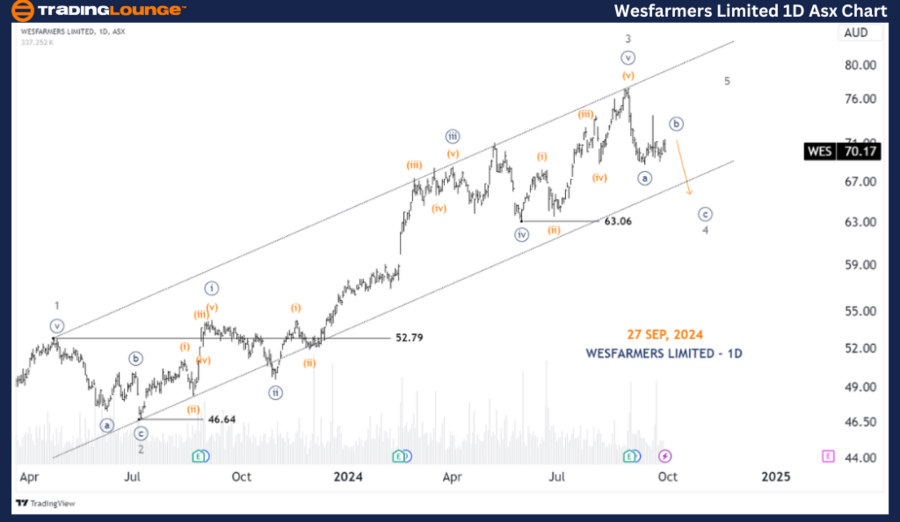

ASX: Wesfarmers Limited – WES Elliott Wave Analysis (1D Chart)

Greetings, our updated Elliott Wave analysis focuses on Wesfarmers Limited (WES) listed on the Australian Stock Exchange (ASX). Our outlook indicates that WES may continue its downward movement in the fourth wave.

ASX: Wesfarmers Limited – WES 1D Chart (Semilog Scale) Analysis

WES Elliott Wave Technical Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave 4-grey of Wave (3)-orange

Details: The ongoing development of Wave 4-grey suggests a further decline, potentially reaching the lower boundary of the channel or targeting the price level at 63.06. A more detailed examination of the 4H chart will give more insight into its internal structure.

Invalidation point: 52.79

ASX: WESFARMERS LIMITED – WES 4-Hour Chart Analysis

Function: Counter trend (Minute degree, navy)

Mode: Corrective

Structure: Zigzag

Position: Wave (c)-orange of Wave ((b))-navy

Details: Wave ((a))-navy has been completed, and wave ((b))-navy is expected to take more time to finalize. It is likely forming a Triangle, progressing from wave (a)-orange to (e)-orange. Upon completion, wave ((c))-navy is anticipated to resume its downward trajectory towards the previously discussed targets.

Invalidation point: 77.17

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: SONIC HEALTHCARE LIMITED – SHL Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our Elliott Wave analysis for ASX: WESFARMERS LIMITED (WES) provides a detailed forecast of the current market trend, highlighting key price levels for traders to monitor. By identifying validation and invalidation points, we enhance confidence in the accuracy of our wave count. This comprehensive approach aims to offer readers a clear, professional insight into market movements and potential opportunities to capitalize on them effectively.