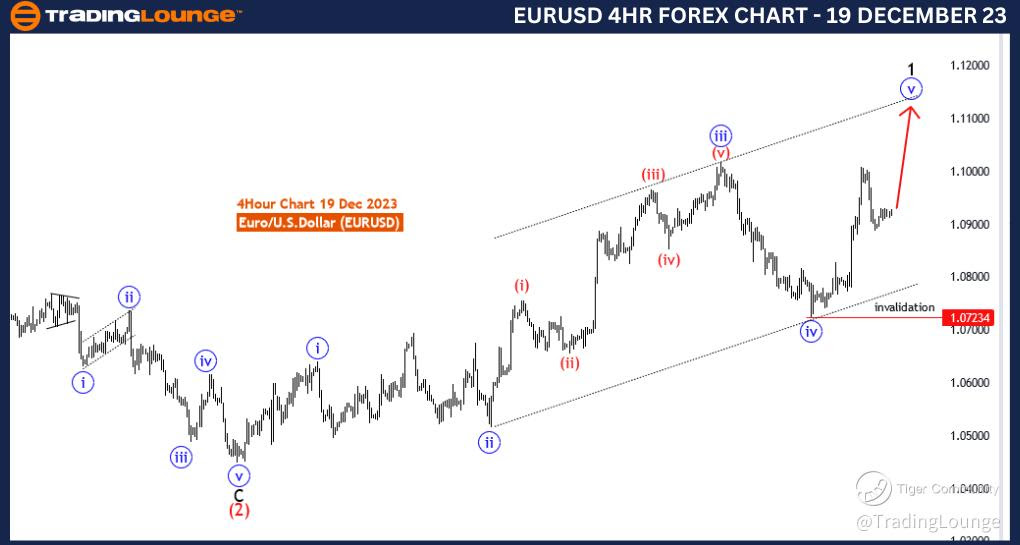

EURUSD Elliott Wave Analysis Trading Lounge 4 Hour Chart, 19 December 23

Euro/U.S.Dollar(EURUSD) 4 Hour Chart

EURUSD Elliott Wave Technical Analysis

Function: Trend

Mode: impulsive

Structure: blue wave 5 of black wave 1

Position: Red wave 3

Direction Next lower Degrees: black wave 2

Details: Blue Wave 5 of 1 is in play. Wave Cancel invalid level: 1.07234

The "EURUSD Elliott Wave Analysis Trading Lounge 4 Hour Chart" dated 19 December 23, offers a detailed examination of the Euro/U.S. Dollar (EURUSD) currency pair using Elliott Wave analysis. This analysis provides valuable insights for traders seeking to understand current market conditions and potential future developments.

The identified "Function" is "Trend," indicating a focus on recognizing and understanding the prevailing market direction. This is crucial for traders aligning their strategies with the dominant trend, increasing the likelihood of successful trades.

The specified "Mode" is "Impulsive," suggesting that the market is currently experiencing strong, directional price movements. In this context, "Impulsive" likely denotes a robust upward movement, as indicated by "blue wave 5 of black wave 1."

The primary "Structure" involves "blue wave 5 of black wave 1," providing insights into the current wave's place within the broader Elliott Wave framework. Understanding the wave structure aids traders in anticipating potential price movements and making informed trading decisions.

The described "Position" is labeled as "Red wave 3," indicating the current wave's position within the larger Elliott Wave structure. This information is valuable for traders to navigate ongoing market dynamics effectively.

In terms of "Direction Next Lower Degrees," the projection is "black wave 2," signifying the anticipated corrective wave within the broader Elliott Wave structure. This information assists traders in anticipating potential future market movements in the downward direction as part of the corrective phase.

The "Details" section emphasizes that "blue wave 5 of 1 is in play," suggesting a current upward impulsive wave. This information allows traders to align their strategies with the prevailing trend.

The "Wave Cancel invalid level" is identified as "1.07234." This level serves as a crucial point at which the current wave count would be invalidated, prompting a reassessment of market conditions.

In summary, the EURUSD Elliott Wave Analysis for the 4-hour chart on 19 December 23, suggests an impulsive wave labeled as "blue wave 5 of black wave 1," indicating a bullish trend. The analysis provides insights into the anticipated corrective wave, "black wave 2," and highlights a crucial invalidation level at 1.07234. Traders can use this information for a comprehensive understanding of market conditions and to align their strategies accordingly.

Technical Analyst: Malik Awais

Source: Tradinglounge.com get trial here!

