ASX: CAR GROUP LIMITED – CAR Elliott Wave Technical Analysis

TradingLounge

Welcome to today’s Elliott Wave analysis for CAR GROUP LIMITED (ASX: CAR). Our current evaluation suggests that CAR has completed a corrective wave (4) in orange, characterized by a classic Zigzag formation. This development potentially signals the start of a bullish impulsive wave (5). In this brief overview, we explore possible future price movements and crucial invalidation levels to monitor.

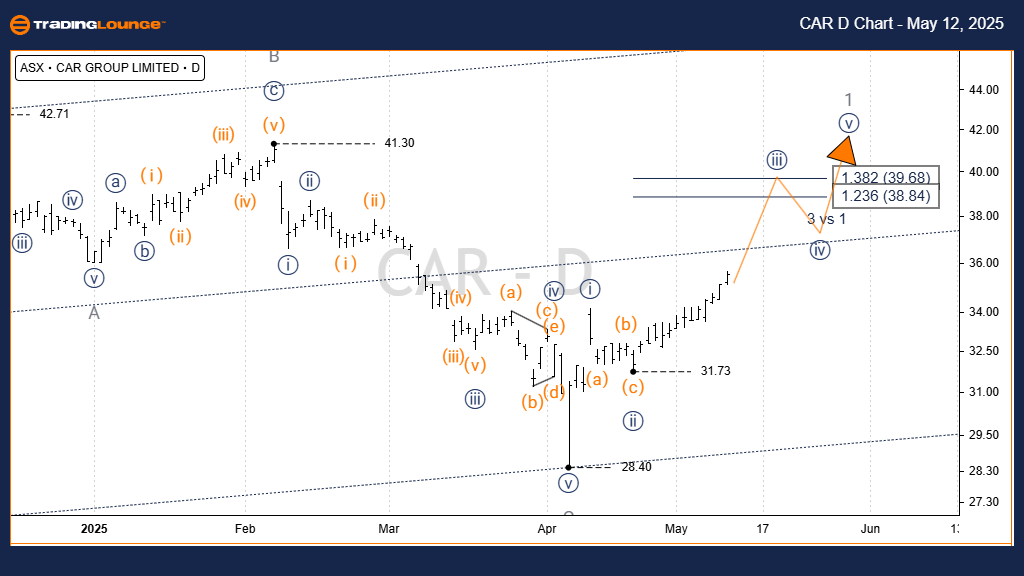

ASX: CAR GROUP LIMITED – CAR Elliott Wave Analysis 1D Chart (Semilog Scale) – Technical Overview

Function: Major Trend (Intermediate degree, orange)

Wave Mode: Motive

Structure Type: Impulse

Current Position: Wave iii)) – navy within Wave (5) – orange

Key Insights:

- The corrective wave (4) – orange began after the peak at 42.71 and may have bottomed at 28.40.

- This structure presents an A-B-C Zigzag, where wave C – grey shows five defined sub-waves, supporting a completed correction.

- As a result, wave (5) – orange appears to be unfolding, with wave iii)) – navy gaining traction.

- Near-term bullish targets are in the 39.68 to 40.00 range.

Invalidation Level: 31.73

(Price action must stay above this level to maintain bullish structure.)

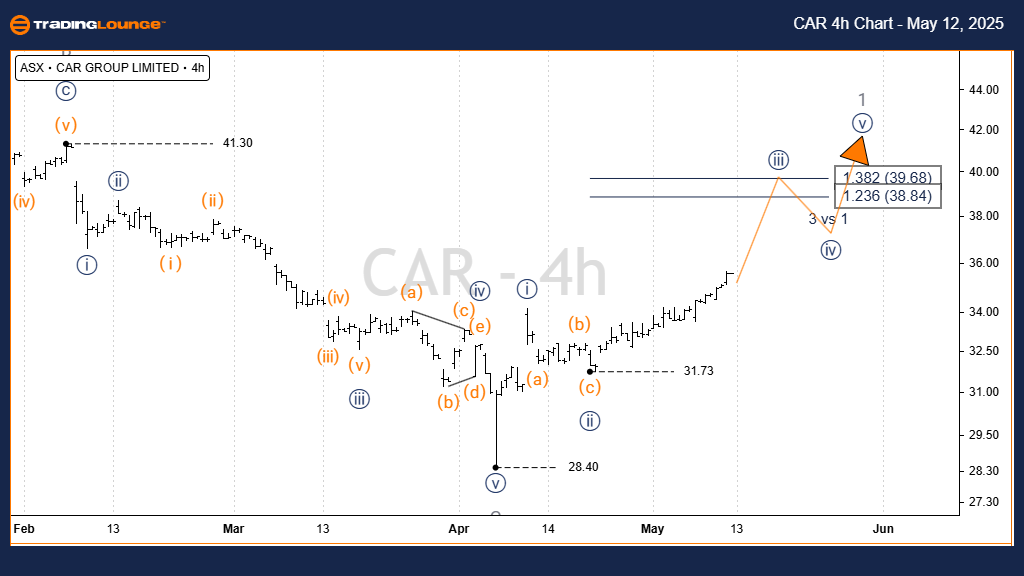

ASX: CAR GROUP LIMITED – CAR 4-Hour Elliott Wave Chart

Short-Term Trend Overview

Function: Major Trend (Minor degree, grey)

Wave Mode: Motive

Structure Type: Impulse

Current Position: Wave ((iii)) – navy of Wave (5) – orange

Key Insights:

- A confirmed breakout above 31.73 initiated the development of wave iii)) – navy.

- Continued price action above 31.73 confirms this bullish trend.

Invalidation Level: 31.73

(A drop below this level would invalidate the current wave count.)

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: Insurance Australia Group Limited (IAG) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This Elliott Wave technical analysis for ASX: CAR provides a comprehensive view of both medium and short-term market trends. By outlining precise validation and invalidation price points, traders gain more confidence in the forecast. The objective is to assist market participants with actionable insights to navigate the evolving price structure of CAR GROUP LIMITED.