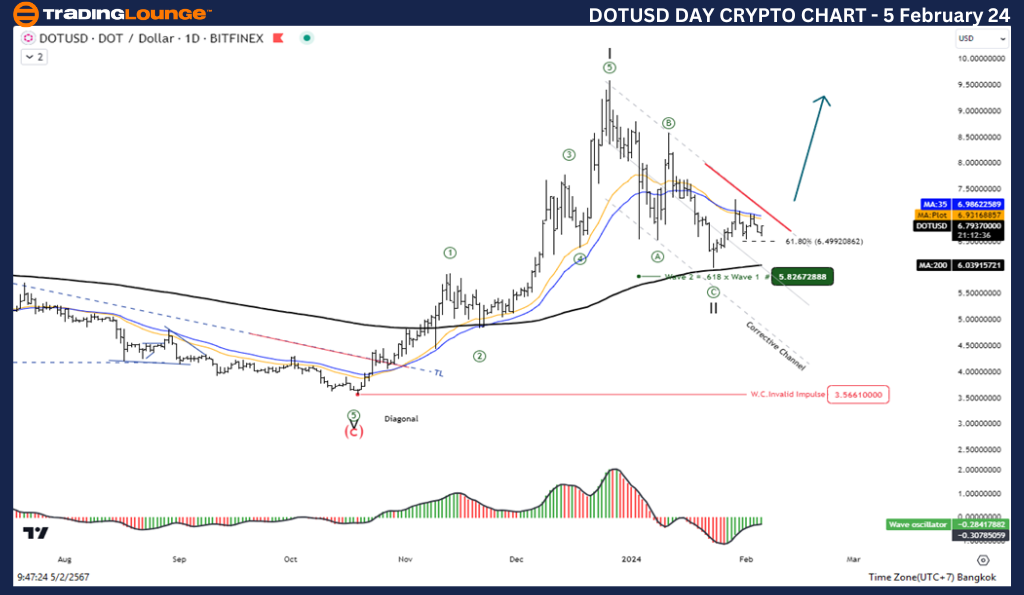

Elliott Wave Analysis TradingLounge Daily Chart, 5 February 24,

The potential of the Polkadot / U.S. dollar(DOTUSD) through Elliott Wave Analysis can provide traders with invaluable insights into market trends and potential entry points. Let's delve into the latest analysis as of February 5, 2024.

DOTUSD Elliott Wave Technical Analysis:

- Function: Capitalizing on Counter Trend movements.

- Mode: Executing Corrective strategies.

- Structure: Embracing the Zigzag pattern.

- Position: Currently in Wave C.

- Direction Next higher Degrees: Anticipating wave (II) of Impulse.

- Wave Cancel invalid level: Critical at 3.566.

Intriguingly, Wave (II) possibly concluded at the 5.992 mark, signaling a potential upsurge in Wave (III).

Polkadot / U.S. dollar(DOTUSD) Trading Strategy: Seizing the moment, as Wave II correction likely reached its terminus at 5.992, traders should brace for an upward trajectory in Wave III. Now is the time to seek entry points and align with the prevailing bullish sentiment.

Polkadot / U.S. dollar(DOTUSD) Technical Indicators:

- Price: Positioned Above the MA200, indicating a robust uptrend.

- Wave Oscillators: Presenting a bullish Momentum, fostering a favorable trading environment.

For more insights and analysis, visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

With this meticulous Elliott Wave analysis, traders can strategize effectively and capitalize on lucrative opportunities in the DOTUSD market. Join the ranks of successful traders by leveraging expert insights and staying ahead of the curve.

Elliott Wave Analysis TradingLounge 4Hr Chart, 5 February 24,

Polkadot / U.S. dollar(DOTUSD)

DOTUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Wave C

Direction Next higher Degrees: wave (II) of Impulse

Wave Cancel invalid level: 3.566

Details: Wave (II) maybe is complete at 5.992 level and the price increase again in Wave (III)

Polkadot / U.S. dollar(DOTUSD) Trading Strategy: Wave II correction appears to have ended at the 5.992 level and prices are entering an uptrend in Wave III, looking for an entry opportunity. Join the trend again in an upward direction.

Polkadot / U.S. dollar(DOTUSD)Technical Indicators: The price is below the MA200 indicating a downtrend, Wave Oscillators a bearish Momentum.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

See Previous: VeChain (VETUSD)