Natural Gas Elliott Wave Forecast | Trading Lounge

Since late May, Natural Gas prices have experienced continued volatility. The upward trend initiated on April 24 is likely to push prices toward the early April range of $4.00 to $4.25 in the near term. As long as the price remains above the April 24 support at $2.858, the bias remains bullish.

Natural Gas Daily Chart Forecast

Natural Gas completed a major bearish Elliott Wave impulse cycle from August 2022 to February 2024. According to Elliott Wave Theory, a 5-wave impulsive move is usually followed by a corrective 3-wave structure. This corrective phase began in February 2024.

The initial 3-wave rally from February 2024 peaked in March 2025, possibly concluding the correction. Traditionally, a subsequent 5-wave bearish sequence would resume the larger downtrend. However, the market instead formed another 3-wave drop, ending on April 24, 2025, which triggered a fresh upward move.

This development indicates the correction from February may still be in progress and could evolve into a complex double correction, potentially extending to $6.23. Currently, the rally from the April low has not confirmed whether it will form a full 5-wave impulse or another 3-wave corrective move, keeping both scenarios viable.

Over the short to medium term, a 3-wave rally from the April low is expected to unfold, targeting the $4.09 to $4.47 range.

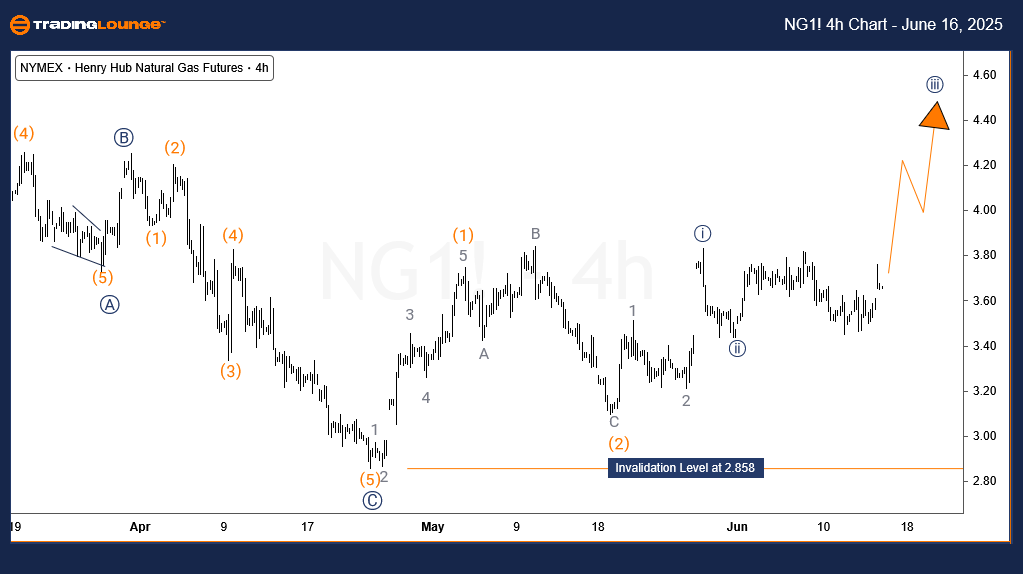

Natural Gas 4-Hour Chart Forecast

The 4-hour chart outlines the smaller wave patterns that have emerged since the April 2025 low. Two legs, labeled wave (1) and wave (2), have been completed, with wave (3) now in progress.

If this sequence represents part of a 5-wave bullish impulse, it could break above the $4.70 resistance level, indicating a double correction is forming from the February low. On the other hand, if the current rally concludes within the $4.09–$4.47 range, it could suggest a simple 3-wave correction, potentially leading to a continuation of the March 2025 downtrend.

Technical Analyst: Sanmi Adeagbo

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: Cocoa Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support