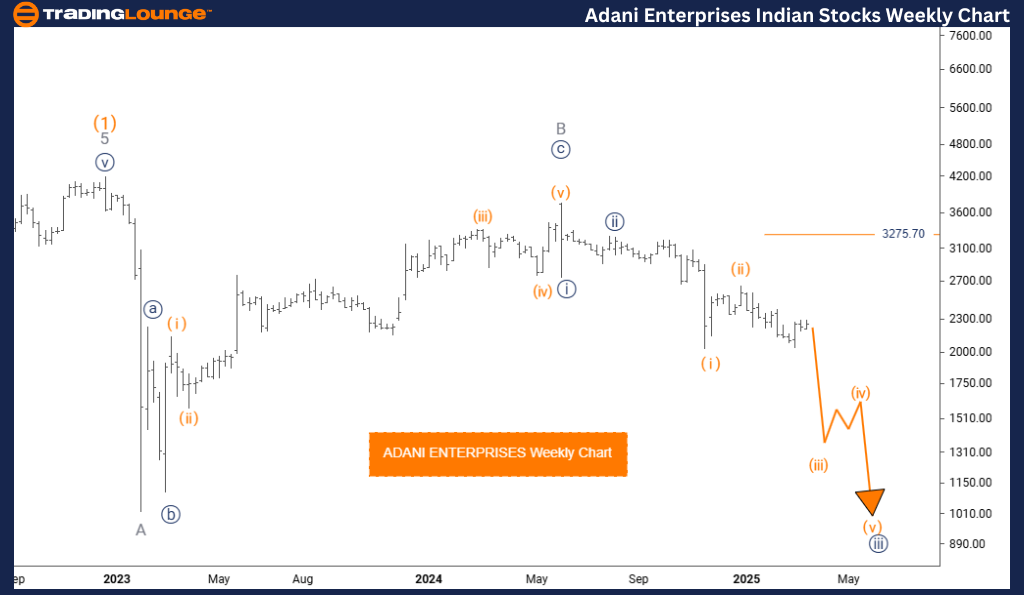

ADANI ENTERPRISES Elliott Wave Analysis – Trading Lounge Day Chart

ADANI ENTERPRISES Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Next Higher Degree Direction: Orange Wave 4

Invalidation Level: 3275.70

Analysis Overview

The ADANI ENTERPRISES Elliott Wave Analysis on the daily chart offers key insights into the stock’s ongoing trend and future market direction.

- The market is currently in a trending phase with impulsive price action, indicating strong directional momentum.

- The primary wave structure under evaluation is Orange Wave 3, which plays a crucial role within the broader Navy Blue Wave 3.

- Following the completion of Orange Wave 2, the market is now advancing into Orange Wave 3, which is anticipated to show strong bullish momentum before transitioning to the next phase.

- Orange Wave 4 is expected to emerge once Orange Wave 3 reaches completion.

- The invalidation level at 3275.70 serves as a critical point. If breached, the current wave analysis would be invalidated, indicating a potential change in trend structure.

Market Insights & Trading Strategy

The ADANI ENTERPRISES Elliott Wave daily chart analysis helps traders understand short-term market movements and adapt their strategies accordingly.

- By focusing on wave patterns and key market levels, traders can identify potential entry and exit points.

- The transition from Orange Wave 3 to Orange Wave 4 will be pivotal in determining the next directional movement.

- Risk management remains essential, with traders advised to monitor the invalidation level and adjust strategies as needed.

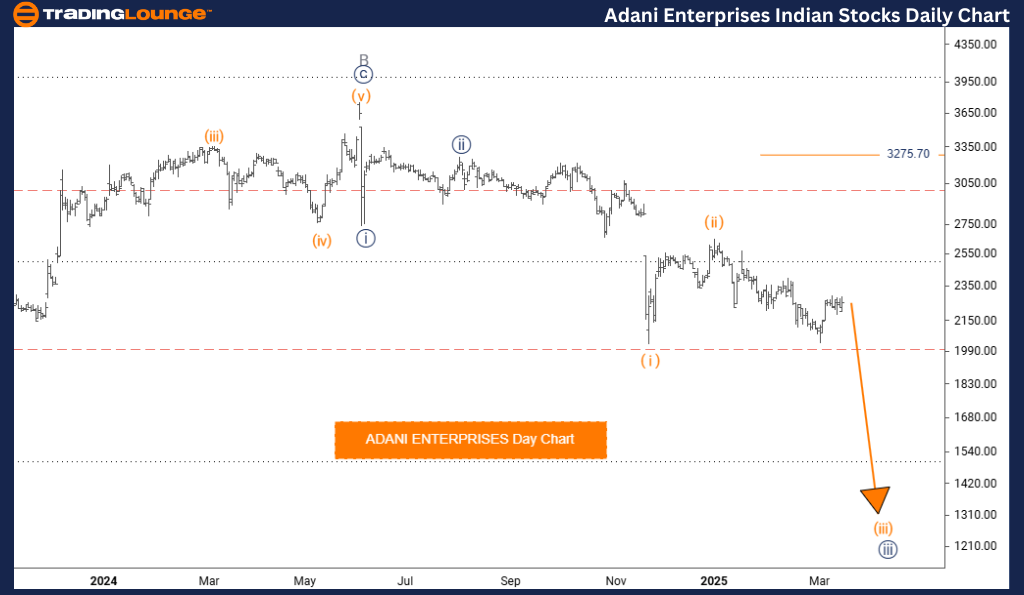

ADANI ENTERPRISES Elliott Wave Analysis – Trading Lounge Weekly Chart

ADANI ENTERPRISES Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange Wave 3

Position: Navy Blue Wave 3

Next Higher Degree Direction: Orange Wave 4

Invalidation Level: 3275.70

Analysis Overview

The ADANI ENTERPRISES Elliott Wave Analysis on the weekly chart provides a broader outlook on the stock’s market structure and long-term trend potential.

- The market remains in a strong uptrend, characterized by impulsive price movements within Orange Wave 3.

- This wave is nested within Navy Blue Wave 3, signifying its importance within the larger Elliott Wave count.

- With Orange Wave 2 completed, the market is now progressing through Orange Wave 3, which is expected to be a key bullish phase before a correction.

- The next phase to watch is Orange Wave 4, which may introduce a retracement or consolidation after the completion of Wave 3.

- The invalidation level remains at 3275.70, acting as a critical support for maintaining the current wave outlook.

Market Insights & Trading Strategy

The weekly chart analysis offers traders a long-term perspective, helping them align strategies with major market trends.

- Understanding the Elliott Wave structure enables traders to anticipate key market turning points.

- Identifying the completion of impulsive waves and the beginning of corrective phases allows traders to make informed decisions.

- Monitoring the transition from Orange Wave 3 to Orange Wave 4 is crucial for those looking to optimize entry and exit strategies.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous:ADANI GREEN Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support