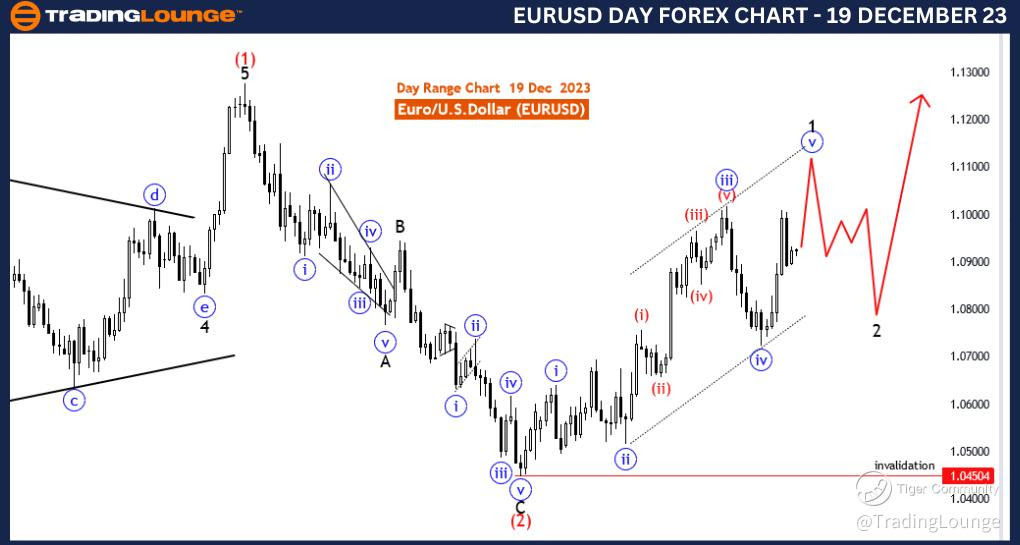

EURUSD Elliott Wave Analysis Trading Lounge Day Chart, 19 December 23

Euro/U.S.Dollar(EURUSD) Day Chart

EURUSD Elliott Wave Technical Analysis

Function: Trend

Mode: impulsive

Structure:blue wave 5 of black wave 1

Position: Red wave 3

Direction Next lower Degrees: black wave 2

Details: blue wave 5 of 1 is in play . Wave Cancel invalid level: 1.04504

The "EURUSD Elliott Wave Analysis Trading Lounge Day Chart" dated 19 December 23, delves into the Euro/U.S. Dollar (EURUSD) currency pair's dynamics through the lens of Elliott Wave analysis. This comprehensive analysis offers traders valuable insights into the current state of the market and potential future developments.

The identified "Function" is "Trend," underscoring the analysis's focus on recognizing and understanding the prevailing market direction. This is a fundamental aspect for traders aiming to align their strategies with the dominant trend for more successful trading outcomes.

The specified "Mode" is "Impulsive," indicating that the market is currently characterized by strong and directional price movements. In this context, "impulsive" likely signifies a robust upward movement, as denoted by "blue wave 5 of black wave 1."

The primary "Structure" involves "blue wave 5 of black wave 1," providing insight into the current wave's place within the broader Elliott Wave framework. Understanding the wave structure is crucial for anticipating potential price movements and making informed trading decisions.

The described "Position" is labeled as "Red wave 3," indicating the current wave's position within the larger Elliott Wave structure. This information is valuable for traders to navigate ongoing market dynamics effectively.

In terms of "Direction Next Lower Degrees," the projection is "black wave 2," signifying the anticipated corrective wave within the broader Elliott Wave structure. This information assists traders in anticipating potential future market movements in the downward direction as part of the corrective phase.

The "Details" section highlights that "blue wave 5 of 1 is in play," suggesting a current upward impulsive wave. This information allows traders to align their strategies with the prevailing trend.

The "Wave Cancel invalid level" is identified as "1.04504." This level serves as a critical point at which the current wave count would be invalidated, prompting a reassessment of market conditions.

In summary, the EURUSD Elliott Wave Analysis for the day chart on 19 December 23, suggests an impulsive wave labeled as "blue wave 5 of black wave 1," indicating a bullish trend. The analysis provides insights into the anticipated corrective wave, "black wave 2," and highlights a crucial invalidation level at 1.04504. Traders can leverage this information for a comprehensive understanding of market conditions and to align their strategies accordingly.

Technical Analyst: Malik Awais

Source: Tradinglounge.com get trial here!