ASX: NEWMONT CORPORATION – NEM Elliott Wave Technical Analysis - TradingLounge

Welcome to our latest Elliott Wave review of Newmont Corporation (ASX:NEM). Based on our current wave count, ASX:NEM appears to be in the midst of a third wave advance. This update provides clearly defined target zones and a precise invalidation level, allowing traders to recognize when the current bullish momentum may either continue or shift.

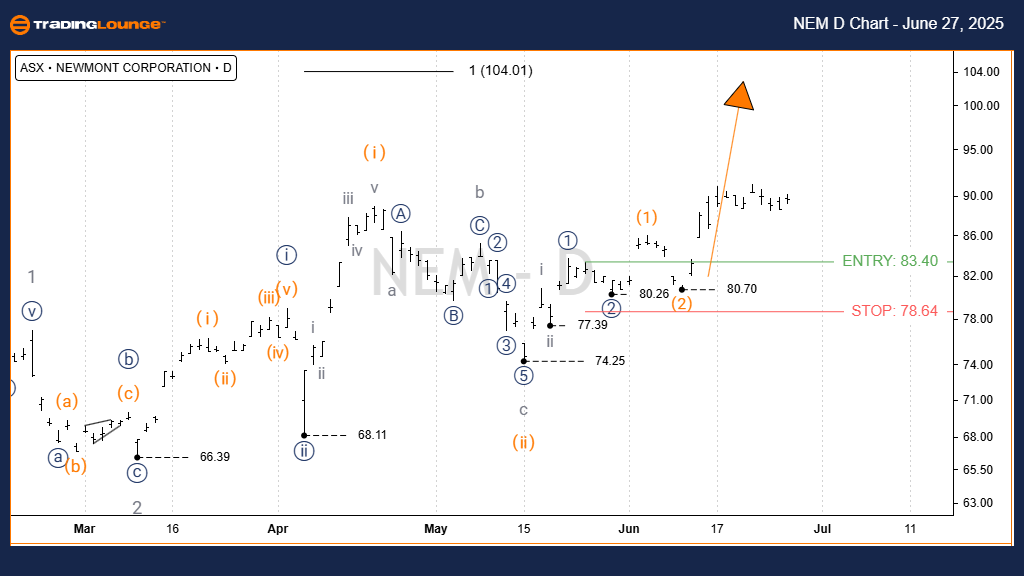

ASX: NEWMONT CORPORATION – NEM Elliott Wave Technical Forecast 1D Chart (Semilog Scale) Breakdown

Function: Identifying primary trend at Minor degree (grey)

Mode: Motive structure

Wave Type: Impulse formation

Wave Count: iii) - orange within iii)) - navy of 3 - grey

Key Observations:

Wave ii) - orange likely bottomed at 74.25, forming a complete zigzag labeled a-b-c (grey).

Since that low, wave iii) - orange has been advancing toward the projected 100.00 level.

Critical Invalidation Point: 74.25

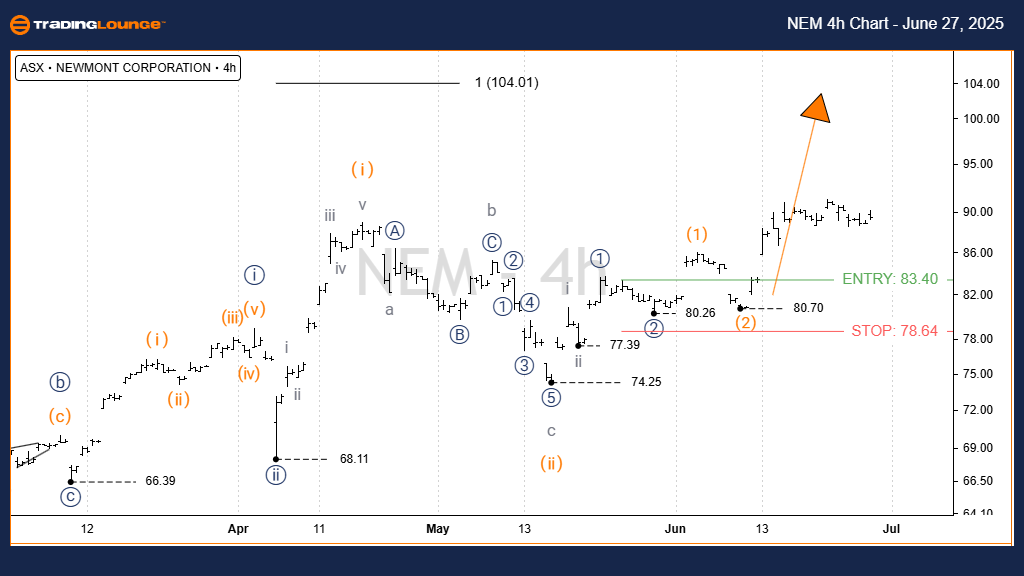

ASX: NEWMONT CORPORATION – NEM 4-Hour Elliott Wave Chart Insight

Function: Mapping the major uptrend at Minor degree (grey)

Mode: Motive wave pattern

Wave Type: Impulse continuation

Wave Count: iii) - orange of ((iii)) - navy within 3 - grey

Analysis Highlights:

Our 4H chart aligns with the daily structure, confirming the impulsive wave iii) - orange is still progressing.

Near-term objective is a rally towards 90.00, with the broader target remaining around 100.00.

Key Invalidation Level: 74.25

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: COLES GROUP LIMITED – COL Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Technical Summary:

This Elliott Wave overview on ASX: NEWMONT CORPORATION – NEM outlines both short-term and long-term wave perspectives. Clear target and invalidation zones provide traders with high-probability trade ideas. Our structured approach aims to enhance clarity and boost confidence in decision-making through disciplined technical evaluation.