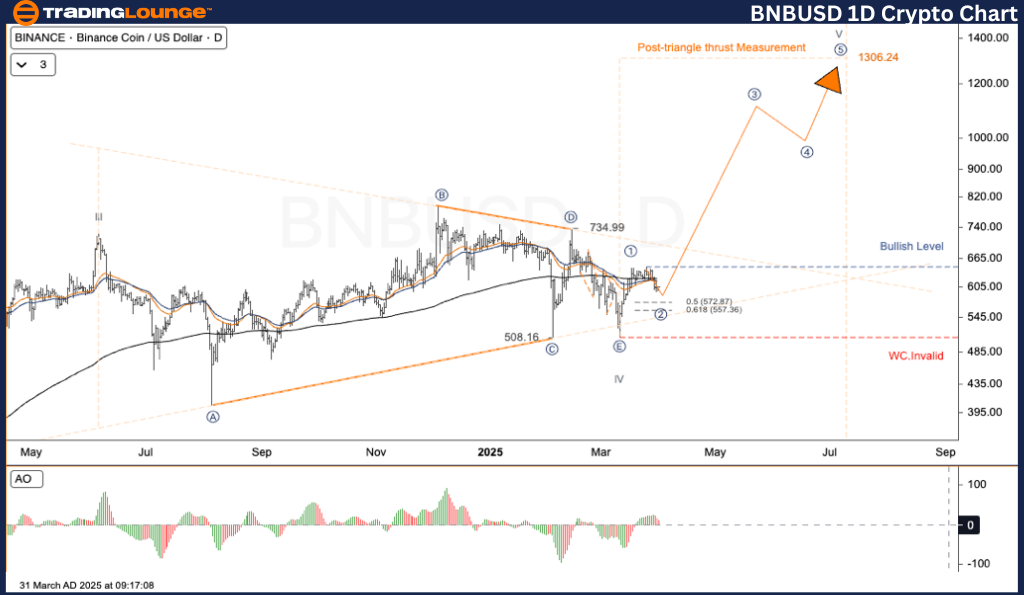

Binance/ U.S. Dollar (BNBUSD) Elliott Wave Analysis – TradingLounge Daily Chart

BNBUSD Elliott Wave Technical Review

Market Function: Counter Trend

Wave Type: Corrective

Pattern: Triangle

Current Wave: Wave E

Higher Degree Direction: Wave IV in an Impulse

Invalidation Level:

Binance/ U.S. Dollar (BNBUSD) Trading Strategy:

According to Elliott Wave Theory, BNBUSD is currently positioned in Wave IV, preparing for the potential emergence of Wave V, which is projected to be a significant bullish trend. The Post-Triangle Thrust target for this breakout scenario is calculated at $1,306.24, derived from the measured triangle height. A bullish confirmation is expected upon a breakout above the $734.99 resistance level, marking a potential trend continuation.

Trading Strategies

Approach

Method

✅ For Swing Traders (Short-Term)

A decisive price move above the $734.99 resistance level, confirmed by increased trading volume, may indicate the start of Wave V.

Risk Control

Invalidation Level: $490.00 (Price drop below this threshold invalidates the current wave count)

Binance/ U.S. Dollar (BNBUSD) Elliott Wave Analysis – TradingLounge H4 Chart

BNBUSD Elliott Wave Technical Review

Market Function: Counter Trend

Wave Type: Corrective

Pattern: Triangle

Current Wave: Wave E

Higher Degree Direction: Wave IV in an Impulse

Invalidation Level:

Binance/ U.S. Dollar (BNBUSD) Trading Strategy:

BNBUSD is holding within Wave IV, with sub-wave 1 already completed. The asset is now in Wave 2, a correction phase aligning with key Fibonacci retracement levels between 0.5 and 0.618 — specifically in the range of $572.87 to $557.36. A bullish reaction from this zone could trigger Wave 3, with resistance expected near $705.

Trading Strategies

Approach

Method

✅ For Swing Traders (Short-Term)

A breakout beyond $734.99, supported by high volume, could act as a catalyst for the initiation of Wave V.

Risk Control

Invalidation Level: $490.00 (Break below this point invalidates current Elliott Wave structure)

Technical Analyst: Kittiampon Somboonsod

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: THETAUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support